- Australia

- /

- Real Estate

- /

- ASX:UOS

Three Undiscovered Gems in Australia with Promising Potential

Reviewed by Simply Wall St

The Australian stock market has recently experienced a significant upswing, with the ASX gaining 1.3% amid sector rallies in Materials and Healthcare, driven by global economic uncertainties such as potential U.S. government shutdowns. In this buoyant environment, identifying promising small-cap stocks can be particularly rewarding, as these companies often offer unique growth opportunities that align with current market dynamics and investor sentiment.

Top 10 Undiscovered Gems With Strong Fundamentals In Australia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Fiducian Group | NA | 10.00% | 9.57% | ★★★★★★ |

| MFF Capital Investments | NA | 40.81% | 44.64% | ★★★★★★ |

| Spheria Emerging Companies | NA | -1.31% | 0.28% | ★★★★★★ |

| Hearts and Minds Investments | NA | 56.27% | 59.19% | ★★★★★★ |

| Focus Minerals | NA | 75.35% | 51.34% | ★★★★★★ |

| Djerriwarrh Investments | 2.39% | 8.18% | 7.91% | ★★★★★★ |

| Carlton Investments | 0.02% | 9.10% | 8.68% | ★★★★★☆ |

| Zimplats Holdings | 5.44% | -9.79% | -42.03% | ★★★★★☆ |

| Peet | 53.46% | 12.70% | 31.21% | ★★★★☆☆ |

| Australian United Investment | 1.90% | 5.23% | 4.56% | ★★★★☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

Cogstate (ASX:CGS)

Simply Wall St Value Rating: ★★★★★★

Overview: Cogstate Limited is a neuroscience solutions company that focuses on developing and commercializing digital brain health assessments globally, with a market capitalization of A$383.54 million.

Operations: Cogstate generates revenue primarily from its Clinical Trials segment, which accounts for $50.58 million, while the Healthcare segment contributes $2.51 million.

