- Australia

- /

- Medical Equipment

- /

- ASX:IBX

Imagion Biosystems (ASX:IBX) Has Rewarded Shareholders With An Exceptional 582% Total Return On Their Investment

While some are satisfied with an index fund, active investors aim to find truly magnificent investments on the stock market. When an investor finds a multi-bagger (a stock that goes up over 200%), it makes a big difference to their portfolio. For example, the Imagion Biosystems Limited (ASX:IBX) share price rocketed moonwards 543% in just one year. Also pleasing for shareholders was the 38% gain in the last three months. The company reported its financial results recently; you can catch up on the latest numbers by reading our company report. And shareholders have also done well over the long term, with an increase of 177% in the last three years.

We love happy stories like this one. The company should be really proud of that performance!

See our latest analysis for Imagion Biosystems

Imagion Biosystems wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Shareholders of unprofitable companies usually expect strong revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

Imagion Biosystems grew its revenue by 8.3% last year. That's not great considering the company is losing money. So it's truly surprising that the share price rocketed 543% in a single year. We're happy that investors have made money, but we can't help questioning whether the rise is sustainable. This is an example of the huge profits some lucky shareholders occasionally make on growth stocks.

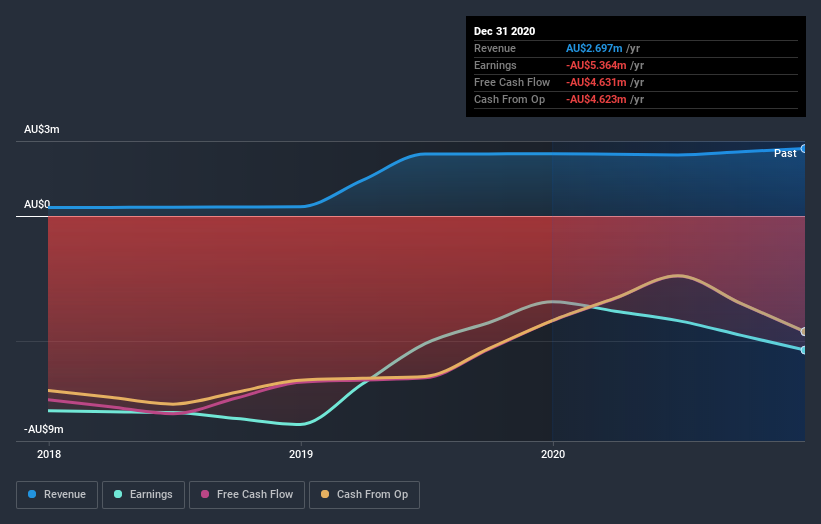

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

Take a more thorough look at Imagion Biosystems' financial health with this free report on its balance sheet.

What about the Total Shareholder Return (TSR)?

We'd be remiss not to mention the difference between Imagion Biosystems' total shareholder return (TSR) and its share price return. Arguably the TSR is a more complete return calculation because it accounts for the value of dividends (as if they were reinvested), along with the hypothetical value of any discounted capital that have been offered to shareholders. Imagion Biosystems hasn't been paying dividends, but its TSR of 582% exceeds its share price return of 543%, implying it has either spun-off a business, or raised capital at a discount; thereby providing additional value to shareholders.

A Different Perspective

Pleasingly, Imagion Biosystems' total shareholder return last year was 582%. That's better than the annualized TSR of 49% over the last three years. These improved returns may hint at some real business momentum, implying that now could be a great time to delve deeper. It's always interesting to track share price performance over the longer term. But to understand Imagion Biosystems better, we need to consider many other factors. Consider for instance, the ever-present spectre of investment risk. We've identified 3 warning signs with Imagion Biosystems (at least 1 which can't be ignored) , and understanding them should be part of your investment process.

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on AU exchanges.

When trading Imagion Biosystems or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About ASX:IBX

Imagion Biosystems

Provides medical imaging technologies using magnetic resonance.

Moderate risk with imperfect balance sheet.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success