- Australia

- /

- Industrial REITs

- /

- ASX:GMG

ASX Stocks Estimated To Be Below Value In June 2024

Reviewed by Simply Wall St

Amidst fluctuations in the ASX200 and sector-specific downturns, particularly in IT and Energy, investors are keenly observing market movements for potential opportunities. In such an environment, identifying undervalued stocks becomes crucial as it might offer a strategic advantage in navigating through these challenging market conditions.

Top 10 Undervalued Stocks Based On Cash Flows In Australia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Smart Parking (ASX:SPZ) | A$0.48 | A$0.96 | 49.9% |

| Charter Hall Group (ASX:CHC) | A$12.17 | A$22.71 | 46.4% |

| HMC Capital (ASX:HMC) | A$7.37 | A$14.21 | 48.1% |

| ReadyTech Holdings (ASX:RDY) | A$3.18 | A$5.96 | 46.6% |

| Atturra (ASX:ATA) | A$0.765 | A$1.51 | 49.4% |

| hipages Group Holdings (ASX:HPG) | A$1.10 | A$1.95 | 43.5% |

| IPH (ASX:IPH) | A$6.18 | A$11.36 | 45.6% |

| Millennium Services Group (ASX:MIL) | A$1.145 | A$2.24 | 48.9% |

| SiteMinder (ASX:SDR) | A$4.87 | A$8.91 | 45.3% |

| Treasury Wine Estates (ASX:TWE) | A$11.99 | A$20.61 | 41.8% |

Here's a peek at a few of the choices from the screener

Life360 (ASX:360)

Overview: Life360, Inc. is a global technology company that provides a platform for locating people, pets, and things, with operations spanning North America, Europe, the Middle East, Africa, and other international markets; it has a market capitalization of A$3.40 billion.

Operations: The company generates revenue primarily through its software and programming segment, amounting to $314.60 million.

