- Australia

- /

- Healthtech

- /

- ASX:AYA

Artrya (ASX:AYA): Assessing Valuation After Recent AUD 80 Million Equity Raise

Reviewed by Simply Wall St

Artrya (ASX:AYA) has drawn fresh attention after announcing a completed AUD 75 million follow-on equity offering, swiftly followed by another AUD 5 million raise. Both capital injections, priced at AUD 2.05 per share, indicate the company’s intent to bolster its balance sheet, pursue growth opportunities, or fund ongoing projects. For investors tracking the healthcare space, sizeable fundraising like this can be a turning point. It may signal management’s confidence in future prospects or a necessary step to fuel the next phase of expansion.

Taking a step back, Artrya’s stock has surged 7% over the past year, with momentum especially strong over the past three months. The company has posted double-digit revenue growth and improved net income figures, underscoring solid underlying trends. This recent capital raise fits into a pattern of strategic moves aimed at building long-term value. However, short-term market reactions sometimes lag or overshoot the reality of fundamentals.

Now, as the dust settles from Artrya’s latest equity offerings, the pressing question is whether investors have a genuine opportunity to buy in ahead of future growth or if the market has already priced in what is coming next.

Price-to-Book Ratio of 12.7x: Is it justified?

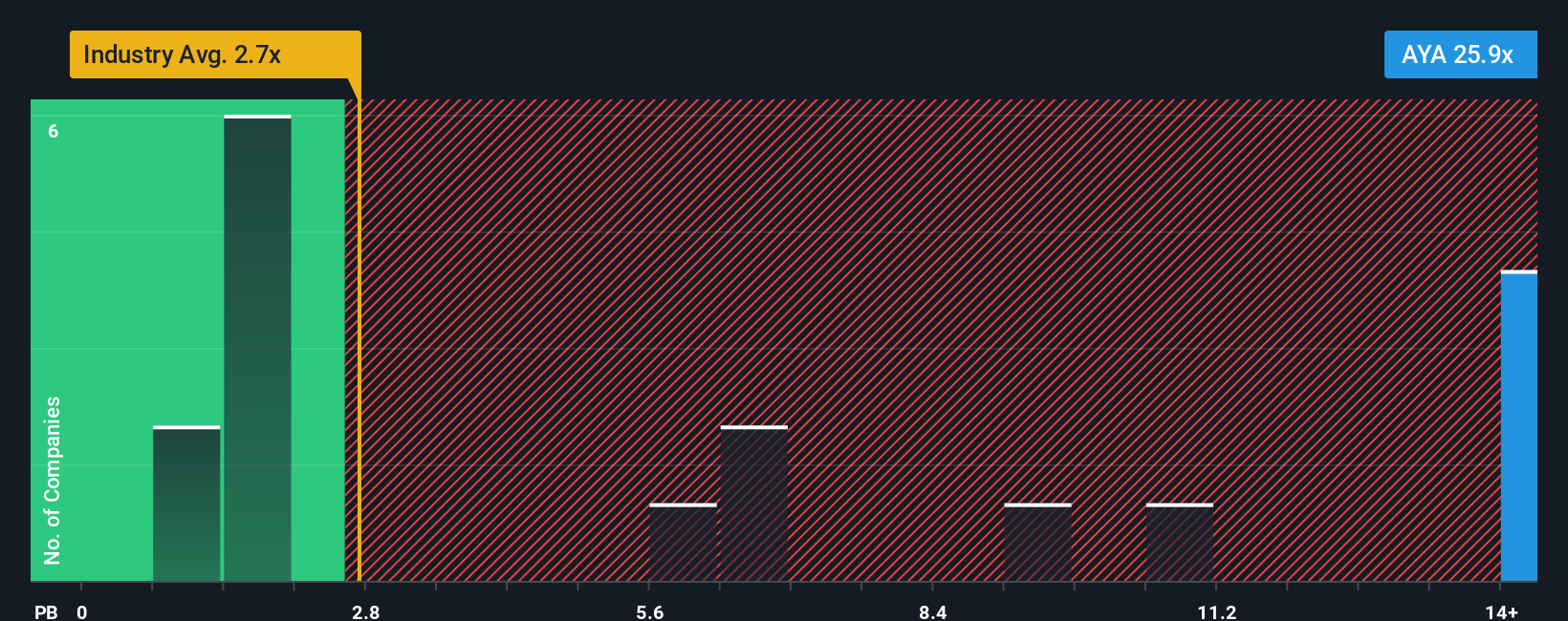

Artrya’s shares currently trade at a price-to-book (P/B) ratio of 12.7x, notably higher than both their peer average and the broader healthcare services industry. On this measure, the company appears overvalued compared to similar businesses.

The price-to-book ratio compares a company’s market value to its net assets. It is often used to assess whether shares are trading above or below their underlying equity. For healthcare service companies, a high P/B ratio can suggest optimism for future growth or profitability, but it may also indicate a disconnect between market expectations and current financials.

Artrya’s premium valuation implies the market has high expectations for its rapid revenue growth and anticipated shift to profitability. However, investors should scrutinize whether this optimism is matched by the company’s business performance and future projections, as fundamentals may not fully support this price premium.

Result: Fair Value of $3.06 (OVERVALUED)

See our latest analysis for Artrya.However, downside risks remain if Artrya’s revenue growth falters or if profitability takes longer than anticipated. Either scenario could dampen current valuations.

Find out about the key risks to this Artrya narrative.Another View: What Does the Industry Comparison Tell Us?

Looking at Artrya’s valuation through a different lens, comparing it with the broader healthcare services industry, it still appears richly valued. This alternate method challenges the idea that the market’s optimism is fully justified. Is the market seeing something others are missing, or is caution in order?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Artrya Narrative

If you have a different interpretation of the data or prefer a hands-on approach, it is quick and straightforward to develop your own outlook in just a few minutes. Do it your way

A great starting point for your Artrya research is our analysis highlighting 1 key reward and 4 important warning signs that could impact your investment decision.

Ready for More Investment Ideas?

Set yourself up for smarter investing by searching beyond the obvious. The right strategy now can help you spot tomorrow’s winners before the crowd catches on.

- Uncover hidden gems with strong fundamentals by using our undervalued stocks based on cash flows to find stocks trading below their true potential.

- Tap into the future of healthcare by exploring companies applying artificial intelligence breakthroughs with our healthcare AI stocks link.

- Benefit from steady income streams by screening for shares that offer yields above 3 percent through our dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:AYA

Artrya

A medical technology company, engages in the development and commercialization of artificial intelligence platform that detects, diagnoses, and address coronary artery disease in Australia.

Flawless balance sheet with high growth potential.

Market Insights

Community Narratives