- Australia

- /

- Specialty Stores

- /

- ASX:AX1

3 ASX Penny Stocks With Market Caps Under A$900M To Watch

Reviewed by Simply Wall St

Australian shares are poised for a modest gain, buoyed by Wall Street's positive momentum following encouraging inflation data, while local market participants await Australia's own inflation report and key international trade discussions. In this context, penny stocks—often representing smaller or emerging companies—continue to capture investor interest due to their potential for affordability and growth. Despite the term's origins in past market eras, these stocks remain relevant as they can offer unique opportunities when backed by strong financial fundamentals.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Rewards & Risks |

| Alfabs Australia (ASX:AAL) | A$0.485 | A$139M | ✅ 4 ⚠️ 3 View Analysis > |

| Dusk Group (ASX:DSK) | A$0.93 | A$57.91M | ✅ 4 ⚠️ 2 View Analysis > |

| IVE Group (ASX:IGL) | A$2.76 | A$424.49M | ✅ 4 ⚠️ 3 View Analysis > |

| MotorCycle Holdings (ASX:MTO) | A$3.90 | A$287.85M | ✅ 4 ⚠️ 2 View Analysis > |

| Pureprofile (ASX:PPL) | A$0.043 | A$50.3M | ✅ 3 ⚠️ 1 View Analysis > |

| Veris (ASX:VRS) | A$0.076 | A$40.03M | ✅ 3 ⚠️ 2 View Analysis > |

| West African Resources (ASX:WAF) | A$3.04 | A$3.47B | ✅ 4 ⚠️ 2 View Analysis > |

| LaserBond (ASX:LBL) | A$0.515 | A$60.81M | ✅ 4 ⚠️ 1 View Analysis > |

| Fleetwood (ASX:FWD) | A$3.23 | A$298.24M | ✅ 3 ⚠️ 2 View Analysis > |

| Clover (ASX:CLV) | A$0.65 | A$108.55M | ✅ 3 ⚠️ 2 View Analysis > |

Click here to see the full list of 417 stocks from our ASX Penny Stocks screener.

Let's uncover some gems from our specialized screener.

Accent Group (ASX:AX1)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Accent Group Limited operates in the retail, distribution, and franchise sectors for lifestyle footwear, apparel, and accessories across Australia and New Zealand with a market capitalization of A$793.57 million.

Operations: Accent Group generates its revenue primarily through two segments: Retail, which accounts for A$1.30 billion, and Wholesale, contributing A$459.71 million.

