As the Australian market experiences a significant upswing, with the ASX climbing 1.3% driven by robust performances in sectors like Materials and Healthcare, investors are keenly observing how these trends might influence high-growth tech stocks. In such a dynamic environment, identifying promising stocks often involves looking for companies that demonstrate strong innovation potential and adaptability to shifting economic conditions.

Top 10 High Growth Tech Companies In Australia

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Pureprofile | 11.53% | 37.56% | ★★★★★☆ |

| Infomedia | 7.00% | 20.05% | ★★★★★☆ |

| Clinuvel Pharmaceuticals | 22.04% | 26.15% | ★★★★★☆ |

| Pro Medicus | 19.67% | 21.17% | ★★★★★☆ |

| BlinkLab | 104.90% | 101.40% | ★★★★★★ |

| Artrya | 49.60% | 61.45% | ★★★★★☆ |

| Wrkr | 53.03% | 122.27% | ★★★★★★ |

| Immutep | 102.12% | 42.06% | ★★★★★☆ |

| PYC Therapeutics | 10.34% | 33.76% | ★★★★★☆ |

| FINEOS Corporation Holdings | 9.95% | 57.30% | ★★★★☆☆ |

Click here to see the full list of 23 stocks from our ASX High Growth Tech and AI Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Cogstate (ASX:CGS)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Cogstate Limited is a neuroscience solutions company focused on the development and global distribution of digital brain health assessments, with a market capitalization of A$383.54 million.

Operations: Cogstate generates revenue primarily from its Clinical Trials segment, which includes precision recruitment tools and research, contributing $50.58 million, while the Healthcare segment, including sports applications, adds $2.51 million.

