Some have more dollars than sense, they say, so even companies that have no revenue, no profit, and a record of falling short, can easily find investors. Unfortunately, high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson.

In the age of tech-stock blue-sky investing, my choice may seem old fashioned; I still prefer profitable companies like Pro Medicus (ASX:PME). While that doesn't make the shares worth buying at any price, you can't deny that successful capitalism requires profit, eventually. Loss-making companies are always racing against time to reach financial sustainability, but time is often a friend of the profitable company, especially if it is growing.

Check out our latest analysis for Pro Medicus

Pro Medicus's Earnings Per Share Are Growing.

As one of my mentors once told me, share price follows earnings per share (EPS). That makes EPS growth an attractive quality for any company. I, for one, am blown away by the fact that Pro Medicus has grown EPS by 45% per year, over the last three years. Growth that fast may well be fleeting, but like a lotus blooming from a murky pond, it sparks joy for the wary stock pickers.

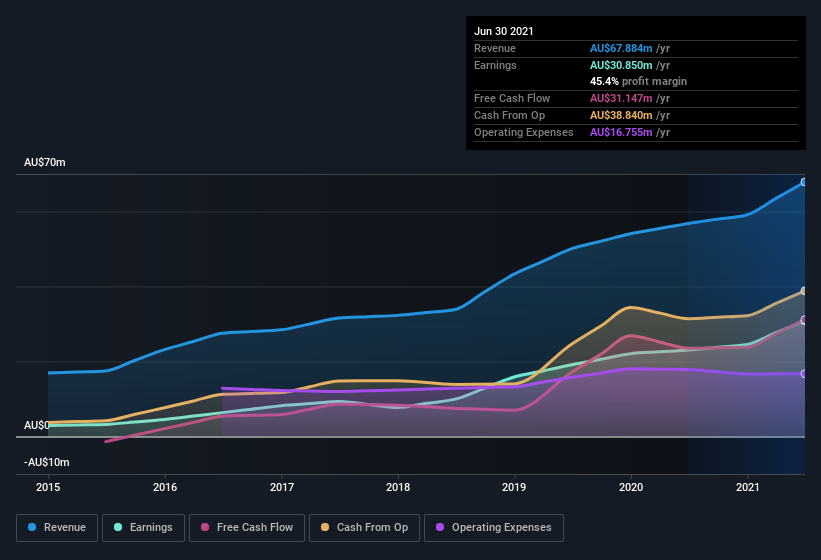

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. Pro Medicus shareholders can take confidence from the fact that EBIT margins are up from 53% to 62%, and revenue is growing. Ticking those two boxes is a good sign of growth, in my book.

In the chart below, you can see how the company has grown earnings, and revenue, over time. Click on the chart to see the exact numbers.

You don't drive with your eyes on the rear-view mirror, so you might be more interested in this free report showing analyst forecasts for Pro Medicus's future profits.

Are Pro Medicus Insiders Aligned With All Shareholders?

Personally, I like to see high insider ownership of a company, since it suggests that it will be managed in the interests of shareholders. So we're pleased to report that Pro Medicus insiders own a meaningful share of the business. Indeed, with a collective holding of 56%, company insiders are in control and have plenty of capital behind the venture. To me this is a good sign because it suggests they will be incentivised to build value for shareholders over the long term. And their holding is extremely valuable at the current share price, totalling AU$3.2b. That means they have plenty of their own capital riding on the performance of the business!

It means a lot to see insiders invested in the business, but I find myself wondering if remuneration policies are shareholder friendly. A brief analysis of the CEO compensation suggests they are. I discovered that the median total compensation for the CEOs of companies like Pro Medicus with market caps between AU$2.7b and AU$8.5b is about AU$2.4m.

The CEO of Pro Medicus only received AU$508k in total compensation for the year ending . That looks like modest pay to me, and may hint at a certain respect for the interests of shareholders. While the level of CEO compensation isn't a huge factor in my view of the company, modest remuneration is a positive, because it suggests that the board keeps shareholder interests in mind. It can also be a sign of good governance, more generally.

Does Pro Medicus Deserve A Spot On Your Watchlist?

Pro Medicus's earnings per share growth have been levitating higher, like a mountain goat scaling the Alps. The cherry on top is that insiders own a bucket-load of shares, and the CEO pay seems really quite reasonable. The strong EPS improvement suggests the businesses is humming along. Pro Medicus certainly ticks a few of my boxes, so I think it's probably well worth further consideration. Another important measure of business quality not discussed here, is return on equity (ROE). Click on this link to see how Pro Medicus shapes up to industry peers, when it comes to ROE.

Of course, you can do well (sometimes) buying stocks that are not growing earnings and do not have insiders buying shares. But as a growth investor I always like to check out companies that do have those features. You can access a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About ASX:PME

Pro Medicus

A healthcare informatics company, engages in the development and supply of healthcare imaging software, and radiology information (RIS) system software and services to hospitals, imaging centers, and health care groups in Australia, North America, and Europe.

Flawless balance sheet with high growth potential.