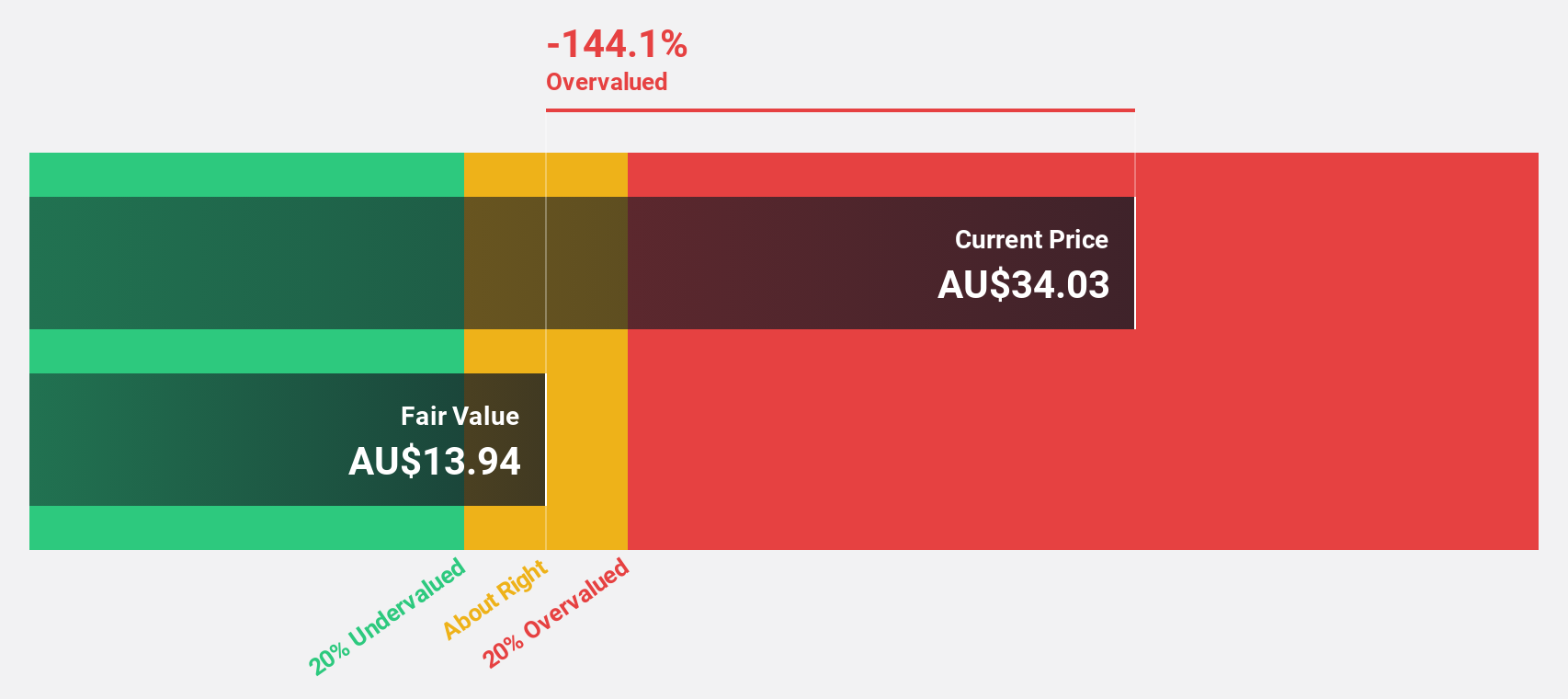

Estimated Discount To Fair Value: 35.6%

Life360, recently added to the NASDAQ Composite Index and completing a A$155.25 million equity offering, appears undervalued based on cash flows. Trading at A$15.44, significantly below the estimated fair value of A$23.97, the company is poised for profitability within three years amidst robust revenue growth forecasts (15.1% annually). However, recent substantial insider selling and shareholder dilution over the past year temper its prospects despite these positive indicators.

- Upon reviewing our latest growth report, Life360's projected financial performance appears quite optimistic.

- Unlock comprehensive insights into our analysis of Life360 stock in this financial health report.

Goodman Group (ASX:GMG)

Overview: Goodman Group is an integrated property group that operates in Australia, New Zealand, Asia, Europe, the United Kingdom, and the Americas, with a market capitalization of approximately A$67.10 billion.

Operations: The company generates its revenue from integrated property operations across Australia, New Zealand, Asia, Europe, the United Kingdom, and the Americas.

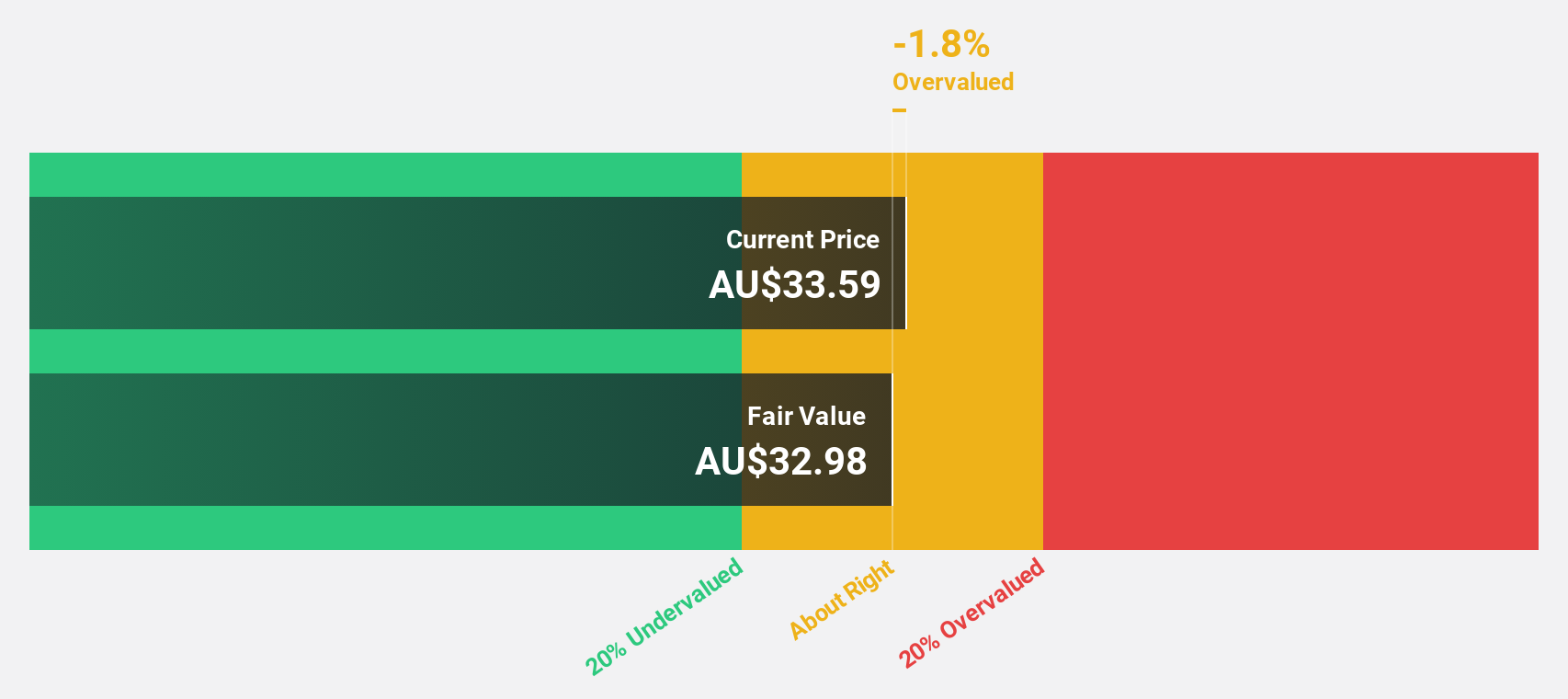

Estimated Discount To Fair Value: 12%

Goodman Group, trading at A$35.33, is considered undervalued against an estimated fair value of A$40.13 based on discounted cash flows. The company's revenue growth forecast at 26% per year surpasses the Australian market average of 5.4%. Despite a significant drop in profit margins from last year and substantial insider selling recently, Goodman's earnings are expected to grow by 35.76% annually. However, its return on equity is projected to be low at 12.3% in three years.

