- Australia

- /

- Medical Equipment

- /

- ASX:NAN

Top ASX Growth Companies With High Insider Ownership In September 2024

Reviewed by Simply Wall St

Over the last 7 days, the Australian market has dropped 1.7%, driven by a decline of 5.4% in the Materials sector. However, over the longer term, the market has risen by 10% in the last year with earnings forecast to grow by 12% annually. In this context, identifying growth companies with high insider ownership can be particularly valuable as insiders often have deeper insights into their company's potential and may signal confidence in future performance.

Top 10 Growth Companies With High Insider Ownership In Australia

| Name | Insider Ownership | Earnings Growth |

| Hartshead Resources (ASX:HHR) | 13.9% | 102.6% |

| Clinuvel Pharmaceuticals (ASX:CUV) | 13.6% | 27.4% |

| Catalyst Metals (ASX:CYL) | 17% | 61.8% |

| AVA Risk Group (ASX:AVA) | 15.7% | 118.8% |

| Pointerra (ASX:3DP) | 18.7% | 126.4% |

| Acrux (ASX:ACR) | 14.6% | 91.6% |

| Hillgrove Resources (ASX:HGO) | 10.4% | 70.5% |

| Adveritas (ASX:AV1) | 21.1% | 144.2% |

| Liontown Resources (ASX:LTR) | 16.4% | 69.7% |

| Plenti Group (ASX:PLT) | 12.8% | 106.4% |

Let's take a closer look at a couple of our picks from the screened companies.

Aussie Broadband (ASX:ABB)

Simply Wall St Growth Rating: ★★★★☆☆

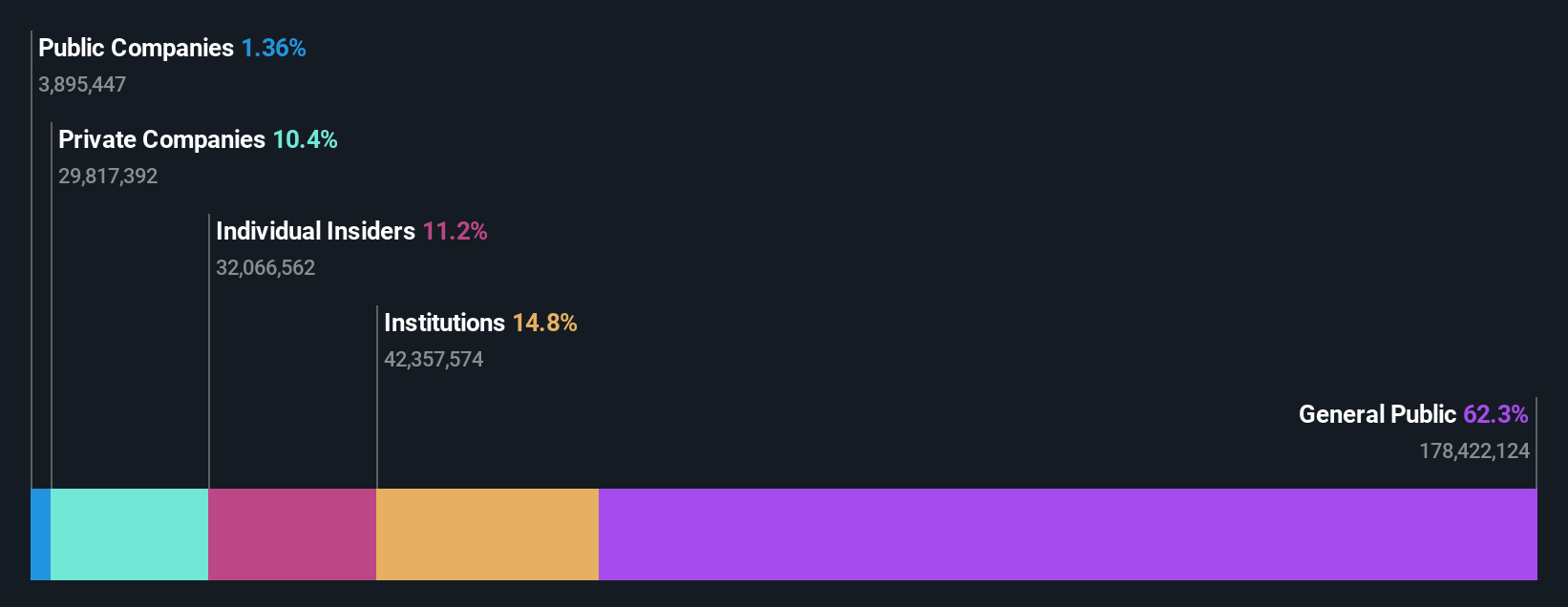

Overview: Aussie Broadband Limited offers telecommunications and technology services in Australia, with a market cap of A$1.14 billion.

Operations: The company's revenue segments include Business (A$96.97 million), Wholesale (A$159.73 million), Residential (A$585.07 million), Symbio Group (A$69.93 million), and Enterprise and Government (A$88.04 million).

