- Australia

- /

- Healthcare Services

- /

- ASX:MAP

3 ASX Penny Stocks With Market Caps Up To A$300M

Reviewed by Simply Wall St

The Australian share market is poised for a positive opening, with the ASX 200 expected to rise following a week marked by geopolitical developments and economic data releases. In such fluctuating conditions, investors often look beyond established giants to explore opportunities in smaller companies. Penny stocks, though an older term, remain relevant as they represent smaller or newer companies that can offer value and growth potential. This article will explore three penny stocks that stand out for their financial strength and potential appeal amidst current market trends.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Financial Health Rating |

| Embark Early Education (ASX:EVO) | A$0.78 | A$143.12M | ★★★★☆☆ |

| LaserBond (ASX:LBL) | A$0.57 | A$66.82M | ★★★★★★ |

| Austin Engineering (ASX:ANG) | A$0.505 | A$313.17M | ★★★★★☆ |

| MaxiPARTS (ASX:MXI) | A$1.90 | A$105.1M | ★★★★★★ |

| GTN (ASX:GTN) | A$0.5425 | A$106.53M | ★★★★★★ |

| Helloworld Travel (ASX:HLO) | A$2.02 | A$328.89M | ★★★★★★ |

| SHAPE Australia (ASX:SHA) | A$3.00 | A$248.73M | ★★★★★★ |

| IVE Group (ASX:IGL) | A$2.18 | A$337.66M | ★★★★☆☆ |

| SKS Technologies Group (ASX:SKS) | A$1.59 | A$243.19M | ★★★★★★ |

| Nickel Industries (ASX:NIC) | A$0.745 | A$3.2B | ★★★★★☆ |

Click here to see the full list of 1,031 stocks from our ASX Penny Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Gold Hydrogen (ASX:GHY)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Gold Hydrogen Limited focuses on the discovery, exploration, and development of hydrogen and helium gas in Australia, with a market cap of A$93.45 million.

Operations: The company generates revenue of A$0.49 million from the exploration and development of its PEL tenements.

Market Cap: A$93.45M

Gold Hydrogen Limited is a pre-revenue company focused on hydrogen and helium exploration in Australia, with a market cap of A$93.45 million. Despite its unprofitability and lack of significant revenue, the company has no debt, providing some financial stability. Recent developments include plans for an extensive 2025 drilling campaign at the Ramsay Project to assess commercial production potential. The appointment of Peter Bubendorfer as Chief Geologist brings valuable industry experience, potentially strengthening their exploration efforts. However, with less than three years of financial data available and a new management team, investors should consider these factors carefully.

- Click to explore a detailed breakdown of our findings in Gold Hydrogen's financial health report.

- Gain insights into Gold Hydrogen's past trends and performance with our report on the company's historical track record.

Microba Life Sciences (ASX:MAP)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Microba Life Sciences Limited operates in the field of microbiome testing, supplements, and analysis services across several regions including Australia, Europe, New Zealand, the UAE, the UK, the US, Asia, and Ireland with a market cap of A$134.36 million.

Operations: The company generates revenue of A$12.09 million from its testing services and supplements segment.

