- Australia

- /

- Oil and Gas

- /

- ASX:EEG

ASX Penny Stocks To Watch In May 2025

Reviewed by Simply Wall St

The Australian market recently saw the ASX200 close slightly down by 0.08% at 8,151 points, with Energy and Real Estate sectors leading gains. Despite the mixed performance across sectors, penny stocks remain an intriguing area for investors seeking growth opportunities in smaller or newer companies. Though often seen as a relic of past trading days, these stocks can still offer significant potential when backed by solid financials.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Rewards & Risks |

| CTI Logistics (ASX:CLX) | A$1.74 | A$140.15M | ✅ 4 ⚠️ 2 View Analysis > |

| Accent Group (ASX:AX1) | A$1.85 | A$1.05B | ✅ 4 ⚠️ 2 View Analysis > |

| EZZ Life Science Holdings (ASX:EZZ) | A$1.515 | A$71.47M | ✅ 4 ⚠️ 2 View Analysis > |

| IVE Group (ASX:IGL) | A$2.63 | A$405.5M | ✅ 4 ⚠️ 2 View Analysis > |

| GTN (ASX:GTN) | A$0.61 | A$116.58M | ✅ 3 ⚠️ 2 View Analysis > |

| West African Resources (ASX:WAF) | A$2.43 | A$2.77B | ✅ 4 ⚠️ 1 View Analysis > |

| GR Engineering Services (ASX:GNG) | A$2.85 | A$476.96M | ✅ 2 ⚠️ 1 View Analysis > |

| Bisalloy Steel Group (ASX:BIS) | A$3.27 | A$155.16M | ✅ 3 ⚠️ 1 View Analysis > |

| Regal Partners (ASX:RPL) | A$2.17 | A$729.48M | ✅ 4 ⚠️ 3 View Analysis > |

| NRW Holdings (ASX:NWH) | A$2.74 | A$1.25B | ✅ 5 ⚠️ 1 View Analysis > |

Click here to see the full list of 992 stocks from our ASX Penny Stocks screener.

We'll examine a selection from our screener results.

Beamtree Holdings (ASX:BMT)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Beamtree Holdings Limited offers artificial intelligence-based decision support software and data insight services to the healthcare industry both in Australia and internationally, with a market cap of A$72.45 million.

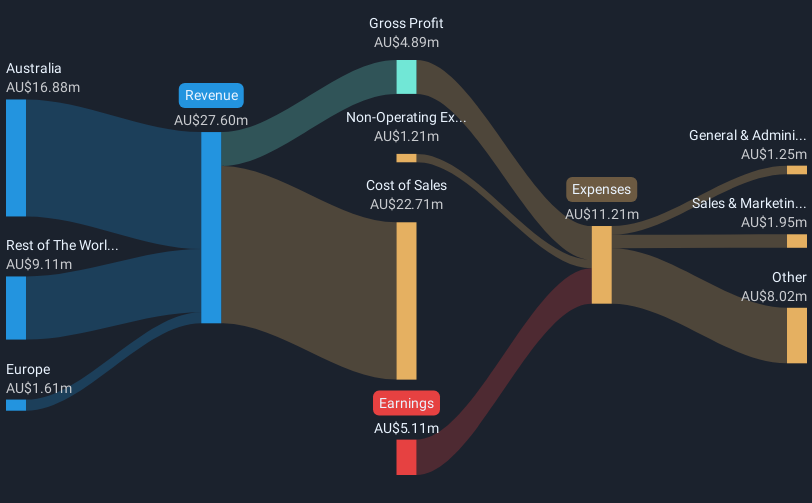

Operations: Beamtree Holdings generates its revenue from three main geographical segments: Europe (A$1.96 million), Australia (A$16.66 million), and the Rest of the World (A$10.26 million).

Market Cap: A$72.45M

Beamtree Holdings Limited, with a market cap of A$72.45 million, is leveraging its AI-driven healthcare solutions to secure new contracts in Australia, the UK, and Canada worth A$0.6 million annually. Despite being unprofitable with increasing losses over the past five years at 44.9% per year, Beamtree's revenue is forecast to grow by 22.18% annually. The company trades at a significant discount to its estimated fair value and has more cash than debt but faces challenges in achieving profitability within three years. Recent strategic board changes aim to bolster leadership amid efforts for international expansion and recurring revenue growth targets.