Market Cap: A$793.57M

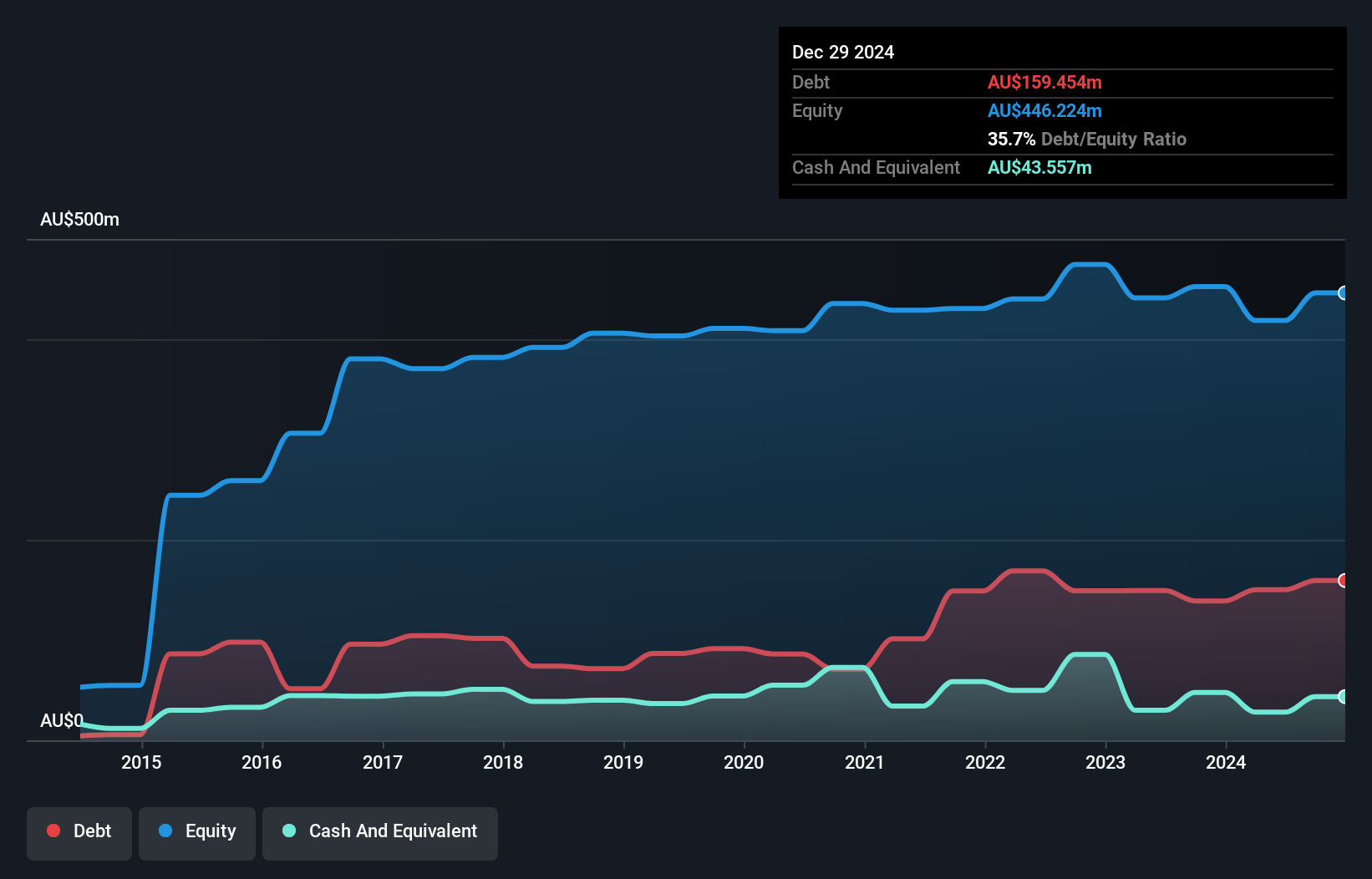

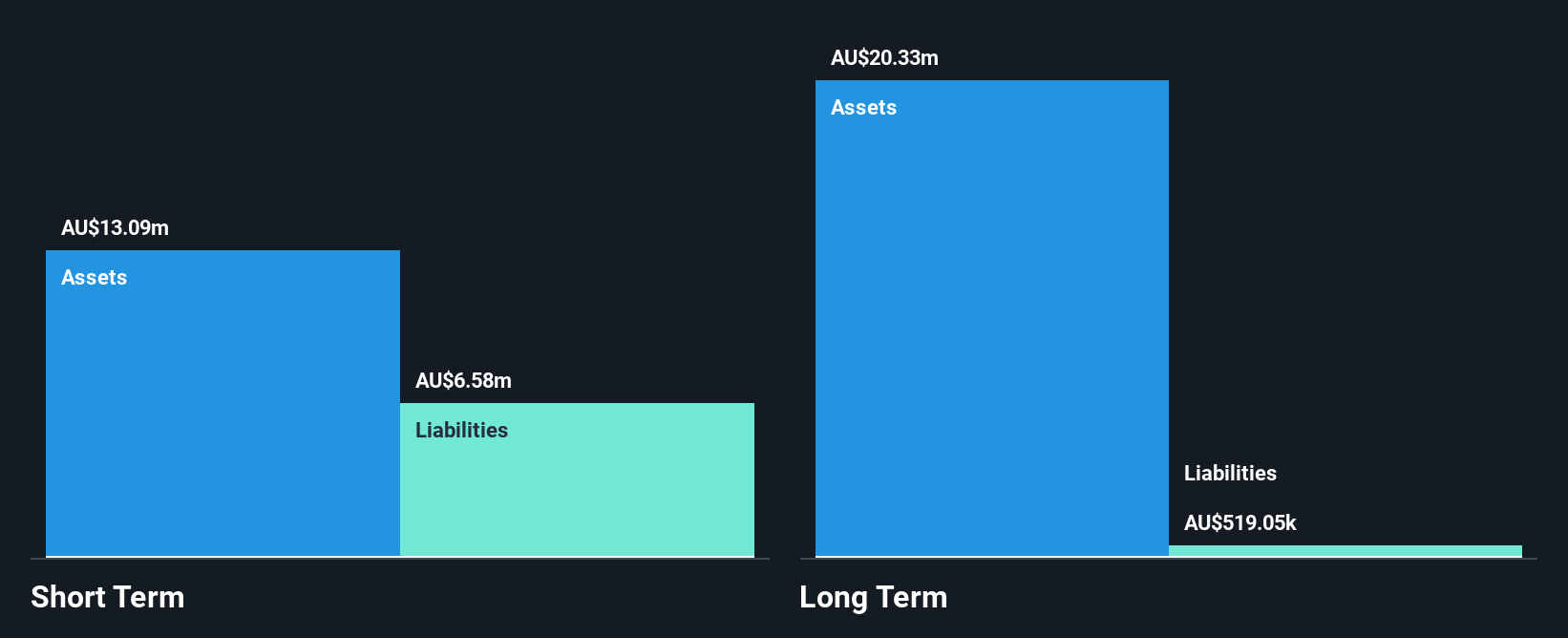

Accent Group's recent strategic alliance with Bamboo Rose to enhance planning capabilities through the TotalPLM platform aims to improve forecasting accuracy and operational efficiency. Despite a challenging year with negative earnings growth, Accent Group maintains strong interest coverage and cash flow relative to its debt. The company is trading below analyst price targets, suggesting potential upside, though its return on equity remains low. While dividends have been unstable, the board and management team are experienced, providing stability. Short-term assets cover liabilities adequately; however, long-term liabilities slightly exceed short-term assets. Earnings are forecasted to grow annually by 11.87%.

- Get an in-depth perspective on Accent Group's performance by reading our balance sheet health report here.

- Understand Accent Group's earnings outlook by examining our growth report.

Kinatico (ASX:KYP)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Kinatico Ltd offers screening, verification, and SaaS-based workforce management and compliance technology systems in Australia and New Zealand, with a market cap of A$166.36 million.

Operations: The company generates revenue of A$32.56 million from providing screening and verification checks.

Market Cap: A$166.36M

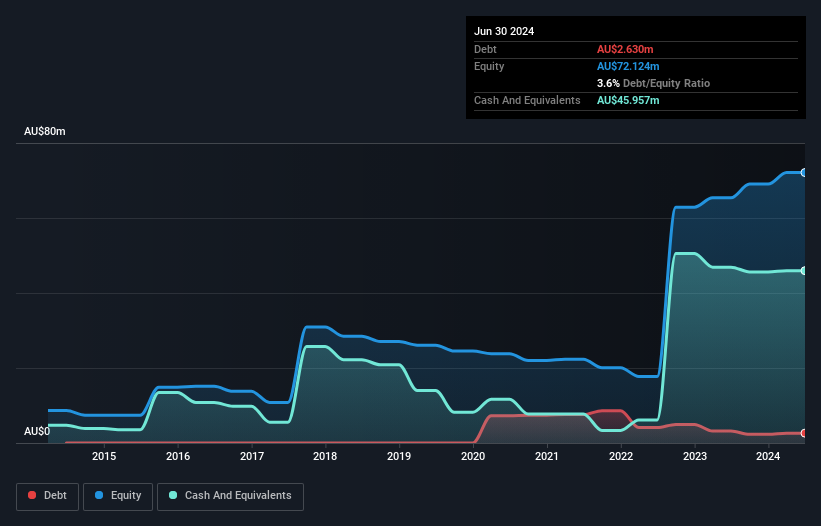

Kinatico Ltd, with a market cap of A$166.36 million, has demonstrated consistent revenue growth, reporting earnings of A$32.13 million for the year ending June 2025. The company has maintained profitability over the past five years with a notable annual earnings growth rate of 51.4%. Despite having no debt, Kinatico's return on equity is low at 4.1%. The board and management team are experienced, which provides operational stability amidst recent executive changes. Trading below estimated fair value by 25.5%, Kinatico’s short-term assets comfortably cover its liabilities while boasting high-quality earnings and stable weekly volatility.