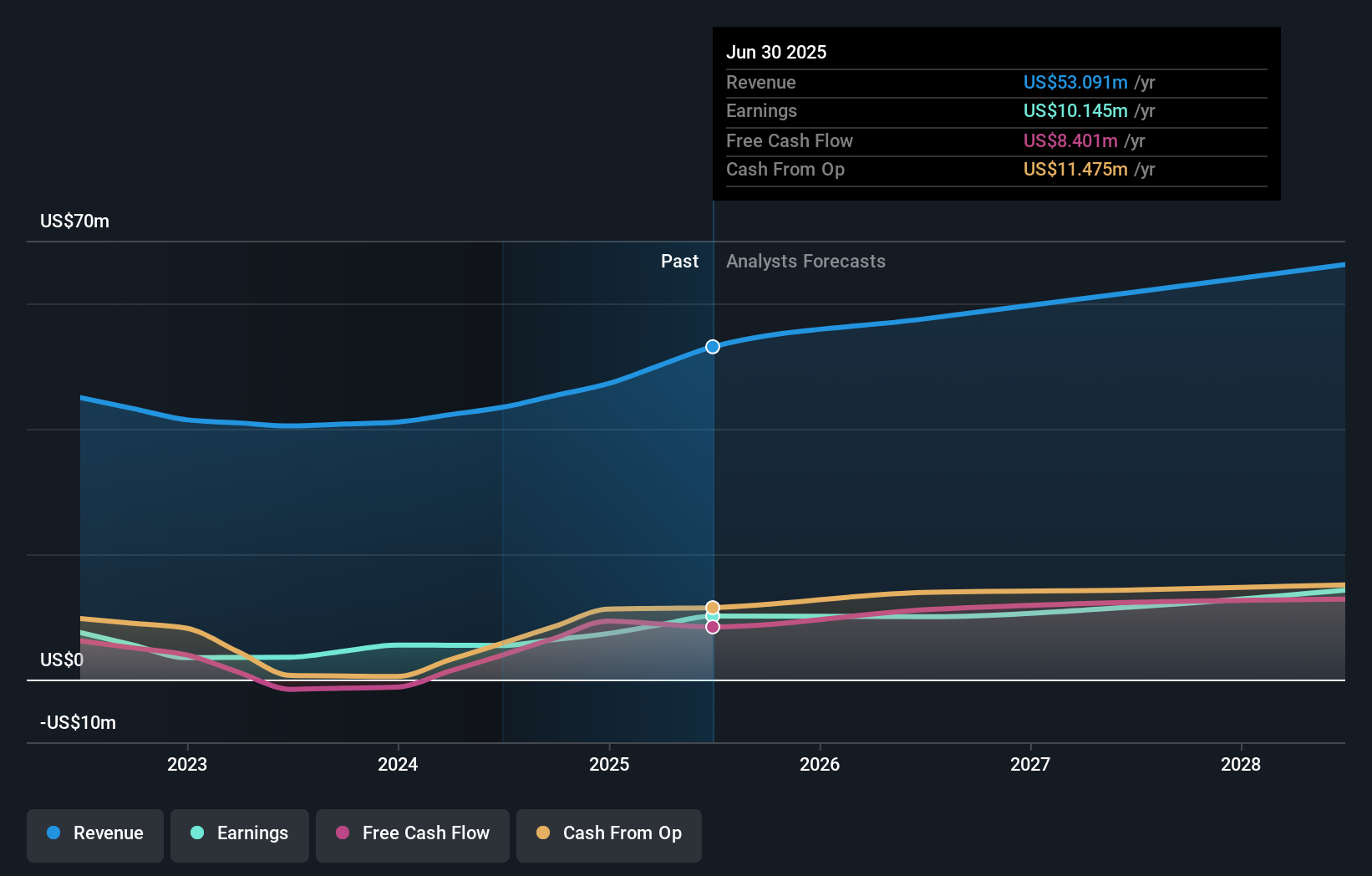

Cogstate, a neuroscience technology firm focused on digital brain health assessments, is leveraging strategic partnerships and AI-driven products for growth. With no debt and high-quality earnings, Cogstate's recent collaboration with Medidata is set to enhance its market reach in CNS indications. The company reported annual sales of US$50.81 million, up from US$39.72 million last year, with net income rising to US$10.14 million from US$5.45 million previously. Despite trading 9.5% below fair value estimates and projected revenue growth of 7.6% annually over three years, challenges like operational costs and regulatory compliance remain significant considerations for investors.

GenusPlus Group (ASX:GNP)

Simply Wall St Value Rating: ★★★★★★

Overview: GenusPlus Group Ltd specializes in the installation, construction, and maintenance of power and communication systems in Australia with a market capitalization of approximately A$1.10 billion.

Operations: GenusPlus Group generates revenue primarily through three segments: Infrastructure (A$405.10 million), Energy & Engineering (A$224.06 million), and Services (A$122.11 million).

GenusPlus Group, a nimble player in Australia's infrastructure sector, is seizing opportunities from the country's renewable energy shift and grid upgrades. With recent earnings of A$35 million up from A$19 million last year and sales reaching A$751 million, the company showcases robust growth. Its debt to equity ratio improved to 6.3% over five years, reflecting prudent financial management. Despite competition and cost pressures, GenusPlus's focus on high-margin projects like battery storage positions it well for future gains. The company was recently added to the S&P Global BMI Index while actively seeking smart M&A opportunities to bolster its portfolio further.

United Overseas Australia (ASX:UOS)

Simply Wall St Value Rating: ★★★★★☆

Overview: United Overseas Australia Ltd, along with its subsidiaries, is involved in the development and resale of land and buildings across Malaysia, Singapore, Vietnam, and Australia, with a market capitalization of A$1.17 billion.