Insider Ownership: 10.8%

Aussie Broadband's earnings are forecast to grow significantly at 27.3% per year, outpacing the Australian market's 12.1%. Despite recent shareholder dilution and large one-off items impacting financial results, ABB reported strong revenue growth from A$787.95 million to A$999.75 million in FY2024, with net income rising to A$26.38 million. Insider ownership remains high, though no substantial insider trading occurred in the past three months. Recent executive changes include a new Group CFO and an upcoming CTO transition.

- Unlock comprehensive insights into our analysis of Aussie Broadband stock in this growth report.

- Upon reviewing our latest valuation report, Aussie Broadband's share price might be too optimistic.

Humm Group (ASX:HUM)

Simply Wall St Growth Rating: ★★★★☆☆

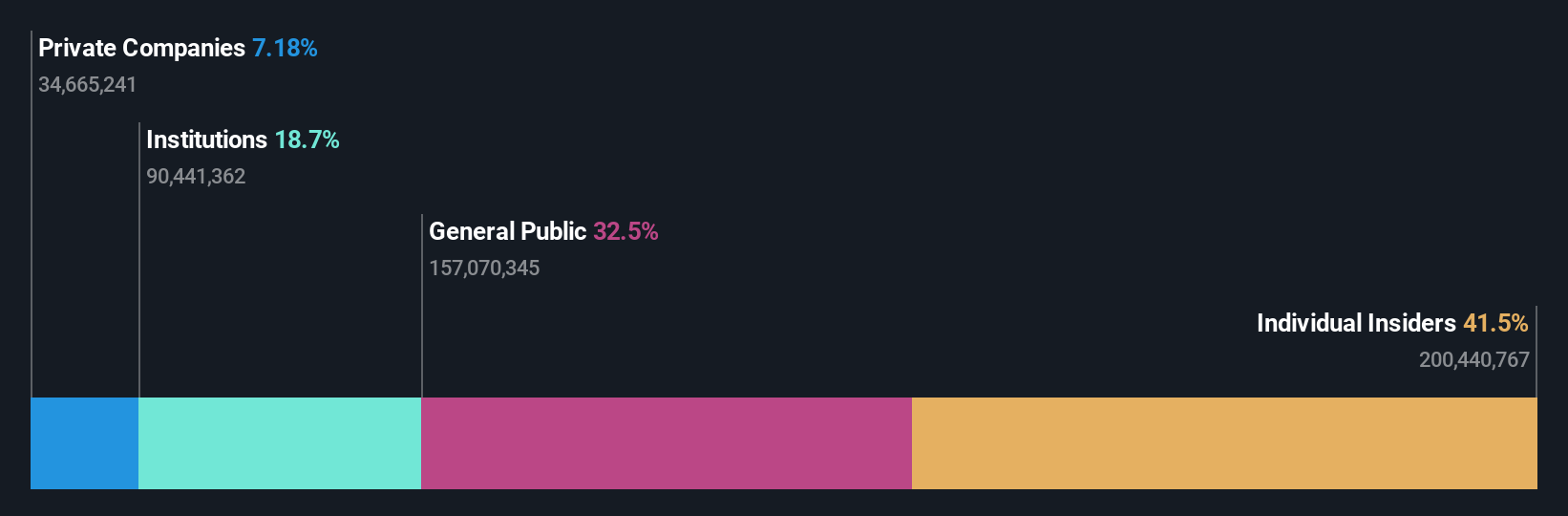

Overview: Humm Group Limited offers a range of financial products and services across Australia, New Zealand, Ireland, the United Kingdom, and Canada with a market cap of A$388.79 million.

Operations: The company's revenue segments include PosPP (A$49.70 million), Australia Cards (A$42 million), New Zealand Cards (A$65.90 million), and Commercial and Leasing (A$86.10 million).

Insider Ownership: 27.9%

Humm Group's earnings are expected to grow significantly at 23.9% per year, surpassing the Australian market's 12.1%. Although revenue growth is forecasted at a slower rate of 13.1% per year, it still outpaces the broader market's 5.3%. The company became profitable this year despite large one-off items impacting results and debt not being well covered by operating cash flow. Recent buybacks indicate strong insider confidence, with A$10 million spent repurchasing shares in 2024.

- Click here to discover the nuances of Humm Group with our detailed analytical future growth report.

- Our comprehensive valuation report raises the possibility that Humm Group is priced lower than what may be justified by its financials.

Nanosonics (ASX:NAN)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Nanosonics Limited is a global infection prevention company with a market cap of A$1.11 billion.

Operations: Nanosonics generates revenue primarily from its Healthcare Equipment segment, which accounts for A$170.01 million.

Insider Ownership: 15.1%

Nanosonics' earnings are forecast to grow significantly at 23.2% per year, outpacing the Australian market's 12.1%. However, recent financial results showed a decline in net income to A$12.97 million from A$19.88 million last year despite a slight increase in sales to A$170.01 million. The company's profit margins have also decreased from 12% to 7.6%. Nanosonics trades at 28.3% below its estimated fair value, indicating potential undervaluation for growth-focused investors.

- Delve into the full analysis future growth report here for a deeper understanding of Nanosonics.

- Insights from our recent valuation report point to the potential overvaluation of Nanosonics shares in the market.

Where To Now?

- Get an in-depth perspective on all 97 Fast Growing ASX Companies With High Insider Ownership by using our screener here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Nanosonics might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:NAN

Flawless balance sheet with reasonable growth potential.