- Australia

- /

- Metals and Mining

- /

- ASX:VSL

3 ASX Growth Stocks With Up To 34% Insider Ownership

Reviewed by Simply Wall St

The Australian market has shown positive momentum, rising 1.1% over the last week and 11% over the past year, with the Materials sector leading at a 3.2% increase. In this favorable environment, growth companies with significant insider ownership can be particularly compelling as they often indicate strong internal confidence in future performance.

Top 10 Growth Companies With High Insider Ownership In Australia

| Name | Insider Ownership | Earnings Growth |

| Hartshead Resources (ASX:HHR) | 13.9% | 102.6% |

| Cettire (ASX:CTT) | 28.7% | 26.7% |

| Acrux (ASX:ACR) | 14.6% | 115.6% |

| Clinuvel Pharmaceuticals (ASX:CUV) | 13.6% | 28.1% |

| Liontown Resources (ASX:LTR) | 16.4% | 69.7% |

| Catalyst Metals (ASX:CYL) | 17.5% | 75.7% |

| Hillgrove Resources (ASX:HGO) | 10.4% | 49.4% |

| Adveritas (ASX:AV1) | 21.1% | 103.9% |

| Plenti Group (ASX:PLT) | 12.8% | 106.4% |

| Change Financial (ASX:CCA) | 26.6% | 77.9% |

We're going to check out a few of the best picks from our screener tool.

Chrysos (ASX:C79)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Chrysos Corporation Limited (ASX:C79) develops and supplies mining technology, with a market cap of A$707.27 million.

Operations: Chrysos generates revenue from the development and supply of mining technology.

Insider Ownership: 17.5%

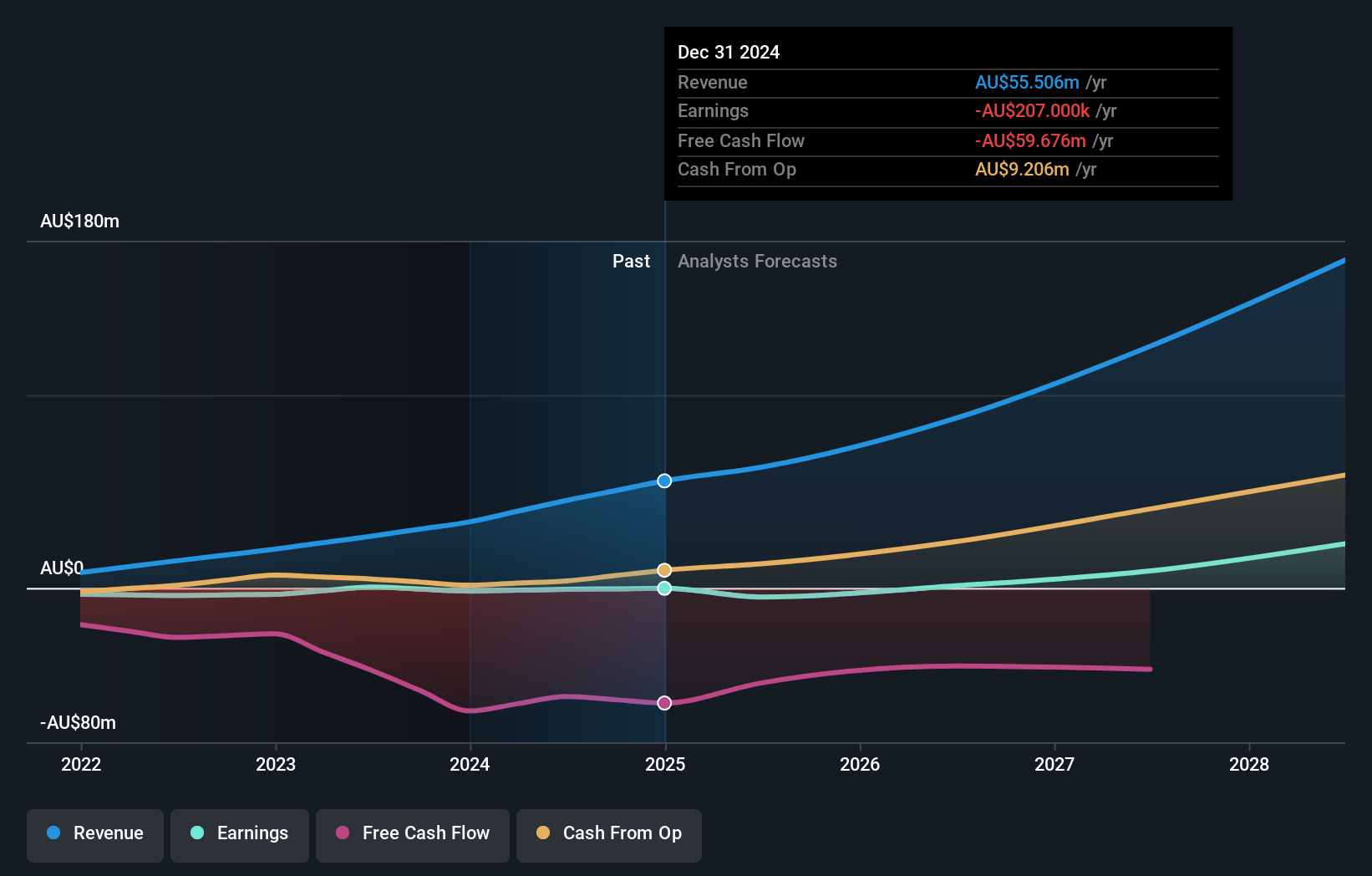

Chrysos Corporation Limited demonstrates significant growth potential with high insider ownership. The company reported A$44.18 million in sales for FY2024, up from A$25.61 million the previous year, though it posted a net loss of A$0.704 million compared to a net income of A$0.443 million previously. Revenue is forecast to grow at 30.5% annually, outpacing the broader Australian market's 5.3%. Despite some dilution and recent insider selling, Chrysos is expected to achieve profitability within three years.

