September 2024's ASX Stocks That Could Be Trading Below Their Value

Reviewed by Simply Wall St

The market is up 1.4% over the last week, with the Financials sector up 2.3%. In the last year, the market has climbed 15%, and earnings are forecast to grow by 12% annually. Identifying undervalued stocks in such a robust environment involves looking for companies that have strong fundamentals yet remain overlooked by investors.

Top 10 Undervalued Stocks Based On Cash Flows In Australia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Genesis Minerals (ASX:GMD) | A$2.11 | A$3.98 | 47% |

| Charter Hall Group (ASX:CHC) | A$15.65 | A$29.23 | 46.5% |

| Megaport (ASX:MP1) | A$7.25 | A$13.51 | 46.3% |

| Ingenia Communities Group (ASX:INA) | A$5.04 | A$9.34 | 46.1% |

| Little Green Pharma (ASX:LGP) | A$0.086 | A$0.17 | 49.2% |

| Millennium Services Group (ASX:MIL) | A$1.145 | A$2.24 | 48.9% |

| Clover (ASX:CLV) | A$0.37 | A$0.72 | 48.5% |

| Structural Monitoring Systems (ASX:SMN) | A$0.65 | A$1.27 | 49% |

| Ai-Media Technologies (ASX:AIM) | A$0.76 | A$1.42 | 46.4% |

| Superloop (ASX:SLC) | A$1.77 | A$3.31 | 46.6% |

Let's explore several standout options from the results in the screener.

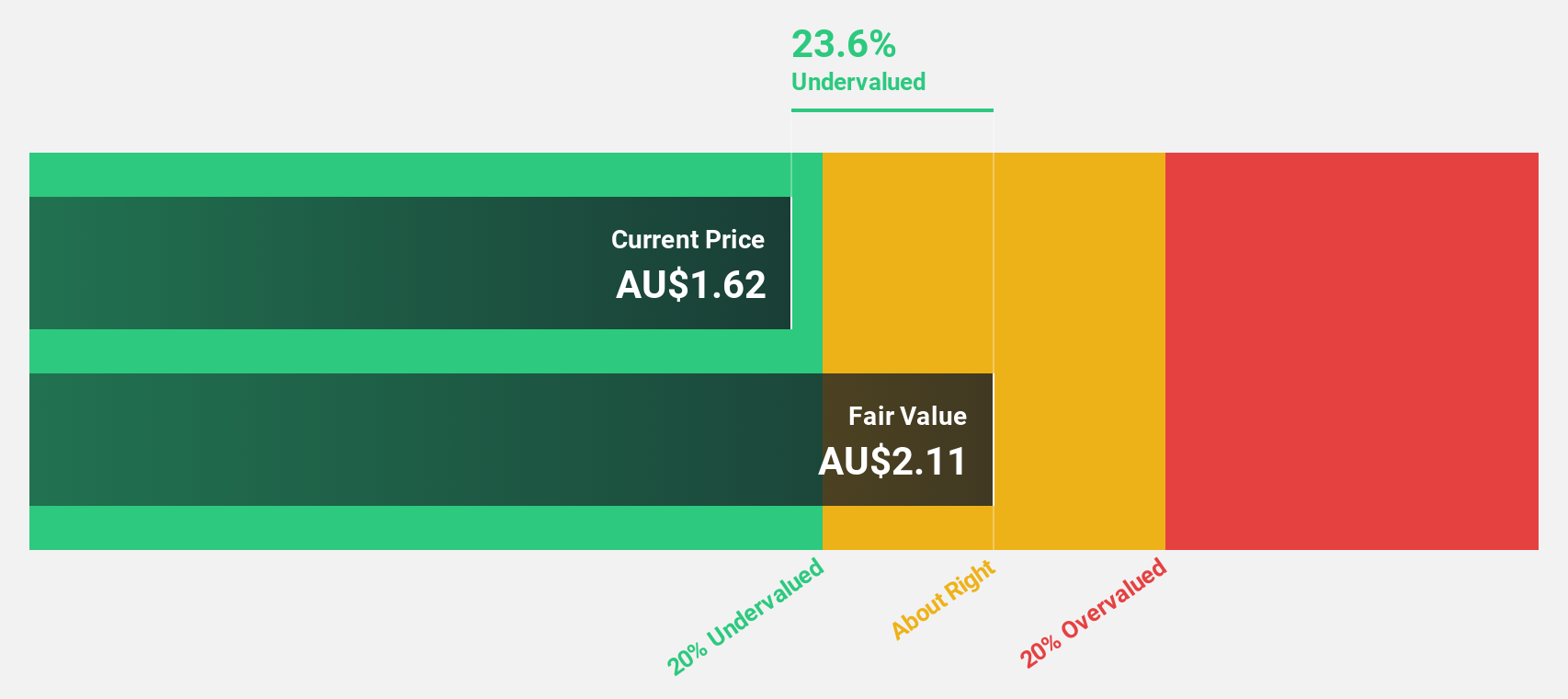

Life360 (ASX:360)

Overview: Life360, Inc. operates a technology platform for locating people, pets, and things across various regions including North America, Europe, the Middle East, Africa, and internationally with a market cap of A$4.07 billion.