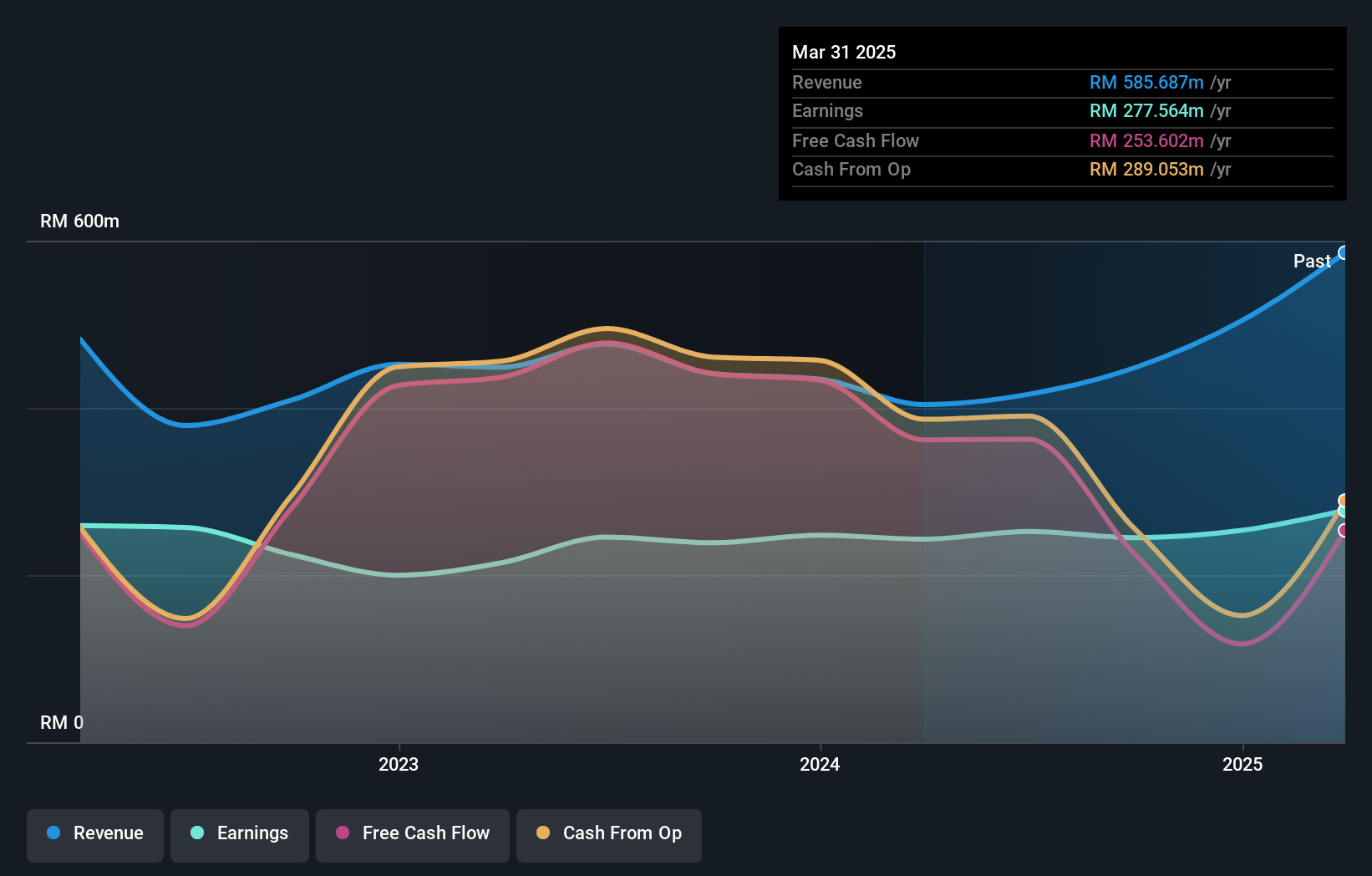

Operations: United Overseas Australia's primary revenue stream is derived from land development and resale, generating A$438.18 million. The investment segment contributes A$257.51 million to the total revenue.

