- Australia

- /

- Healthtech

- /

- ASX:VHT

What Volpara Health Technologies Limited's (ASX:VHT) 52% Share Price Gain Is Not Telling You

The Volpara Health Technologies Limited (ASX:VHT) share price has done very well over the last month, posting an excellent gain of 52%. Looking back a bit further, it's encouraging to see the stock is up 99% in the last year.

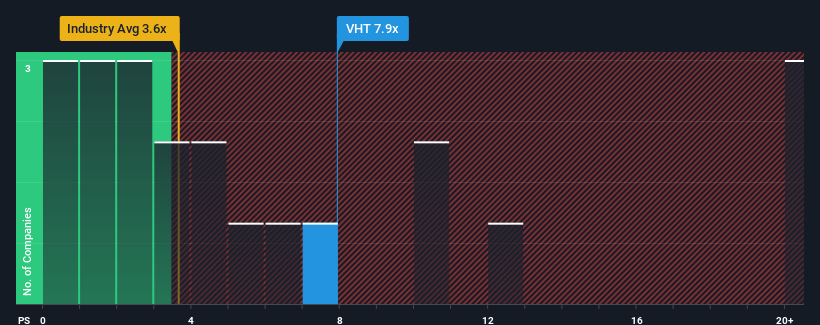

Since its price has surged higher, Volpara Health Technologies may be sending bearish signals at the moment with its price-to-sales (or "P/S") ratio of 7.9x, since almost half of all companies in the Healthcare Services in Australia have P/S ratios under 6.2x and even P/S lower than 2x are not unusual. However, the P/S might be high for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for Volpara Health Technologies

How Volpara Health Technologies Has Been Performing

Volpara Health Technologies could be doing better as it's been growing revenue less than most other companies lately. One possibility is that the P/S ratio is high because investors think this lacklustre revenue performance will improve markedly. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Keen to find out how analysts think Volpara Health Technologies' future stacks up against the industry? In that case, our free report is a great place to start.How Is Volpara Health Technologies' Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as high as Volpara Health Technologies' is when the company's growth is on track to outshine the industry.

Retrospectively, the last year delivered an exceptional 24% gain to the company's top line. The latest three year period has also seen an excellent 149% overall rise in revenue, aided by its short-term performance. So we can start by confirming that the company has done a great job of growing revenue over that time.

Turning to the outlook, the next year should generate growth of 21% as estimated by the dual analysts watching the company. That's shaping up to be materially lower than the 44% growth forecast for the broader industry.

In light of this, it's alarming that Volpara Health Technologies' P/S sits above the majority of other companies. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. Only the boldest would assume these prices are sustainable as this level of revenue growth is likely to weigh heavily on the share price eventually.

The Final Word

The large bounce in Volpara Health Technologies' shares has lifted the company's P/S handsomely. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

It comes as a surprise to see Volpara Health Technologies trade at such a high P/S given the revenue forecasts look less than stellar. When we see a weak revenue outlook, we suspect the share price faces a much greater risk of declining, bringing back down the P/S figures. Unless these conditions improve markedly, it's very challenging to accept these prices as being reasonable.

Plus, you should also learn about this 1 warning sign we've spotted with Volpara Health Technologies.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:VHT

Volpara Health Technologies

Provides breast imaging analytics software products in New Zealand.

Excellent balance sheet and slightly overvalued.

Market Insights

Community Narratives