- Australia

- /

- Healthtech

- /

- ASX:BMT

The five-year returns have been decent for Beamtree Holdings (ASX:BMT) shareholders despite underlying losses increasing

It might be of some concern to shareholders to see the Beamtree Holdings Limited (ASX:BMT) share price down 10% in the last month. On the bright side the share price is up over the last half decade. In that time, it is up 47%, which isn't bad, but is below the market return of 76%.

After a strong gain in the past week, it's worth seeing if longer term returns have been driven by improving fundamentals.

Given that Beamtree Holdings didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. When a company doesn't make profits, we'd generally hope to see good revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

In the last 5 years Beamtree Holdings saw its revenue grow at 38% per year. Even measured against other revenue-focussed companies, that's a good result. While the compound gain of 8% per year is good, it's not unreasonable given the strong revenue growth. If you think there could be more growth to come, now might be the time to take a close look at Beamtree Holdings. Opportunity lies where the market hasn't fully priced growth in the underlying business.

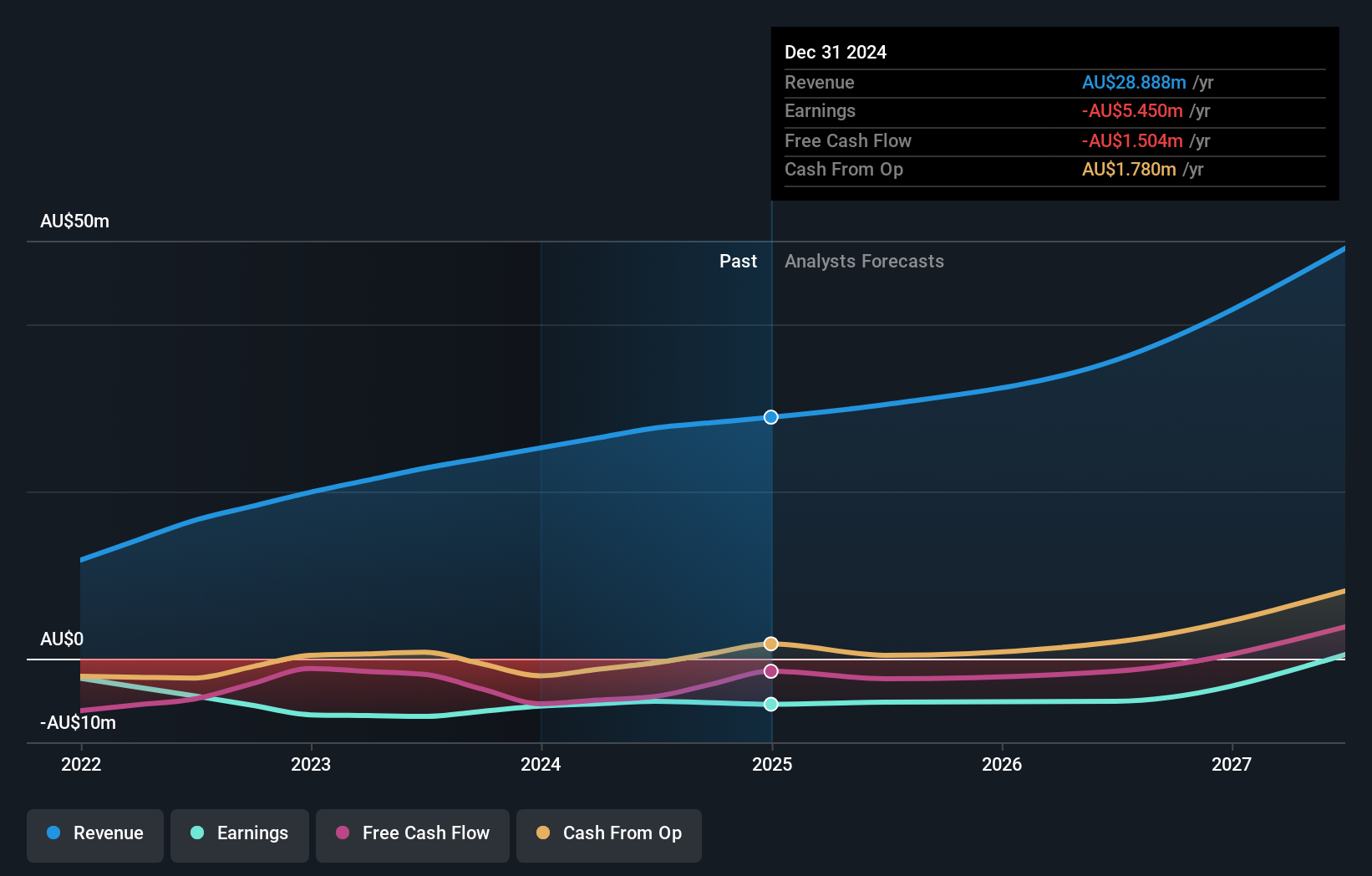

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

A Different Perspective

It's nice to see that Beamtree Holdings shareholders have received a total shareholder return of 20% over the last year. That gain is better than the annual TSR over five years, which is 8%. Therefore it seems like sentiment around the company has been positive lately. Someone with an optimistic perspective could view the recent improvement in TSR as indicating that the business itself is getting better with time. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Consider risks, for instance. Every company has them, and we've spotted 2 warning signs for Beamtree Holdings you should know about.

But note: Beamtree Holdings may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Australian exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Beamtree Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:BMT

Beamtree Holdings

Provides artificial intelligence-based decision support software and data insight solutions, and other software services to the healthcare industry in Australia and internationally.

Good value with adequate balance sheet.

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.