Operations: The company's revenue from Software & Programming amounts to $328.68 million.

Estimated Discount To Fair Value: 35.7%

Life360 is trading at A$18.27, significantly below its estimated fair value of A$28.40, indicating it may be undervalued based on cash flows. Recent product updates, including new Tile Bluetooth trackers with enhanced features and integration with the Life360 app, aim to boost user engagement and revenue streams. The company has also upgraded its 2024 revenue guidance to US$370 million - US$378 million due to expanded partnerships and increased data sales, despite reporting a net loss for the second quarter.

- The analysis detailed in our Life360 growth report hints at robust future financial performance.

- Navigate through the intricacies of Life360 with our comprehensive financial health report here.

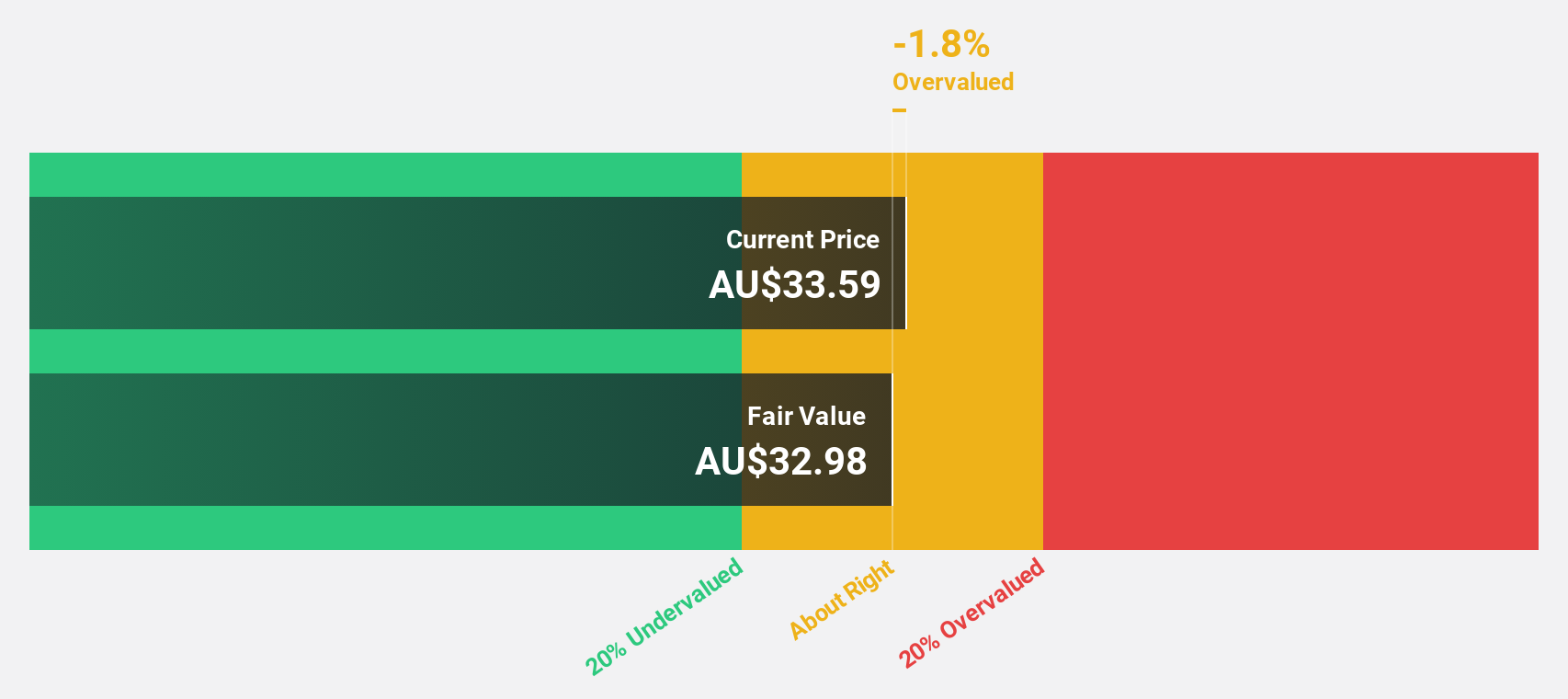

Ansell (ASX:ANN)

Overview: Ansell Limited designs, sources, develops, manufactures, distributes, and sells hand and body protection solutions globally with a market cap of A$4.62 billion.

Operations: Revenue Segments (in millions of $): Healthcare: $834.20, Industrial (Including Specialty Markets): $785.10 Ansell's revenue is derived from two main segments: Healthcare ($834.20 million) and Industrial, including Specialty Markets ($785.10 million).

Estimated Discount To Fair Value: 43.6%

Ansell is trading at A$31.91, significantly below its estimated fair value of A$56.62, suggesting it is undervalued based on cash flows. Despite a recent decline in net income to US$76.5 million from US$148.3 million and a drop in profit margins from 9% to 4.7%, the company's earnings are forecasted to grow at 22.49% annually over the next three years, outpacing the broader Australian market's growth rate of 12.3%.