- Get an in-depth perspective on Beamtree Holdings' performance by reading our balance sheet health report here.

- Understand Beamtree Holdings' earnings outlook by examining our growth report.

Cogstate (ASX:CGS)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Cogstate Limited is a neuroscience technology company focused on developing and commercializing digital brain health assessments for academic and industry research, with a market cap of A$233.01 million.

Operations: Cogstate generates revenue primarily from two segments: Healthcare, including sports-related services, which contributes $2.98 million, and Clinical Trials, encompassing precision recruitment tools and research activities, accounting for $44.22 million.

Market Cap: A$233.01M

Cogstate Limited, with a market cap of A$233.01 million, is showing promising financial health and growth potential in the neuroscience technology sector. The company reported half-year revenue of US$23.94 million, up from US$20.17 million the previous year, with net income rising to US$3.9 million. Cogstate's debt-free status enhances its financial stability while its price-to-earnings ratio of 20.5x suggests it is valued below industry averages. Despite a relatively inexperienced board, the management team boasts experience and has overseen significant profit growth exceeding industry benchmarks, supported by robust short-term assets covering liabilities effectively.

- Jump into the full analysis health report here for a deeper understanding of Cogstate.

- Explore Cogstate's analyst forecasts in our growth report.

Empire Energy Group (ASX:EEG)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Empire Energy Group Limited, along with its subsidiaries, focuses on the production and sale of oil and natural gas in Australia, with a market capitalization of A$203.46 million.

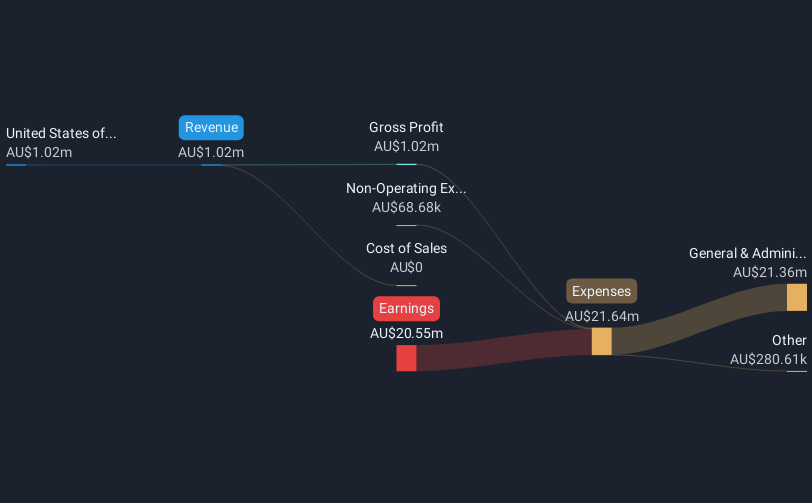

Operations: The company generates revenue of A$1.02 million from its operations in the United States of America.

Market Cap: A$203.46M

Empire Energy Group, with a market cap of A$203.46 million, is pre-revenue and faces challenges as it remains unprofitable with rising losses over the past five years. Despite its experienced board and management team, concerns exist regarding its financial stability, highlighted by an auditor's doubt about its ability to continue as a going concern. The company has been added to the S&P/ASX All Ordinaries Index but continues to report net losses, though these have decreased from the previous year. Its short-term assets exceed liabilities, yet cash runway constraints remain critical for future operations.

- Click here and access our complete financial health analysis report to understand the dynamics of Empire Energy Group.

- Evaluate Empire Energy Group's prospects by accessing our earnings growth report.

Next Steps

- Reveal the 992 hidden gems among our ASX Penny Stocks screener with a single click here.

- Interested In Other Possibilities? Outshine the giants: these 28 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Empire Energy Group, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Empire Energy Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:EEG

Empire Energy Group

Together its subsidiaries, engages in the production and sale of oil and natural gas in Australia.

Excellent balance sheet low.

Similar Companies

Market Insights

Community Narratives