- Insights from our recent growth report point to a promising forecast for Goodman Group's business outlook.

- Navigate through the intricacies of Goodman Group with our comprehensive financial health report here.

Regis Healthcare (ASX:REG)

Overview: Regis Healthcare Limited operates in Australia, providing residential aged care services with a market capitalization of approximately A$1.26 billion.

Operations: The company generates its revenue primarily from residential aged care services, totaling approximately A$882.29 million.

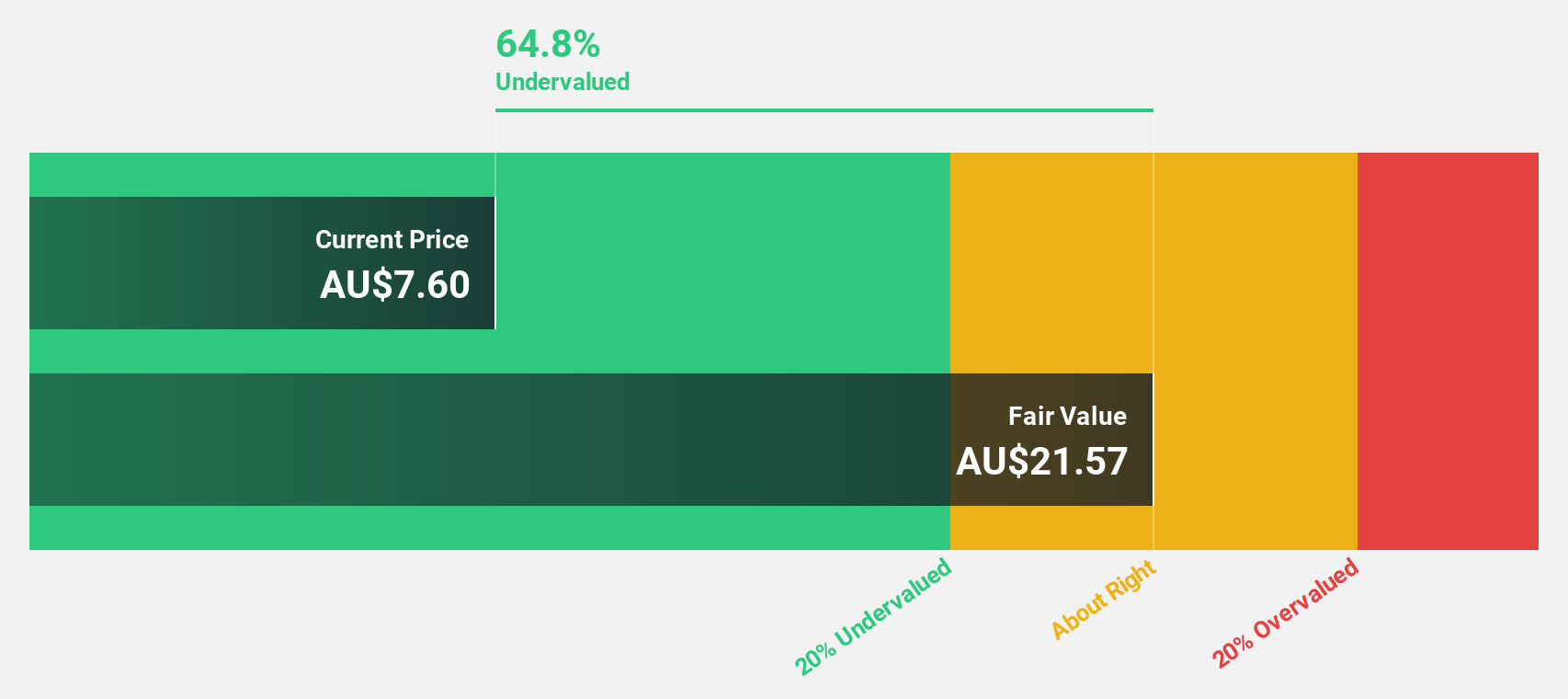

Estimated Discount To Fair Value: 32%

Regis Healthcare, with a current price of A$4.18, is perceived as undervalued when compared to our fair value estimate of A$6.15, reflecting a 32% discount. This pricing comes amidst expectations for the company to turn profitable within the next three years, supported by a robust revenue growth forecast of 9.1% annually—outpacing the Australian market's average of 5.4%. Additionally, its projected return on equity is very high at 184%. However, concerns are raised by significant insider selling over the past quarter.

- In light of our recent growth report, it seems possible that Regis Healthcare's financial performance will exceed current levels.

- Get an in-depth perspective on Regis Healthcare's balance sheet by reading our health report here.

Seize The Opportunity

- Get an in-depth perspective on all 49 Undervalued ASX Stocks Based On Cash Flows by using our screener here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:GMG

Adequate balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives