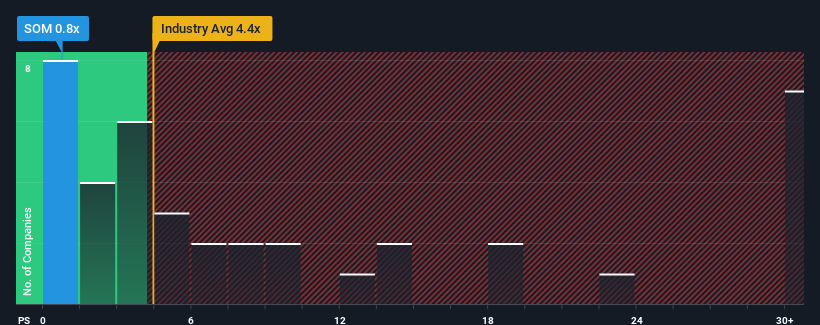

SomnoMed Limited's (ASX:SOM) price-to-sales (or "P/S") ratio of 0.8x might make it look like a strong buy right now compared to the Medical Equipment industry in Australia, where around half of the companies have P/S ratios above 4.4x and even P/S above 15x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly reduced P/S.

View our latest analysis for SomnoMed

What Does SomnoMed's Recent Performance Look Like?

SomnoMed's revenue growth of late has been pretty similar to most other companies. One possibility is that the P/S ratio is low because investors think this modest revenue performance may begin to slide. If you like the company, you'd be hoping this isn't the case so that you could pick up some stock while it's out of favour.

Want the full picture on analyst estimates for the company? Then our free report on SomnoMed will help you uncover what's on the horizon.Is There Any Revenue Growth Forecasted For SomnoMed?

In order to justify its P/S ratio, SomnoMed would need to produce anemic growth that's substantially trailing the industry.

Retrospectively, the last year delivered an exceptional 15% gain to the company's top line. Pleasingly, revenue has also lifted 46% in aggregate from three years ago, thanks to the last 12 months of growth. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Turning to the outlook, the next year should generate growth of 15% as estimated by the dual analysts watching the company. Meanwhile, the rest of the industry is forecast to expand by 13%, which is not materially different.

With this in consideration, we find it intriguing that SomnoMed's P/S is lagging behind its industry peers. It may be that most investors are not convinced the company can achieve future growth expectations.

The Key Takeaway

Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Our examination of SomnoMed's revealed that its P/S remains low despite analyst forecasts of revenue growth matching the wider industry. The low P/S could be an indication that the revenue growth estimates are being questioned by the market. At least the risk of a price drop looks to be subdued, but investors seem to think future revenue could see some volatility.

You need to take note of risks, for example - SomnoMed has 2 warning signs (and 1 which shouldn't be ignored) we think you should know about.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:SOM

SomnoMed

SomnoMed Limited, together with its subsidiaries, produce and sells devices for the oral treatment of sleep related disorders in the Asia Pacific region, North America, and Europe.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives