- Australia

- /

- Medical Equipment

- /

- ASX:IPD

3 ASX Penny Stocks With Market Caps Under A$3B

Reviewed by Simply Wall St

The Australian stock market has experienced a notable upswing, with the ASX climbing by 1.3% driven by gains in sectors like Materials and Healthcare. Amidst this backdrop, penny stocks continue to attract attention for their potential to offer growth at accessible price points. Though often associated with smaller or newer companies, these stocks can provide compelling opportunities when backed by strong financials and clear growth prospects.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Rewards & Risks |

| Alfabs Australia (ASX:AAL) | A$0.49 | A$140.43M | ✅ 4 ⚠️ 3 View Analysis > |

| EZZ Life Science Holdings (ASX:EZZ) | A$2.53 | A$119.35M | ✅ 2 ⚠️ 2 View Analysis > |

| Dusk Group (ASX:DSK) | A$0.795 | A$49.5M | ✅ 4 ⚠️ 2 View Analysis > |

| IVE Group (ASX:IGL) | A$2.80 | A$431.86M | ✅ 4 ⚠️ 3 View Analysis > |

| MotorCycle Holdings (ASX:MTO) | A$3.00 | A$221.42M | ✅ 4 ⚠️ 2 View Analysis > |

| Pureprofile (ASX:PPL) | A$0.042 | A$49.13M | ✅ 3 ⚠️ 1 View Analysis > |

| Veris (ASX:VRS) | A$0.0735 | A$38.05M | ✅ 4 ⚠️ 2 View Analysis > |

| West African Resources (ASX:WAF) | A$3.04 | A$3.47B | ✅ 4 ⚠️ 1 View Analysis > |

| Praemium (ASX:PPS) | A$0.775 | A$370.23M | ✅ 5 ⚠️ 2 View Analysis > |

| Service Stream (ASX:SSM) | A$2.26 | A$1.38B | ✅ 3 ⚠️ 1 View Analysis > |

Click here to see the full list of 421 stocks from our ASX Penny Stocks screener.

Here's a peek at a few of the choices from the screener.

Anson Resources (ASX:ASN)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Anson Resources Limited is a critical minerals company focused on the exploration and development of natural resources in the United States and Australia, with a market cap of A$144.23 million.

Operations: Currently, Anson Resources Limited does not report any revenue segments.

Market Cap: A$144.23M

Anson Resources Limited, with a market cap of A$144.23 million, is a pre-revenue company focused on critical minerals exploration. Despite having more cash than debt and its short-term assets covering liabilities, the company faces financial challenges with only a two-month cash runway as of June 2025 and recent losses totaling A$8.5 million for the year ended June 30, 2025. Its share price has been highly volatile recently, and it was removed from the S&P/ASX Emerging Companies Index in September 2025 following an equity offering that raised A$5 million to bolster its financial position.

- Navigate through the intricacies of Anson Resources with our comprehensive balance sheet health report here.

- Gain insights into Anson Resources' historical outcomes by reviewing our past performance report.

Deep Yellow (ASX:DYL)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Deep Yellow Limited, with a market cap of A$2.02 billion, is involved in the acquisition, exploration, development, and evaluation of uranium properties in Australia and Namibia.

Operations: Deep Yellow Limited currently does not report any revenue segments.

Market Cap: A$2.02B

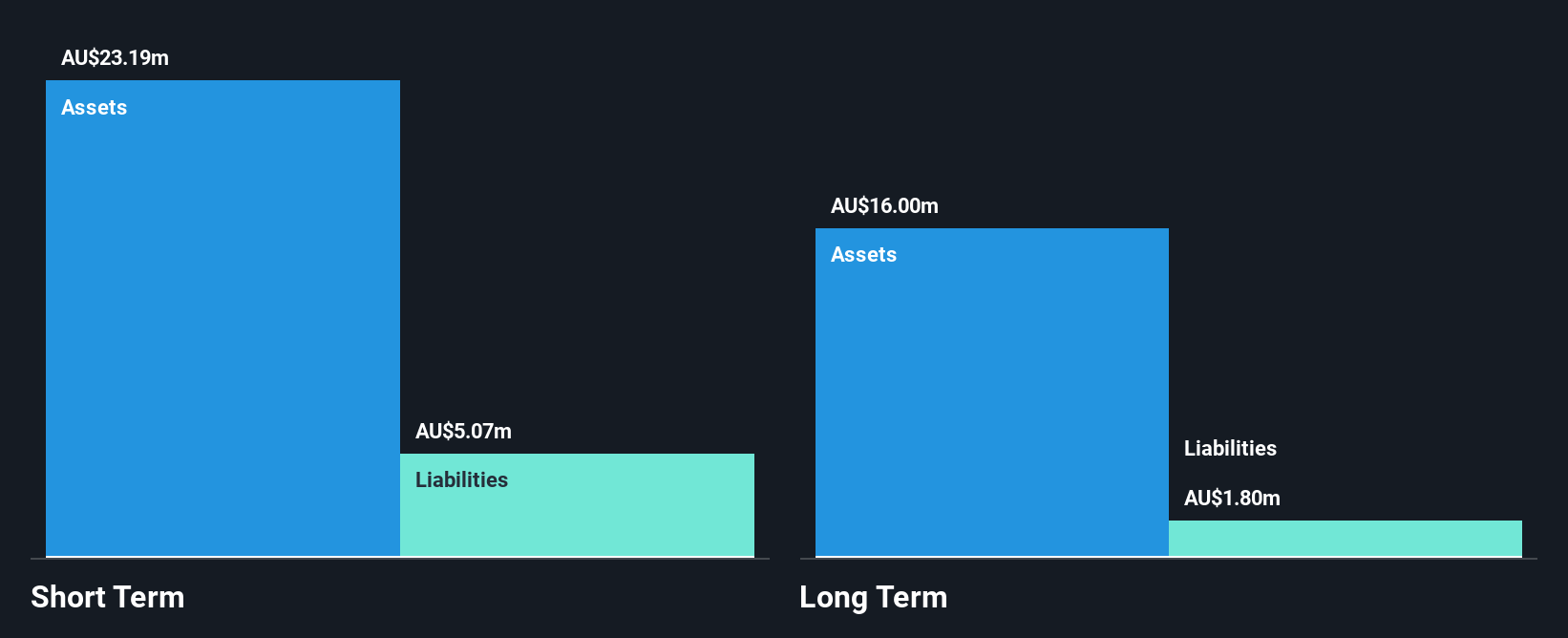

Deep Yellow Limited, with a market cap of A$2.02 billion, has transitioned to profitability recently, reporting net income of A$7.16 million for the year ended June 30, 2025. The company’s revenue increased significantly from the previous year to A$11.59 million, marking a pivotal shift from its pre-revenue phase. Its short-term assets comfortably cover both short and long-term liabilities, and it remains debt-free with no shareholder dilution over the past year. Despite low return on equity at 1.1%, Deep Yellow's earnings quality is high and its management team is experienced with an average tenure of 4.1 years.

- Click to explore a detailed breakdown of our findings in Deep Yellow's financial health report.

- Review our growth performance report to gain insights into Deep Yellow's future.

ImpediMed (ASX:IPD)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: ImpediMed Limited is a medical technology company that develops, manufactures, and sells bioimpedance spectroscopy (BIS) technology medical devices and software services across Australia, Europe, the United States, and internationally with a market cap of A$95.70 million.

Operations: The company generates revenue of A$12.72 million from its medical technology devices and software services.

Market Cap: A$95.7M

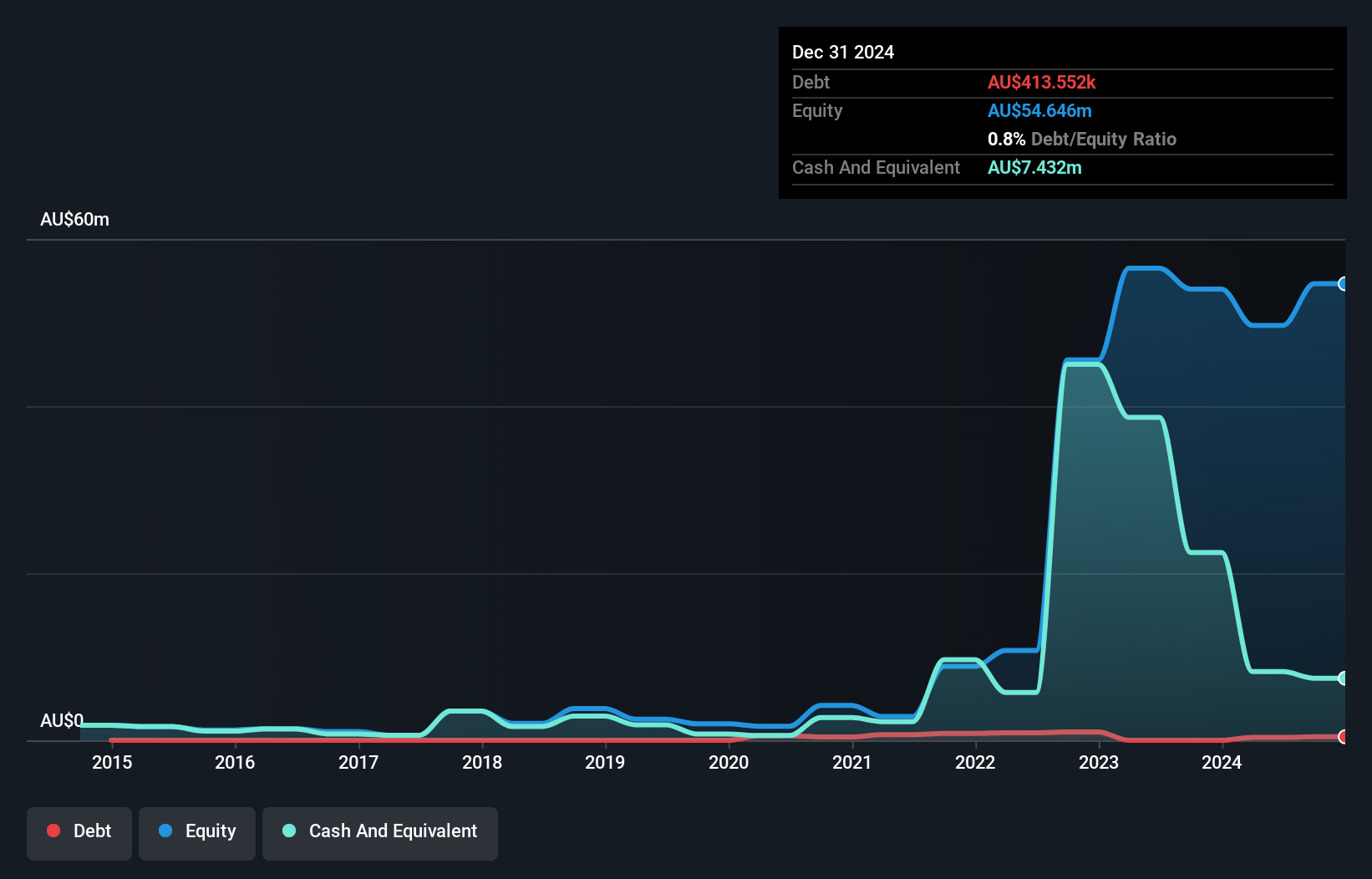

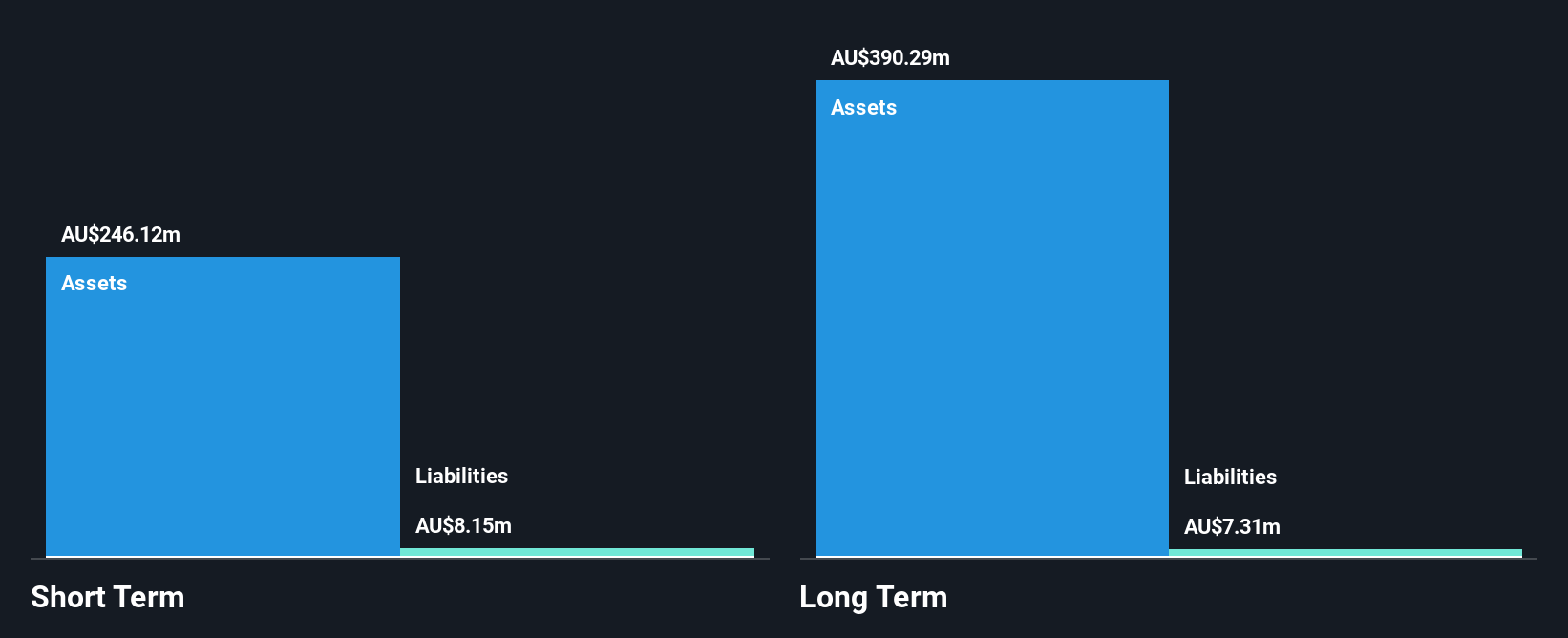

ImpediMed Limited, with a market cap of A$95.70 million, remains unprofitable despite generating A$12.72 million in revenue for the year ending June 30, 2025. The company's short-term assets exceed its liabilities, and it holds more cash than debt, offering some financial stability. However, losses have grown over the past five years by 1.5% annually. Recent auditor concerns about its ability to continue as a going concern add uncertainty to its outlook. Despite having sufficient cash runway for over a year at current free cash flow levels, management and board experience remain limited with recent appointments.

- Unlock comprehensive insights into our analysis of ImpediMed stock in this financial health report.

- Learn about ImpediMed's future growth trajectory here.

Next Steps

- Click here to access our complete index of 421 ASX Penny Stocks.

- Want To Explore Some Alternatives? The end of cancer? These 29 emerging AI stocks are developing tech that will allow early idenification of life changing disesaes like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:IPD

ImpediMed

A medical technology company, develops, manufactures and sells bioimpedance spectroscopy (BIS) technology medical devices and software services in Australia, Europe, the United States, and internationally.

Exceptional growth potential with excellent balance sheet.

Market Insights

Community Narratives