- Australia

- /

- Medical Equipment

- /

- ASX:VTI

Introducing Visioneering Technologies (ASX:VTI), The Stock That Tanked 83%

Even the best investor on earth makes unsuccessful investments. But serious investors should think long and hard about avoiding extreme losses. So spare a thought for the long term shareholders of Visioneering Technologies, Inc. (ASX:VTI); the share price is down a whopping 83% in the last twelve months. A loss like this is a stark reminder that portfolio diversification is important. We wouldn't rush to judgement on Visioneering Technologies because we don't have a long term history to look at. Furthermore, it's down 47% in about a quarter. That's not much fun for holders.

We really feel for shareholders in this scenario. It's a good reminder of the importance of diversification, and it's worth keeping in mind there's more to life than money, anyway.

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

View our latest analysis for Visioneering Technologies

Because Visioneering Technologies is loss-making, we think the market is probably more focussed on revenue and revenue growth, at least for now. Shareholders of unprofitable companies usually expect strong revenue growth. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

In the last twelve months, Visioneering Technologies increased its revenue by 214%. That's well above most other pre-profit companies. So the hefty 83% share price crash makes us think the company has somehow offended market participants. There's clearly something unusual going on here such as an acquisition that hasn't delivered expected profits. What is clear is that the market is not judging the company on its revenue growth right now. Of course, investors do over-react when they are stressed out, so the sell-off could be unjustifiably severe.

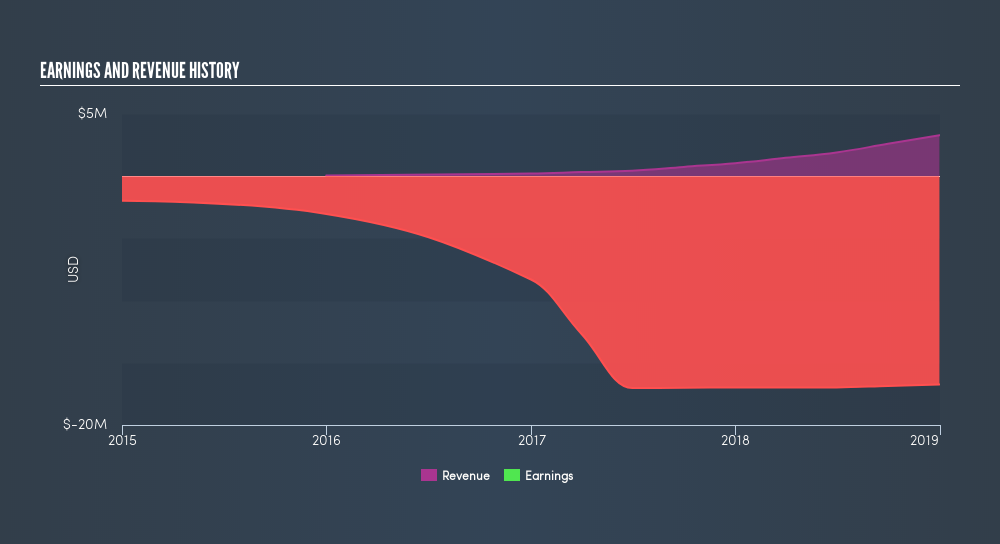

The chart below shows how revenue and earnings have changed with time, (if you click on the chart you can see the actual values).

If you are thinking of buying or selling Visioneering Technologies stock, you should check out this FREE detailed report on its balance sheet.

A Different Perspective

While Visioneering Technologies shareholders are down 83% for the year, the market itself is up 10%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. The share price decline has continued throughout the most recent three months, down 47%, suggesting an absence of enthusiasm from investors. Given the relatively short history of this stock, we'd remain pretty wary until we see some strong business performance. If you would like to research Visioneering Technologies in more detail then you might want to take a look at whether insiders have been buying or selling shares in the company.

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on AU exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About ASX:VTI

Visioneering Technologies

A medical device company, engages in the design, manufacture, sale, and distribution of contact lenses in North America, Europe, and the Asia-Pacific.

Adequate balance sheet low.

Similar Companies

Market Insights

Community Narratives