The recent price decline of 18% in Enlitic, Inc.'s (ASX:ENL) stock may have disappointed insiders who bought US$150.0k worth of shares at an average price of US$0.83 in the past 12 months. Insiders purchase with the hope of seeing their investments increase in value over time. However, due to recent losses, their initial investment is now only worth US$10.8k, which is not great.

While we would never suggest that investors should base their decisions solely on what the directors of a company have been doing, logic dictates you should pay some attention to whether insiders are buying or selling shares.

See our latest analysis for Enlitic

The Last 12 Months Of Insider Transactions At Enlitic

Over the last year, we can see that the biggest insider purchase was by insider Alexander Waislitz for AU$150k worth of shares, at about AU$0.83 per share. That means that even when the share price was higher than AU$0.06 (the recent price), an insider wanted to purchase shares. While their view may have changed since the purchase was made, this does at least suggest they have had confidence in the company's future. We always take careful note of the price insiders pay when purchasing shares. As a general rule, we feel more positive about a stock when an insider has bought shares at above current prices, because that suggests they viewed the stock as good value, even at a higher price. The only individual insider to buy over the last year was Alexander Waislitz.

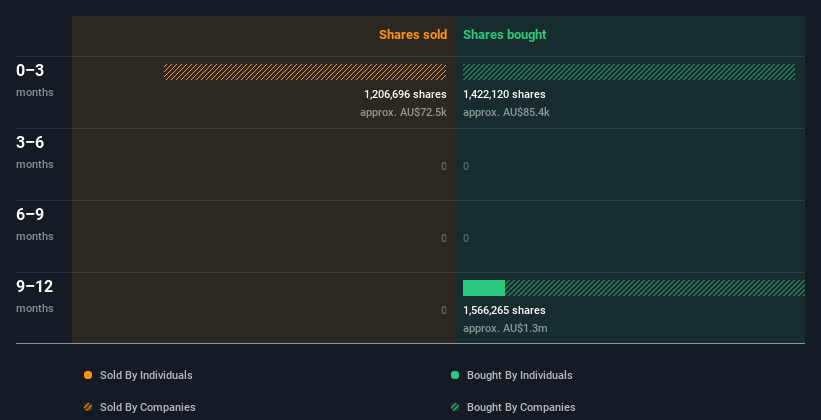

You can see a visual depiction of insider transactions (by companies and individuals) over the last 12 months, below. By clicking on the graph below, you can see the precise details of each insider transaction!

Enlitic is not the only stock that insiders are buying. For those who like to find small cap companies at attractive valuations, this free list of growing companies with recent insider purchasing, could be just the ticket.

Does Enlitic Boast High Insider Ownership?

Another way to test the alignment between the leaders of a company and other shareholders is to look at how many shares they own. A high insider ownership often makes company leadership more mindful of shareholder interests. Based on our data, Enlitic insiders have about 3.3% of the stock, worth approximately AU$168k. However, it's possible that insiders might have an indirect interest through a more complex structure. We prefer to see high levels of insider ownership.

So What Do The Enlitic Insider Transactions Indicate?

It doesn't really mean much that no insider has traded Enlitic shares in the last quarter. But insiders have shown more of an appetite for the stock, over the last year. We'd like to see bigger individual holdings. However, we don't see anything to make us think Enlitic insiders are doubting the company. So while it's helpful to know what insiders are doing in terms of buying or selling, it's also helpful to know the risks that a particular company is facing. Case in point: We've spotted 4 warning signs for Enlitic you should be aware of, and 3 of them make us uncomfortable.

But note: Enlitic may not be the best stock to buy. So take a peek at this free list of interesting companies with high ROE and low debt.

For the purposes of this article, insiders are those individuals who report their transactions to the relevant regulatory body. We currently account for open market transactions and private dispositions of direct interests only, but not derivative transactions or indirect interests.

Valuation is complex, but we're here to simplify it.

Discover if Enlitic might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:ENL

Enlitic

Operates in the healthcare sector in the United States, Europe, and Japan.

Slight risk with mediocre balance sheet.

Market Insights

Community Narratives