- Australia

- /

- Healthcare Services

- /

- ASX:REG

Regis Healthcare (ASX:REG) Valuation Revisited After Share Price Drops on Aged Care Funding Shortfall

Reviewed by Kshitija Bhandaru

Most Popular Narrative: 18.7% Undervalued

The most widely followed narrative suggests that Regis Healthcare is trading at a significant discount to its fair value, based on expectations for future earnings growth, margin expansion, and sector reforms.

Ongoing portfolio expansion through targeted acquisitions and greenfield developments (e.g., Rockpool, Ti Tree, CPSM acquisitions) and significant refurbishment capex are set to increase bed numbers, enhance asset quality, and support higher average pricing. This underpins both top-line revenue and net margin improvement.

Is Regis’s future value all about surging profit margins and top-line growth? There is a bold framework behind how this potential is calculated, built on ambitious forecasts and sector-changing policies. Curious which key metrics tip the balance toward undervaluation? Dive in and discover the specific assumptions that drive this bullish fair value call.

Result: Fair Value of $7.98 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, wage inflation and inadequate government funding adjustments could compress Regis’s margins, which may put both earnings growth and analyst optimism at risk.

Find out about the key risks to this Regis Healthcare narrative.Another View: Market Comparisons Tell a Different Story

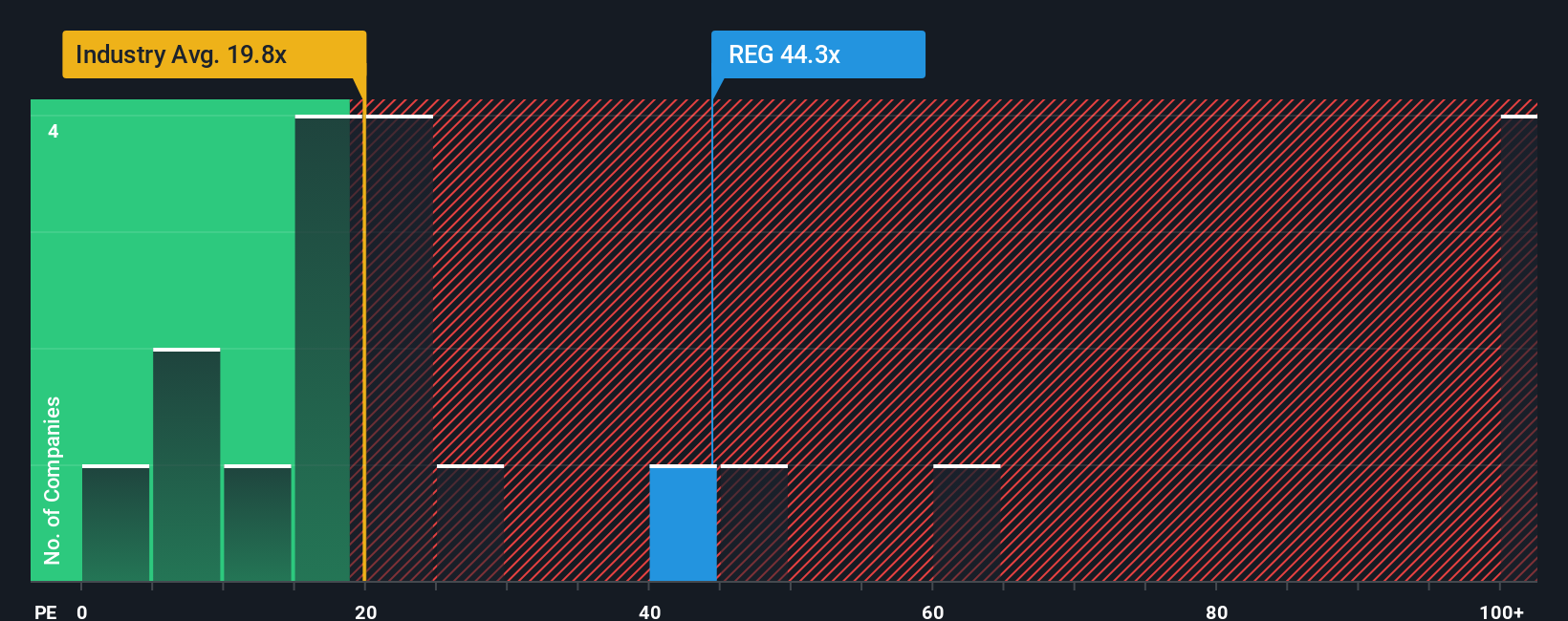

While the fair value assessment points to undervaluation, a look at industry averages suggests Regis Healthcare actually appears expensive on earnings compared to its global healthcare peers. Which method do you trust for the real picture?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Regis Healthcare Narrative

If you have a different perspective, or want to dig into the details firsthand, you can craft your own analysis in just minutes. Do it your way.

A great starting point for your Regis Healthcare research is our analysis highlighting 4 key rewards and 4 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investors never settle for just one opportunity. Boost your portfolio’s potential by searching for stocks aligned with emerging trends and strong fundamentals. There is a world of possibilities waiting for you.

- Hunt for market bargains among companies that are currently trading below their intrinsic value by using our undervalued stocks based on cash flows.

- Capitalize on breakthrough innovation by uncovering businesses riding the AI wave and shaping tomorrow’s technology landscape with our AI penny stocks.

- Seek out steady income by targeting shares that offer attractive yields, and let our dividend stocks with yields > 3% guide you to stocks rewarding investors with healthy dividends.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:REG

Regis Healthcare

Engages in the provision of residential aged care services in Australia.

Reasonable growth potential and fair value.

Similar Companies

Market Insights

Community Narratives