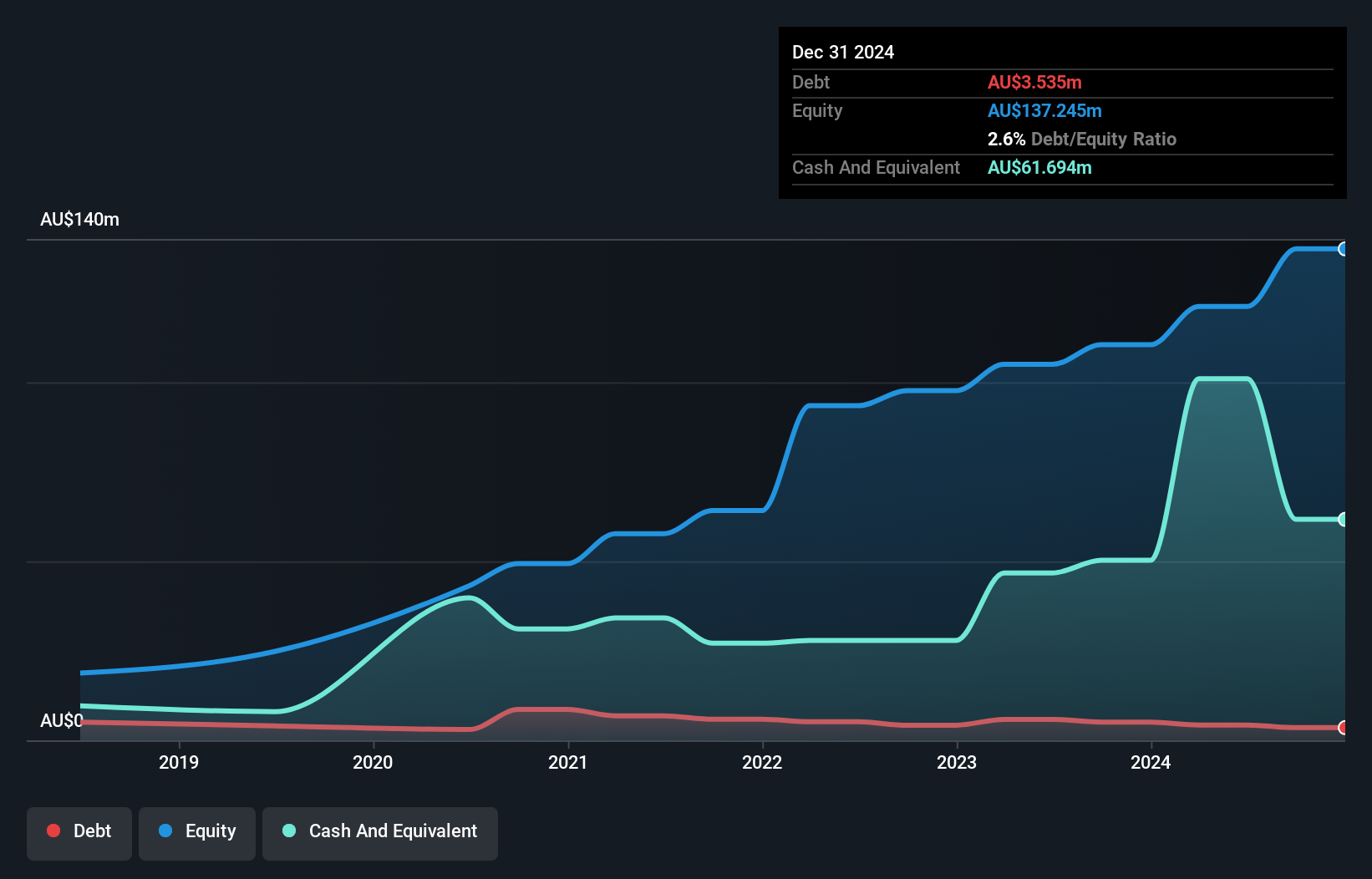

United Overseas Australia, a promising player in the real estate sector, has demonstrated solid financial health with its debt to equity ratio rising from 5.5% to 8.8% over five years, yet it holds more cash than total debt. With earnings growth at 1.7% annually over five years and a recent half-year net income of A$44.61 million, the company shows resilience despite not outpacing industry growth rates of 40.9%. Its price-to-earnings ratio at 11.5x is notably lower than the market's average of 21x, suggesting potential value for investors seeking opportunities in this space.

Summing It All Up

- Access the full spectrum of 53 ASX Undiscovered Gems With Strong Fundamentals by clicking on this link.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:UOS

United Overseas Australia

Engages in the development and resale of land and buildings in Malaysia, Singapore, Vietnam, and Australia.

Excellent balance sheet with acceptable track record.

Similar Companies

Market Insights

Community Narratives