- Australia

- /

- Medical Equipment

- /

- ASX:NXS

Take Care Before Jumping Onto Next Science Limited (ASX:NXS) Even Though It's 26% Cheaper

The Next Science Limited (ASX:NXS) share price has fared very poorly over the last month, falling by a substantial 26%. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 37% in that time.

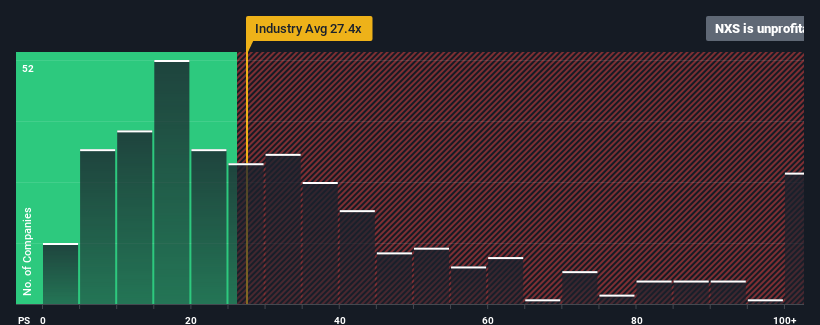

In spite of the heavy fall in price, Next Science's price-to-earnings (or "P/E") ratio of -6.3x might still make it look like a strong buy right now compared to the market in Australia, where around half of the companies have P/E ratios above 17x and even P/E's above 33x are quite common. However, the P/E might be quite low for a reason and it requires further investigation to determine if it's justified.

Next Science could be doing better as its earnings have been going backwards lately while most other companies have been seeing positive earnings growth. The P/E is probably low because investors think this poor earnings performance isn't going to get any better. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

See our latest analysis for Next Science

How Is Next Science's Growth Trending?

In order to justify its P/E ratio, Next Science would need to produce anemic growth that's substantially trailing the market.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 27%. Unfortunately, that's brought it right back to where it started three years ago with EPS growth being virtually non-existent overall during that time. Therefore, it's fair to say that earnings growth has been inconsistent recently for the company.

Turning to the outlook, the next three years should generate growth of 22% each year as estimated by the dual analysts watching the company. Meanwhile, the rest of the market is forecast to only expand by 12% each year, which is noticeably less attractive.

With this information, we find it odd that Next Science is trading at a P/E lower than the market. It looks like most investors are not convinced at all that the company can achieve future growth expectations.

The Bottom Line On Next Science's P/E

Shares in Next Science have plummeted and its P/E is now low enough to touch the ground. Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Our examination of Next Science's analyst forecasts revealed that its superior earnings outlook isn't contributing to its P/E anywhere near as much as we would have predicted. When we see a strong earnings outlook with faster-than-market growth, we assume potential risks are what might be placing significant pressure on the P/E ratio. At least price risks look to be very low, but investors seem to think future earnings could see a lot of volatility.

You need to take note of risks, for example - Next Science has 5 warning signs (and 1 which doesn't sit too well with us) we think you should know about.

Of course, you might also be able to find a better stock than Next Science. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if Next Science might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:NXS

Next Science

Engages in the research, development, and commercialization of technologies that resolve the issues in human health caused by biofilms, incumbent bacteria, fungus, viruses, and infections in North America, Australia, and New Zealand.

Slight risk and slightly overvalued.

Market Insights

Community Narratives