Market Cap: A$134.36M

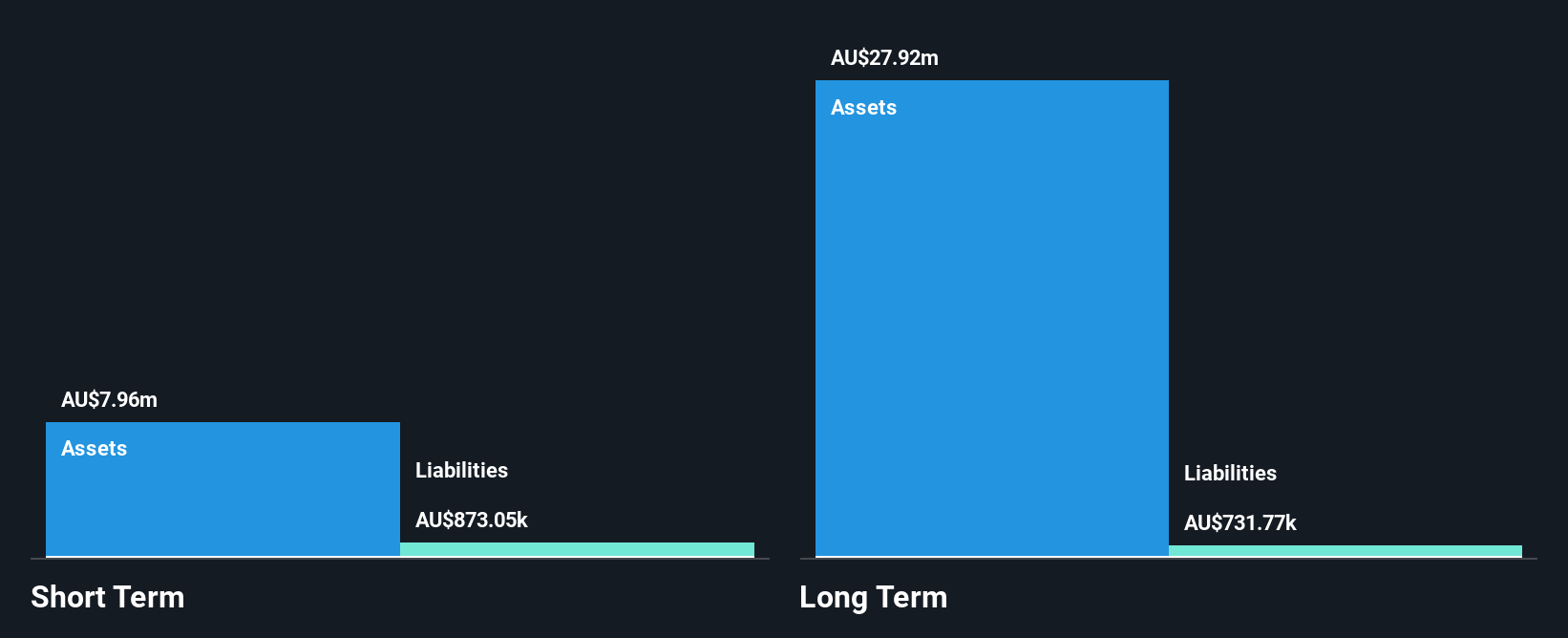

Microba Life Sciences Limited, with a market cap of A$134.36 million, generates A$12.09 million in revenue from its microbiome testing and supplements segment. Despite being unprofitable, the company maintains financial stability as its short-term assets exceed both short and long-term liabilities. However, it faces challenges with less than one year of cash runway if current free cash flow trends continue. The share price has been highly volatile recently, reflecting market uncertainty. Recent events include an upcoming earnings call on January 29th and amendments to the company's constitution approved at their annual general meeting in November 2024.

- Take a closer look at Microba Life Sciences' potential here in our financial health report.

- Review our growth performance report to gain insights into Microba Life Sciences' future.

SKS Technologies Group (ASX:SKS)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: SKS Technologies Group Limited operates in Australia, focusing on the design, supply, and installation of audio visual, electrical, and communication products and services with a market cap of A$243.19 million.

Operations: The company generates revenue of A$136.31 million from its operations in the lighting and audio-visual markets.

Market Cap: A$243.19M

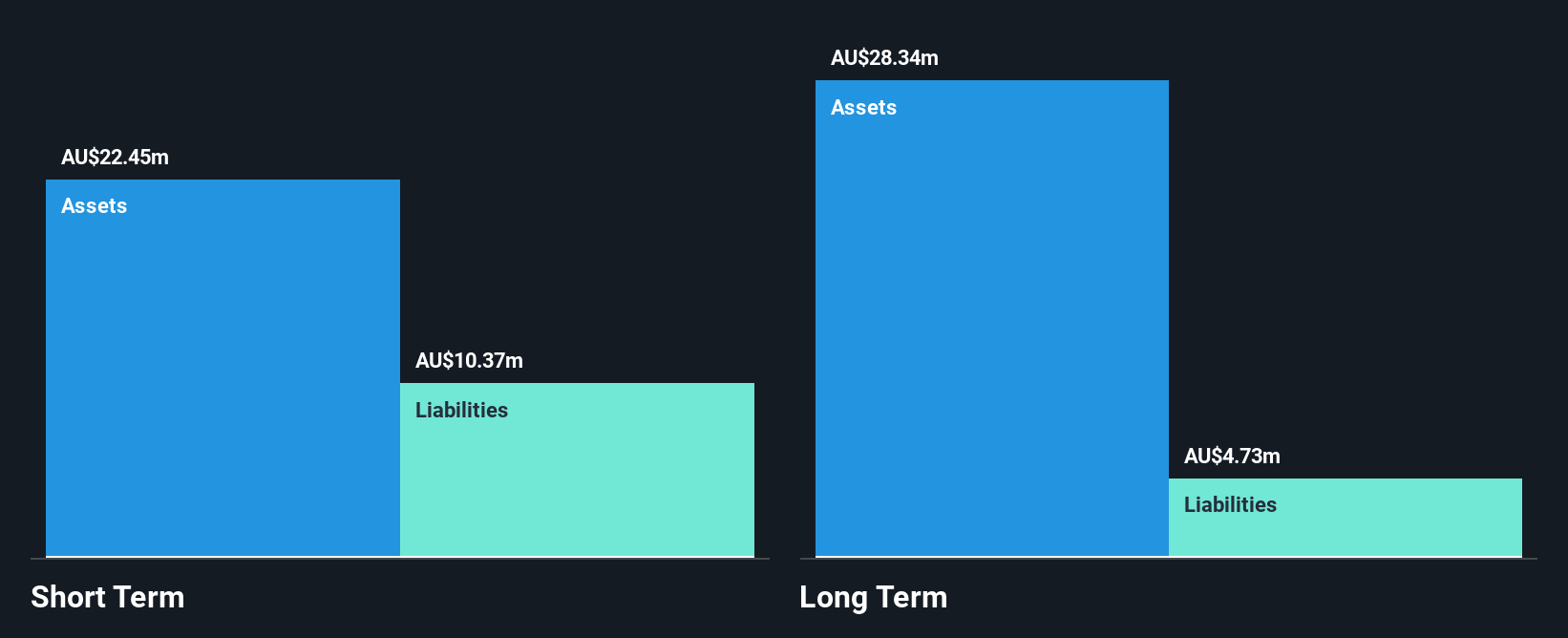

SKS Technologies Group, with a market cap of A$243.19 million and revenue of A$136.31 million, has demonstrated robust financial health and growth potential in the penny stock segment. The company is debt-free, with short-term assets exceeding both short and long-term liabilities, indicating strong liquidity. Its earnings have grown significantly by 47.4% annually over the past five years, accelerating to a very large 948% increase last year—far outpacing industry averages. SKS's Return on Equity is outstanding at 54.5%, and its shares trade at a considerable discount to estimated fair value despite stable weekly volatility.

- Jump into the full analysis health report here for a deeper understanding of SKS Technologies Group.

- Assess SKS Technologies Group's future earnings estimates with our detailed growth reports.

Taking Advantage

- Click here to access our complete index of 1,031 ASX Penny Stocks.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:MAP

Microba Life Sciences

Provides microbiome testing, supplements, and analysis services in Australia, Europe, New Zealand, the United Arab Emirates, the United Kingdom, the United States, Asia, and Ireland.

Flawless balance sheet low.

Similar Companies

Market Insights

Community Narratives