- Australia

- /

- Medical Equipment

- /

- ASX:CYC

What You Can Learn From Cyclopharm Limited's (ASX:CYC) P/SAfter Its 26% Share Price Crash

Cyclopharm Limited (ASX:CYC) shares have had a horrible month, losing 26% after a relatively good period beforehand. Still, a bad month hasn't completely ruined the past year with the stock gaining 50%, which is great even in a bull market.

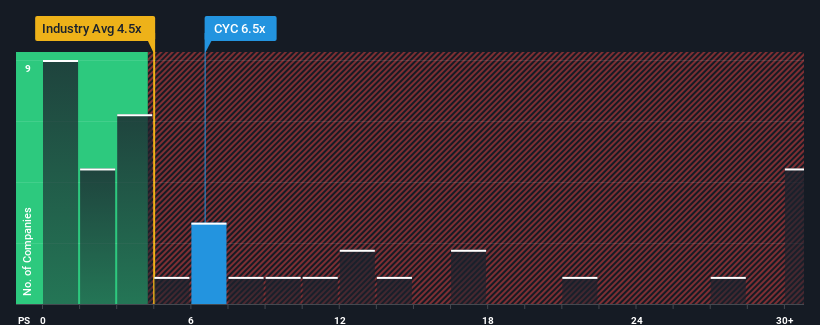

Even after such a large drop in price, Cyclopharm may still be sending bearish signals at the moment with its price-to-sales (or "P/S") ratio of 6.5x, since almost half of all companies in the Medical Equipment in Australia have P/S ratios under 4.5x and even P/S lower than 1.7x are not unusual. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's as high as it is.

Check out our latest analysis for Cyclopharm

What Does Cyclopharm's Recent Performance Look Like?

With revenue growth that's superior to most other companies of late, Cyclopharm has been doing relatively well. The P/S is probably high because investors think this strong revenue performance will continue. If not, then existing shareholders might be a little nervous about the viability of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Cyclopharm will help you uncover what's on the horizon.What Are Revenue Growth Metrics Telling Us About The High P/S?

The only time you'd be truly comfortable seeing a P/S as high as Cyclopharm's is when the company's growth is on track to outshine the industry.

Retrospectively, the last year delivered an exceptional 27% gain to the company's top line. Pleasingly, revenue has also lifted 79% in aggregate from three years ago, thanks to the last 12 months of growth. So we can start by confirming that the company has done a great job of growing revenue over that time.

Looking ahead now, revenue is anticipated to climb by 25% per annum during the coming three years according to the two analysts following the company. With the industry only predicted to deliver 11% per annum, the company is positioned for a stronger revenue result.

In light of this, it's understandable that Cyclopharm's P/S sits above the majority of other companies. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Key Takeaway

There's still some elevation in Cyclopharm's P/S, even if the same can't be said for its share price recently. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

As we suspected, our examination of Cyclopharm's analyst forecasts revealed that its superior revenue outlook is contributing to its high P/S. At this stage investors feel the potential for a deterioration in revenues is quite remote, justifying the elevated P/S ratio. Unless the analysts have really missed the mark, these strong revenue forecasts should keep the share price buoyant.

A lot of potential risks can sit within a company's balance sheet. Take a look at our free balance sheet analysis for Cyclopharm with six simple checks on some of these key factors.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:CYC

Cyclopharm

Cyclopharm Limited manufacture and sells medical equipment and radiopharmaceuticals in the Asia Pacific, Europe, Canada, the United States, and internationally.

Undervalued with adequate balance sheet.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Staggered by dilution; positions for growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026