- Click to explore a detailed breakdown of our findings in Kinatico's financial health report.

- Evaluate Kinatico's prospects by accessing our earnings growth report.

PolyNovo (ASX:PNV)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: PolyNovo Limited designs, manufactures, and sells biodegradable medical devices across several countries including Australia, New Zealand, the United States, and others with a market cap of A$894.64 million.

Operations: The company's revenue is primarily derived from the development, manufacturing, and commercialization of NovoSorb Technology, generating A$128.70 million.

Market Cap: A$894.64M

PolyNovo Limited, with a market cap of A$894.64 million, has shown strong financial health and growth in the medical device sector. The company reported revenue of A$129.19 million for the year ending June 2025, marking significant earnings growth of 151.2% over the past year, exceeding industry averages. Its debt is well-managed with cash flow coverage at 84.8%, and short-term assets surpassing liabilities significantly. Despite a low return on equity at 15.9%, PolyNovo's profit margins have improved to 10.3%. Recent board changes include appointing Robert Douglas, bringing extensive experience in medical technology governance to bolster strategic direction amidst its stable weekly volatility profile.

- Jump into the full analysis health report here for a deeper understanding of PolyNovo.

- Explore PolyNovo's analyst forecasts in our growth report.

Key Takeaways

- Investigate our full lineup of 417 ASX Penny Stocks right here.

- Ready For A Different Approach? The latest GPUs need a type of rare earth metal called Dysprosium and there are only 37 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:AX1

Accent Group

Engages in the retail, distribution, and franchise of lifestyle footwear, apparel, and accessories in Australia and New Zealand.

Very undervalued with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives