- Australia

- /

- Medical Equipment

- /

- ASX:LDX

There's No Escaping Lumos Diagnostics Holdings Limited's (ASX:LDX) Muted Revenues Despite A 154% Share Price Rise

The Lumos Diagnostics Holdings Limited (ASX:LDX) share price has done very well over the last month, posting an excellent gain of 154%. The last 30 days bring the annual gain to a very sharp 65%.

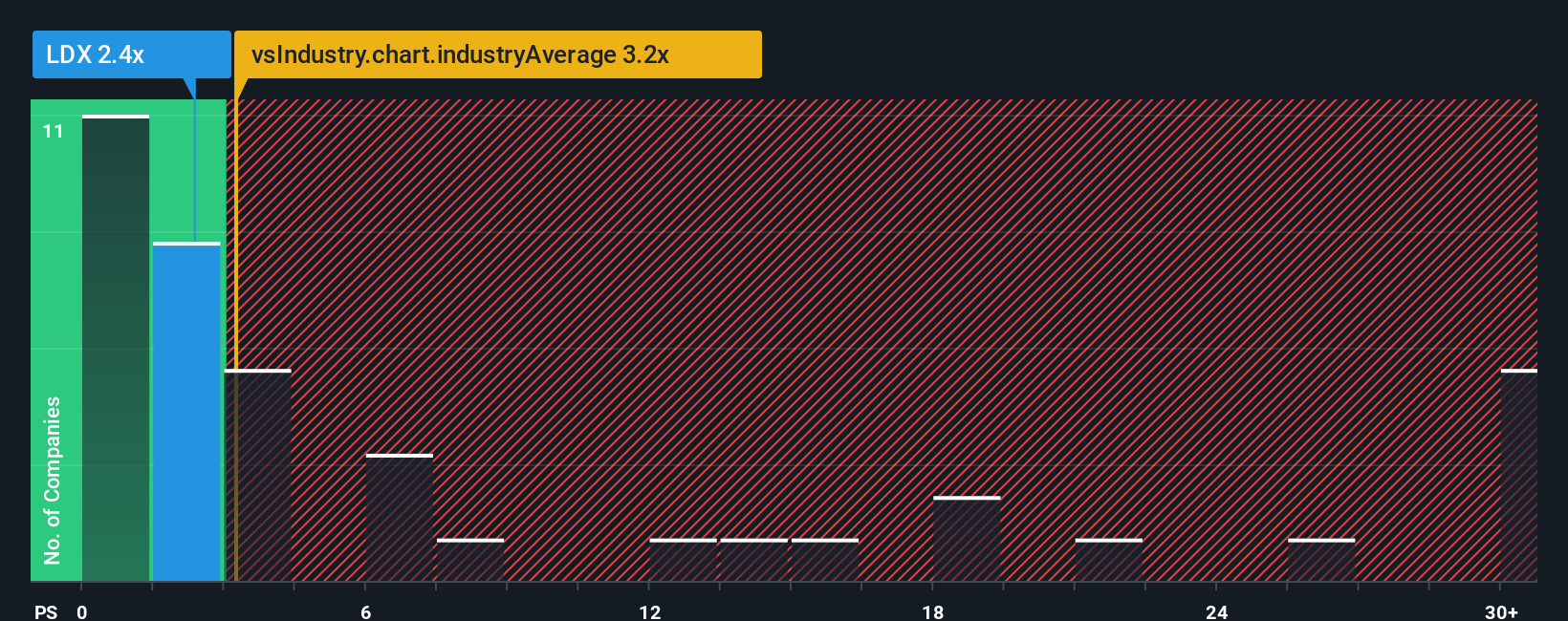

Even after such a large jump in price, Lumos Diagnostics Holdings may still be sending bullish signals at the moment with its price-to-sales (or "P/S") ratio of 2.4x, since almost half of all companies in the Medical Equipment industry in Australia have P/S ratios greater than 3.2x and even P/S higher than 13x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

Check out our latest analysis for Lumos Diagnostics Holdings

What Does Lumos Diagnostics Holdings' P/S Mean For Shareholders?

With revenue growth that's superior to most other companies of late, Lumos Diagnostics Holdings has been doing relatively well. Perhaps the market is expecting future revenue performance to dive, which has kept the P/S suppressed. If the company manages to stay the course, then investors should be rewarded with a share price that matches its revenue figures.

Keen to find out how analysts think Lumos Diagnostics Holdings' future stacks up against the industry? In that case, our free report is a great place to start.How Is Lumos Diagnostics Holdings' Revenue Growth Trending?

In order to justify its P/S ratio, Lumos Diagnostics Holdings would need to produce sluggish growth that's trailing the industry.

Retrospectively, the last year delivered an exceptional 79% gain to the company's top line. Still, revenue has fallen 6.2% in total from three years ago, which is quite disappointing. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to climb by 9.1% during the coming year according to the sole analyst following the company. With the industry predicted to deliver 14% growth, the company is positioned for a weaker revenue result.

In light of this, it's understandable that Lumos Diagnostics Holdings' P/S sits below the majority of other companies. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

What We Can Learn From Lumos Diagnostics Holdings' P/S?

Lumos Diagnostics Holdings' stock price has surged recently, but its but its P/S still remains modest. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that Lumos Diagnostics Holdings maintains its low P/S on the weakness of its forecast growth being lower than the wider industry, as expected. Shareholders' pessimism on the revenue prospects for the company seems to be the main contributor to the depressed P/S. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

Having said that, be aware Lumos Diagnostics Holdings is showing 4 warning signs in our investment analysis, and 2 of those don't sit too well with us.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:LDX

Lumos Diagnostics Holdings

Develops, manufactures, and commercializes point-of-care diagnostic products for diagnosis and management of infectious diseases in the United States.

Adequate balance sheet with limited growth.

Market Insights

Weekly Picks

MicroVision will explode future revenue by 380.37% with a vision towards success

The Indispensable Artery for a New North American Economy

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Recently Updated Narratives

Engineered for Stability. Positioned for Growth.

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026