- Australia

- /

- Healthcare Services

- /

- ASX:SIG

Sigma Healthcare Limited's (ASX:SIG) Subdued P/S Might Signal An Opportunity

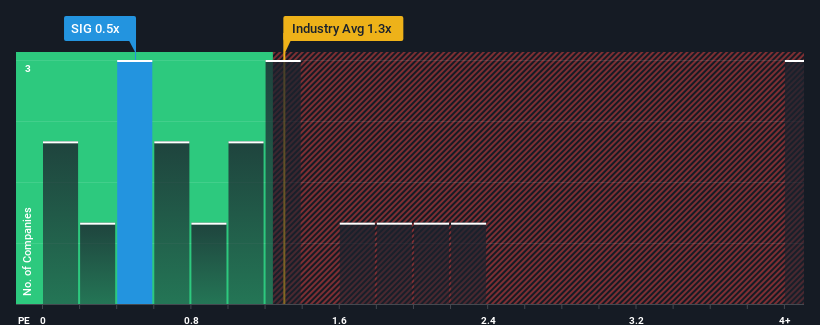

Sigma Healthcare Limited's (ASX:SIG) price-to-sales (or "P/S") ratio of 0.5x may look like a pretty appealing investment opportunity when you consider close to half the companies in the Healthcare industry in Australia have P/S ratios greater than 1.3x. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

View our latest analysis for Sigma Healthcare

How Has Sigma Healthcare Performed Recently?

Sigma Healthcare hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. Perhaps the P/S remains low as investors think the prospects of strong revenue growth aren't on the horizon. So while you could say the stock is cheap, investors will be looking for improvement before they see it as good value.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Sigma Healthcare.Is There Any Revenue Growth Forecasted For Sigma Healthcare?

The only time you'd be truly comfortable seeing a P/S as low as Sigma Healthcare's is when the company's growth is on track to lag the industry.

Retrospectively, the last year delivered a frustrating 1.2% decrease to the company's top line. That put a dampener on the good run it was having over the longer-term as its three-year revenue growth is still a noteworthy 17% in total. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been mostly respectable for the company.

Shifting to the future, estimates from the six analysts covering the company suggest revenue should grow by 17% each year over the next three years. That's shaping up to be materially higher than the 7.2% each year growth forecast for the broader industry.

With this in consideration, we find it intriguing that Sigma Healthcare's P/S sits behind most of its industry peers. Apparently some shareholders are doubtful of the forecasts and have been accepting significantly lower selling prices.

What We Can Learn From Sigma Healthcare's P/S?

We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Sigma Healthcare's analyst forecasts revealed that its superior revenue outlook isn't contributing to its P/S anywhere near as much as we would have predicted. The reason for this depressed P/S could potentially be found in the risks the market is pricing in. It appears the market could be anticipating revenue instability, because these conditions should normally provide a boost to the share price.

There are also other vital risk factors to consider and we've discovered 2 warning signs for Sigma Healthcare (1 is potentially serious!) that you should be aware of before investing here.

If you're unsure about the strength of Sigma Healthcare's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:SIG

Sigma Healthcare

Engages in the wholesale distribution of pharmaceutical goods and medical consumables to community pharmacies primarily in Australia.

Flawless balance sheet and good value.