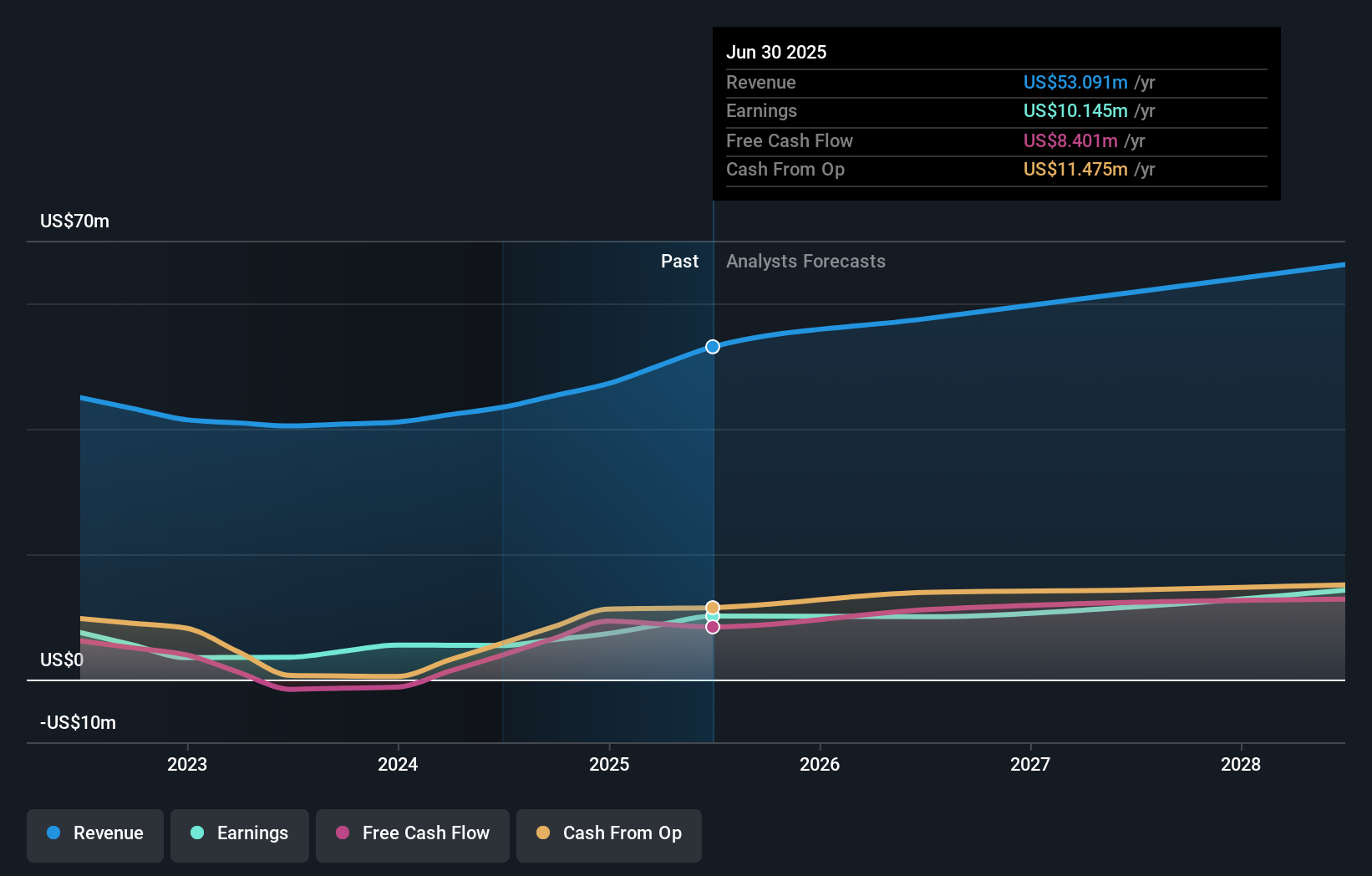

Cogstate, a player in the high-growth tech sector in Australia, is demonstrating robust financial health with a 7.3% annual revenue growth rate, outpacing the national market average of 5.6%. This growth is complemented by an impressive earnings increase of 86.1% over the past year, significantly ahead of its industry's growth rate of 13.2%. The company's commitment to innovation and expansion is evident from its recent share repurchase program where it bought back shares worth AUD 15.7 million, underscoring confidence in its financial strategy and future prospects. Additionally, Cogstate's strategic focus on clinical trials sales contracts, which recently secured $14.1 million since July 2025, positions it well for sustained revenue streams moving forward.

- Take a closer look at Cogstate's potential here in our health report.

Explore historical data to track Cogstate's performance over time in our Past section.

FINEOS Corporation Holdings (ASX:FCL)

Simply Wall St Growth Rating: ★★★★☆☆

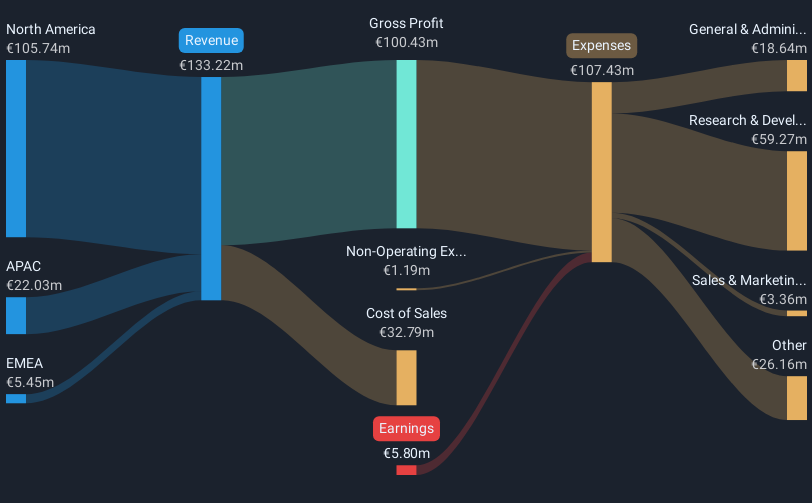

Overview: FINEOS Corporation Holdings plc develops and sells enterprise claims and policy management software for life, accident, and health insurers as well as employee benefits providers across North America, the Asia Pacific, the Middle East, and Africa with a market capitalization of approximately A$1.05 billion.

Operations: The company generates revenue primarily from its Software & Programming segment, amounting to €135.90 million. Its operations focus on providing specialized software solutions to insurers and benefits providers across various regions, including North America and the Asia Pacific.

FINEOS Corporation Holdings is navigating the challenging tech landscape with strategic agility, evidenced by its recent guidance adjustment in response to currency fluctuations and global economic pressures. Despite a net loss reduction from EUR 5.32 million to EUR 1.26 million in the first half of 2025, FINEOS continues to focus on enhancing its software solutions, aiming for a significant increase in recurring revenue—targeting 65% by 2027. This commitment is underpinned by an ambitious goal to boost gross margin to 80% by 2029, reflecting both operational efficiency and a strong market positioning within the tech sector. With revenue growth forecasted at an annual rate of 10%, outstripping Australia's average of 5.6%, and an anticipated shift into profitability within three years, FINEOS demonstrates potential resilience and growth amidst prevailing economic uncertainties.

