- Australia

- /

- Medical Equipment

- /

- ASX:COH

This Is Why We Think Cochlear Limited's (ASX:COH) CEO Might Get A Pay Rise Approved By Shareholders

Shareholders will be pleased by the robust performance of Cochlear Limited (ASX:COH) recently and this will be kept in mind in the upcoming AGM on 18 October 2021. The focus will probably be on the future strategic initiatives that the board and management will put in place to improve the business rather than executive remuneration when they cast their votes on company resolutions. Here is our take on why we think CEO compensation is fair and may even warrant a raise.

View our latest analysis for Cochlear

How Does Total Compensation For Dig Howitt Compare With Other Companies In The Industry?

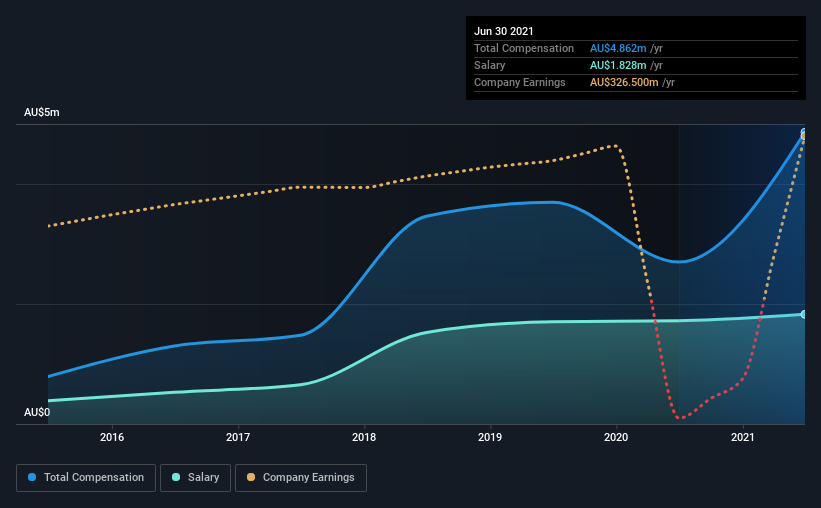

At the time of writing, our data shows that Cochlear Limited has a market capitalization of AU$14b, and reported total annual CEO compensation of AU$4.9m for the year to June 2021. We note that's an increase of 80% above last year. We think total compensation is more important but our data shows that the CEO salary is lower, at AU$1.8m.

On comparing similar companies in the industry with market capitalizations above AU$11b, we found that the median total CEO compensation was AU$10m. This suggests that Dig Howitt is paid below the industry median. Furthermore, Dig Howitt directly owns AU$10m worth of shares in the company, implying that they are deeply invested in the company's success.

| Component | 2021 | 2020 | Proportion (2021) |

| Salary | AU$1.8m | AU$1.7m | 38% |

| Other | AU$3.0m | AU$977k | 62% |

| Total Compensation | AU$4.9m | AU$2.7m | 100% |

On an industry level, around 61% of total compensation represents salary and 39% is other remuneration. Cochlear pays a modest slice of remuneration through salary, as compared to the broader industry. If non-salary compensation dominates total pay, it's an indicator that the executive's salary is tied to company performance.

A Look at Cochlear Limited's Growth Numbers

Cochlear Limited's earnings per share (EPS) grew 5.1% per year over the last three years. It achieved revenue growth of 13% over the last year.

This revenue growth could really point to a brighter future. And the modest growth in EPS isn't bad, either. Although we'll stop short of calling the stock a top performer, we think the company has potential. Looking ahead, you might want to check this free visual report on analyst forecasts for the company's future earnings..

Has Cochlear Limited Been A Good Investment?

Cochlear Limited has generated a total shareholder return of 15% over three years, so most shareholders would be reasonably content. But they probably don't want to see the CEO paid more than is normal for companies around the same size.

In Summary...

The company's overall performance, while not bad, could be better. If it continues on the same road, shareholders might feel even more confident about their investment, and have little to no objections concerning CEO pay. In fact, strategic decisions that could impact the future of the business might be a far more interesting topic for investors as it would help them set their longer-term expectations.

Whatever your view on compensation, you might want to check if insiders are buying or selling Cochlear shares (free trial).

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About ASX:COH

Cochlear

Provides implantable hearing solutions for children and adults worldwide.

Flawless balance sheet with moderate growth potential.

Market Insights

Community Narratives