- Click to explore a detailed breakdown of our findings in Chrysos' earnings growth report.

- Our valuation report here indicates Chrysos may be overvalued.

Nanosonics (ASX:NAN)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Nanosonics Limited is a global infection prevention company with a market cap of A$975.65 million.

Operations: Nanosonics generates revenue primarily from its Healthcare Equipment segment, which amounted to A$170.01 million.

Insider Ownership: 15.1%

Nanosonics' earnings are forecast to grow significantly at 22.29% per year, outpacing the Australian market's 12.8%. Despite a decline in profit margins from 12% to 7.6%, the company trades at a discount of 37% below its estimated fair value. Recent financial results show sales of A$170.01 million and net income of A$12.97 million, down from A$19.88 million last year, with basic earnings per share falling to A$0.0429 from A$0.066.

- Click here and access our complete growth analysis report to understand the dynamics of Nanosonics.

- The analysis detailed in our Nanosonics valuation report hints at an inflated share price compared to its estimated value.

Vulcan Steel (ASX:VSL)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Vulcan Steel Limited (ASX:VSL) operates in the sale and distribution of steel and metal products across New Zealand and Australia, with a market cap of A$834.44 million.

Operations: Vulcan Steel Limited generates revenue from two primary segments: NZ$471.29 million from steel and NZ$593.04 million from metals.

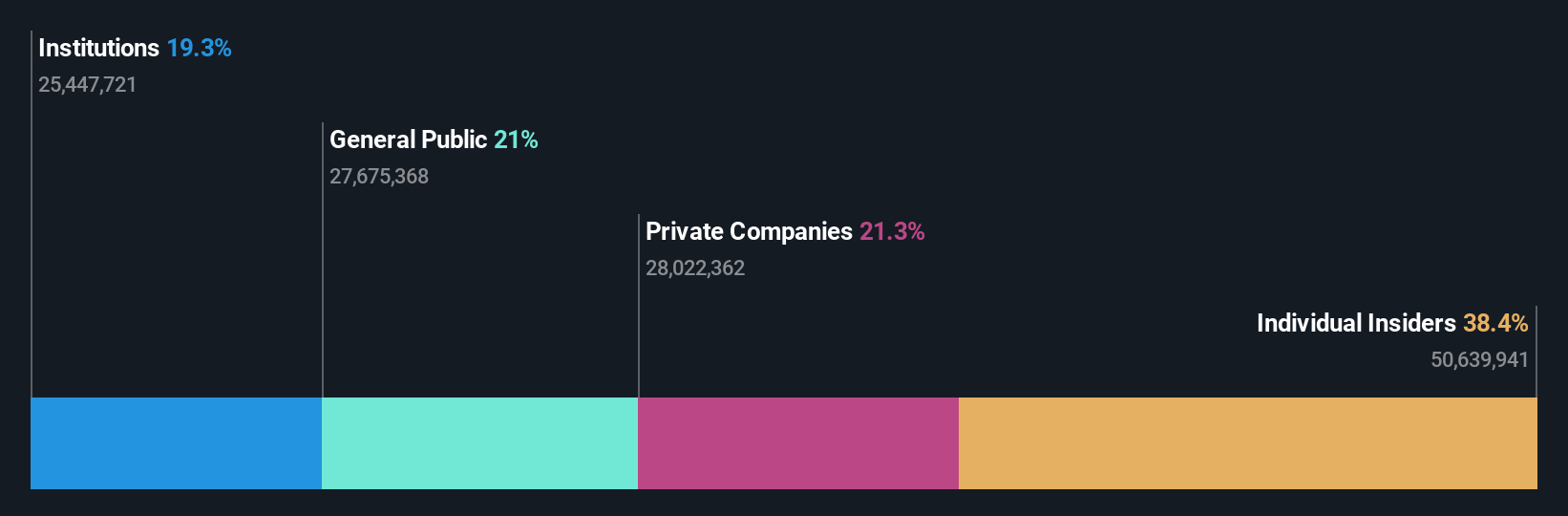

Insider Ownership: 34.5%

Vulcan Steel's earnings are forecast to grow significantly at 32.53% per year, outpacing the Australian market's 12.8%, despite a decline in profit margins from 7.1% to 3.8%. The company trades at a discount of 42.7% below its estimated fair value but faces challenges with interest payments not well covered by earnings and an unstable dividend track record. Recent results show sales of NZ$1.06 billion and net income of NZ$39.99 million, down from NZ$87.9 million last year.

- Navigate through the intricacies of Vulcan Steel with our comprehensive analyst estimates report here.

- Upon reviewing our latest valuation report, Vulcan Steel's share price might be too optimistic.

Key Takeaways

- Unlock more gems! Our Fast Growing ASX Companies With High Insider Ownership screener has unearthed 88 more companies for you to explore.Click here to unveil our expertly curated list of 91 Fast Growing ASX Companies With High Insider Ownership.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:VSL

Vulcan Steel

Engages in the sale and distribution of steel and metal products in New Zealand and Australia.

Reasonable growth potential second-rate dividend payer.