- Our comprehensive growth report raises the possibility that Ansell is poised for substantial financial growth.

- Click to explore a detailed breakdown of our findings in Ansell's balance sheet health report.

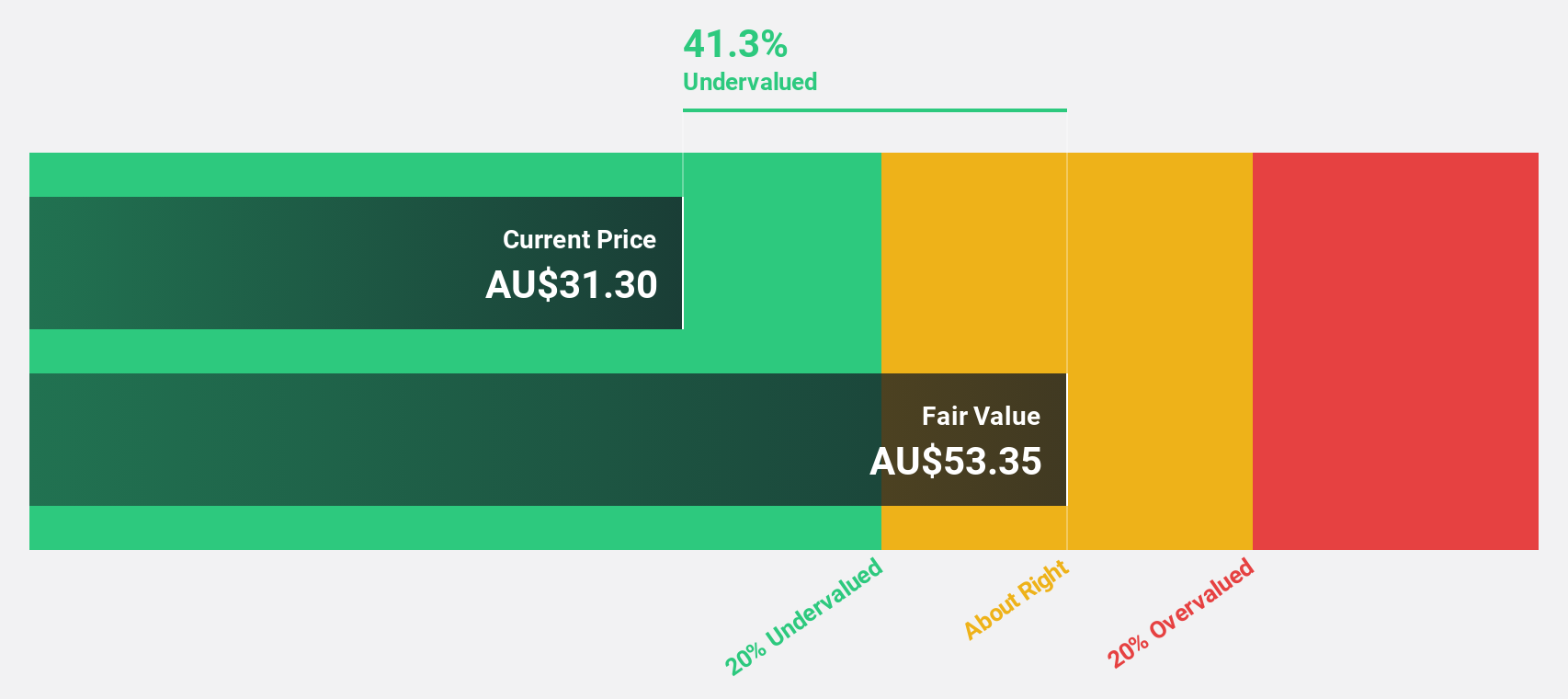

Judo Capital Holdings (ASX:JDO)

Overview: Judo Capital Holdings Limited (ASX:JDO) provides a range of banking products and services tailored for small and medium businesses in Australia, with a market cap of A$1.95 billion.

Operations: Judo Capital Holdings generates A$326.60 million in revenue from its banking products and services for small and medium businesses in Australia.

Estimated Discount To Fair Value: 21.3%

Judo Capital Holdings, trading at A$1.76, is undervalued based on cash flows with an estimated fair value of A$2.24. Earnings are forecast to grow significantly at 26.4% annually over the next three years, outpacing the Australian market's 12.3%. Despite a high level of bad loans (2.8%) and a slight decline in net income to A$69.9 million from A$73.4 million last year, Judo's revenue is expected to grow faster than the market at 17.2% per year.

- Our growth report here indicates Judo Capital Holdings may be poised for an improving outlook.

- Click here and access our complete balance sheet health report to understand the dynamics of Judo Capital Holdings.

Where To Now?

- Dive into all 39 of the Undervalued ASX Stocks Based On Cash Flows we have identified here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:JDO

Judo Capital Holdings

Through its subsidiaries, engages in the provision of various banking products and services for small and medium businesses in Australia.

Reasonable growth potential with mediocre balance sheet.