- Australia

- /

- Healthtech

- /

- ASX:BMT

ASX Penny Stocks To Consider In November 2024

Reviewed by Simply Wall St

As the ASX200 shows signs of a potential rise, buoyed by positive movements on Wall Street and ongoing global events such as China's National People's Congress, investors are keenly observing market shifts. For those interested in exploring beyond established names, penny stocks—though an outdated term—continue to present intriguing opportunities. These smaller or newer companies often possess solid financial foundations that can lead to significant returns, making them worth considering for their potential hidden value.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Financial Health Rating |

| Embark Early Education (ASX:EVO) | A$0.77 | A$141.28M | ★★★★☆☆ |

| LaserBond (ASX:LBL) | A$0.595 | A$69.75M | ★★★★★★ |

| Helloworld Travel (ASX:HLO) | A$1.765 | A$287.37M | ★★★★★★ |

| Austin Engineering (ASX:ANG) | A$0.52 | A$322.48M | ★★★★★☆ |

| Navigator Global Investments (ASX:NGI) | A$1.63 | A$798.83M | ★★★★★☆ |

| Perenti (ASX:PRN) | A$1.155 | A$1.07B | ★★★★★★ |

| Atlas Pearls (ASX:ATP) | A$0.14 | A$61M | ★★★★★★ |

| EZZ Life Science Holdings (ASX:EZZ) | A$3.19 | A$141.71M | ★★★★★★ |

| Joyce (ASX:JYC) | A$4.33 | A$129.2M | ★★★★★★ |

| MaxiPARTS (ASX:MXI) | A$1.885 | A$104.27M | ★★★★★★ |

Click here to see the full list of 1,035 stocks from our ASX Penny Stocks screener.

Let's review some notable picks from our screened stocks.

Alcidion Group (ASX:ALC)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Alcidion Group Limited develops and licenses healthcare software products in Australia, New Zealand, and the United Kingdom, with a market cap of A$72.52 million.

Operations: The company generates A$37.06 million in revenue from its healthcare software solutions segment.

Market Cap: A$72.52M

Alcidion Group, with a market cap of A$72.52 million, has faced challenges as it remains unprofitable and recently reported an increased net loss of A$8.42 million for the year ending June 30, 2024. Despite this, the company is debt-free and has sufficient cash runway for over a year based on current free cash flow. Alcidion's revenue from healthcare software solutions reached A$37.06 million but decreased compared to the previous year. Recent management changes include appointing Will Smart as Non-Executive Director and Michael Sapountzis as Company Secretary, suggesting strategic shifts amidst ongoing financial pressures.

- Take a closer look at Alcidion Group's potential here in our financial health report.

- Understand Alcidion Group's earnings outlook by examining our growth report.

Beamtree Holdings (ASX:BMT)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Beamtree Holdings Limited offers artificial intelligence-based decision support software and data insight services to the healthcare industry both in Australia and internationally, with a market cap of A$73.89 million.

Operations: The company generates revenue primarily from its Healthcare Software segment, which accounts for A$27.60 million.