RPMGlobal Holdings (ASX:RUL)

Simply Wall St Growth Rating: ★★★★☆☆

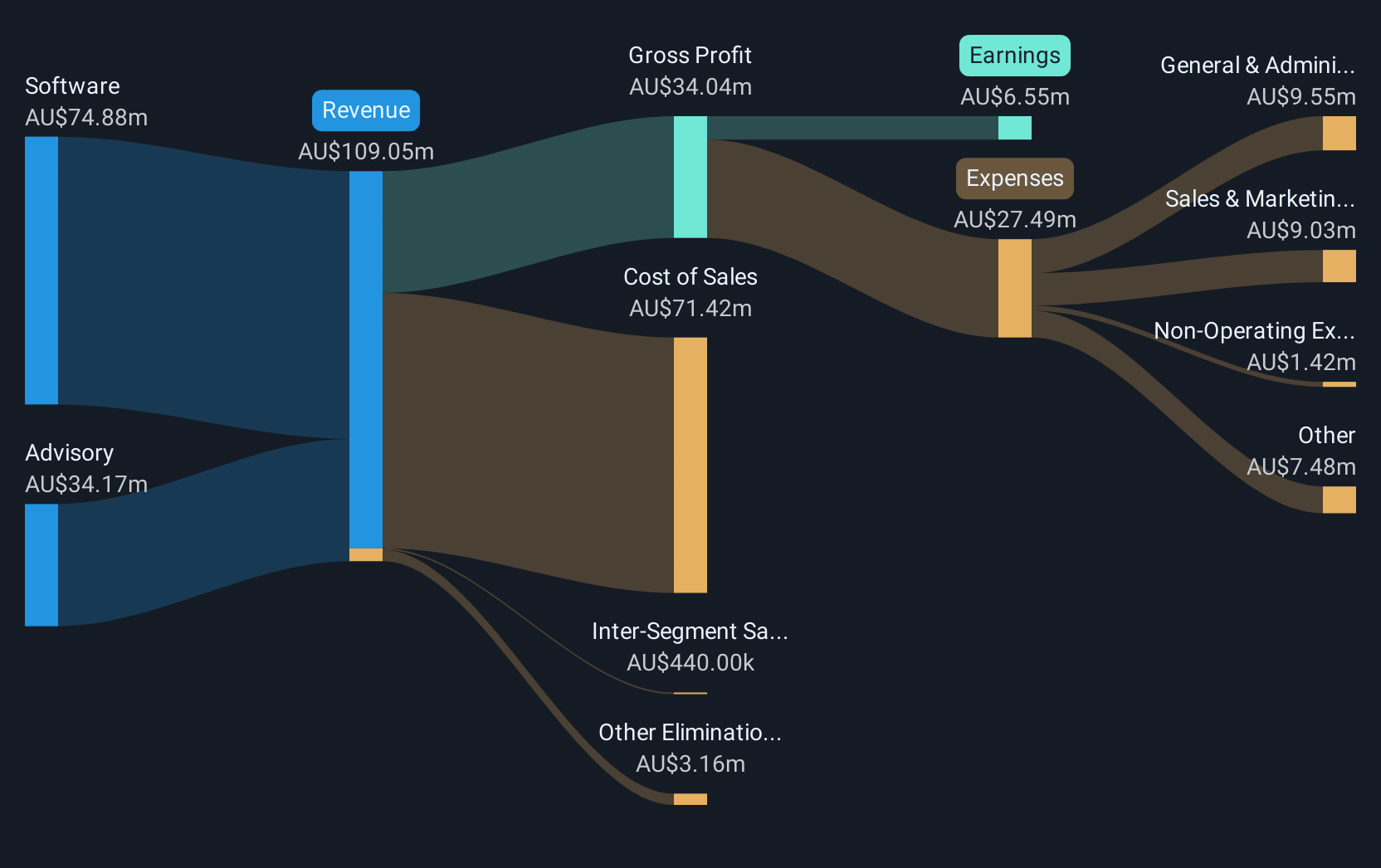

Overview: RPMGlobal Holdings Limited is an Australian company that develops and provides mining software solutions across multiple continents, with a market cap of approximately A$1.03 billion.

Operations: The company generates revenue primarily from its Software and Advisory segments, with the Software segment contributing A$73.96 million and the Advisory segment adding A$24.77 million.

RPMGlobal Holdings has demonstrated robust growth with a significant leap in net income from AUD 8.66 million to AUD 47.46 million year-over-year, reflecting a strategic pivot that resonates well within the tech sector. This growth is underscored by an impressive annual revenue increase of 15%, outpacing the Australian market average of 5.6%. The company's recent engagement in high-profile conferences and a potential acquisition by Caterpillar Inc. for AUD 1.1 billion highlight its expanding influence and strategic relevance in global markets, further solidified by its substantial R&D commitment which aligns with industry demands for continuous innovation and adaptation.

Where To Now?

- Unlock our comprehensive list of 23 ASX High Growth Tech and AI Stocks by clicking here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:RUL

RPMGlobal Holdings

Develops and provides mining software solutions in Australia, Asia, the Americas, Africa, and Europe.

Flawless balance sheet with reasonable growth potential.

Market Insights

Community Narratives