Market Cap: A$73.89M

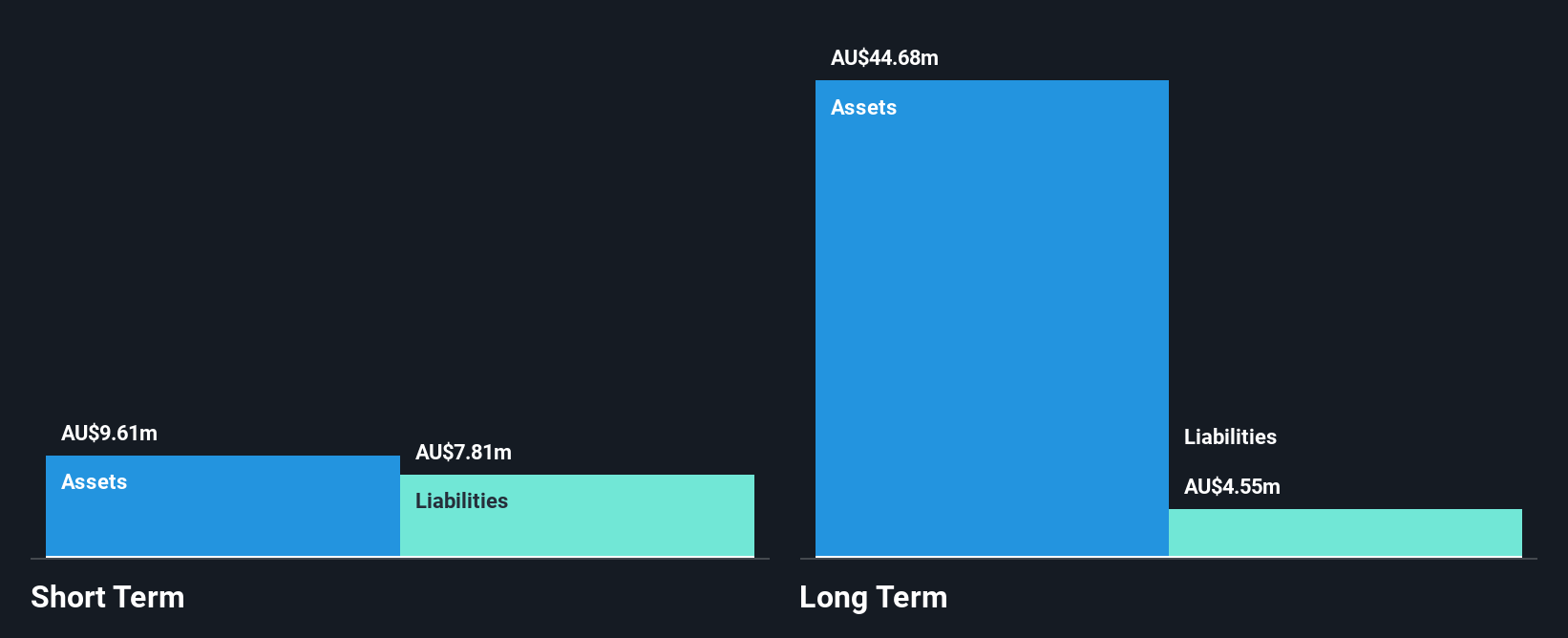

Beamtree Holdings, with a market cap of A$73.89 million, continues to navigate challenges as it remains unprofitable, reporting a net loss of A$5.11 million for the year ending June 30, 2024. Despite this, revenue from its Healthcare Software segment increased to A$27.60 million from the previous year. The company maintains more cash than debt and sufficient short-term assets to cover liabilities while remaining undervalued compared to estimated fair value. Recent executive changes include CEO Tim Kelsey stepping down in early 2025 after overseeing significant transformation and global expansion in AI-driven healthcare solutions.

- Click here to discover the nuances of Beamtree Holdings with our detailed analytical financial health report.

- Gain insights into Beamtree Holdings' future direction by reviewing our growth report.

Kingsland Minerals (ASX:KNG)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Kingsland Minerals Ltd is a mineral exploration and development company based in Western Australia, with a market capitalization of A$13.52 million.

Operations: The company's revenue segment is derived entirely from its mineral exploration activities, generating A$0.09 million.

Market Cap: A$13.52M

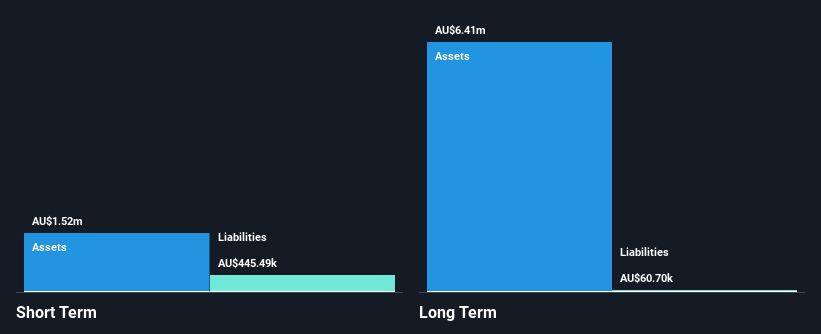

Kingsland Minerals, with a market cap of A$13.52 million, is pre-revenue and recently completed a follow-on equity offering raising A$2.56 million, increasing its shares outstanding by 5.4%. The company remains debt-free with short-term assets exceeding both short and long-term liabilities, providing some financial stability despite its unprofitability and volatile share price. Recent earnings reported a net loss of A$3.4 million for the year ending June 30, 2024, worsening from the previous year’s loss of A$2.12 million. The board is experienced with an average tenure of 3.8 years, though management experience data is insufficient.

- Jump into the full analysis health report here for a deeper understanding of Kingsland Minerals.

- Review our historical performance report to gain insights into Kingsland Minerals' track record.

Where To Now?

- Click here to access our complete index of 1,035 ASX Penny Stocks.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Beamtree Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:BMT

Beamtree Holdings

Provides artificial intelligence-based decision support software and data insight services to healthcare industry in Australia and internationally.

High growth potential and good value.