- Australia

- /

- Medical Equipment

- /

- ASX:AMT

The Allegra Orthopaedics (ASX:AMT) Share Price Is Up 355% And Shareholders Are Delighted

Buying shares in the best businesses can build meaningful wealth for you and your family. And highest quality companies can see their share prices grow by huge amounts. Don't believe it? Then look at the Allegra Orthopaedics Limited (ASX:AMT) share price. It's 355% higher than it was five years ago. If that doesn't get you thinking about long term investing, we don't know what will. On top of that, the share price is up 127% in about a quarter.

Check out our latest analysis for Allegra Orthopaedics

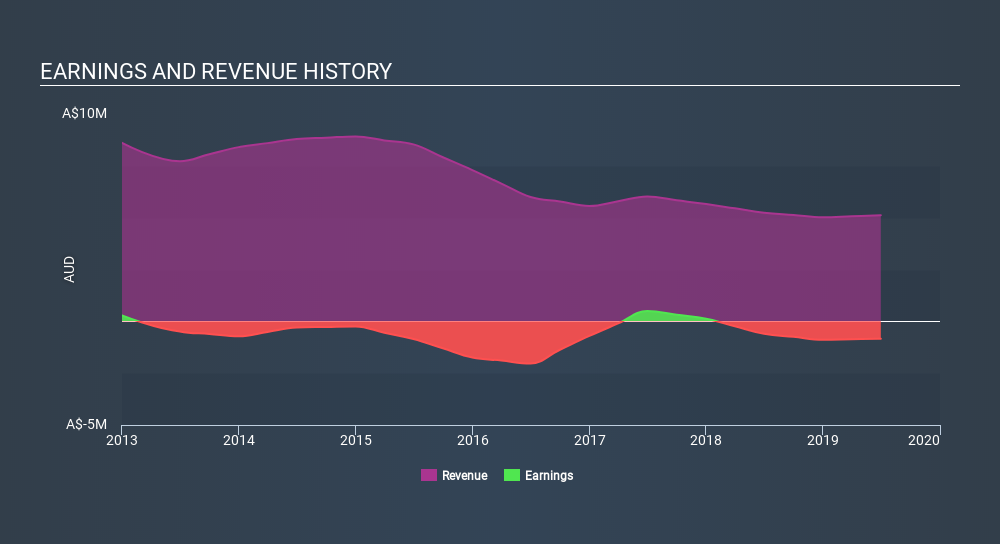

Allegra Orthopaedics isn't a profitable company, so it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

Over the last half decade Allegra Orthopaedics's revenue has actually been trending down at about 13% per year. So it's pretty surprising to see that the share price is up 35% per year. There can be no doubt this kind of decoupling of revenue growth and share price growth is unusual to see in loss making companies. At the risk of upsetting holders, this does suggest that hope for a better future is playing a significant role in the share price action.

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

What about the Total Shareholder Return (TSR)?

We'd be remiss not to mention the difference between Allegra Orthopaedics's total shareholder return (TSR) and its share price return. The TSR attempts to capture the value of dividends (as if they were reinvested) as well as any spin-offs or discounted capital raisings offered to shareholders. Allegra Orthopaedics hasn't been paying dividends, but its TSR of 385% exceeds its share price return of 355%, implying it has either spun-off a business, or raised capital at a discount; thereby providing additional value to shareholders.

A Different Perspective

Allegra Orthopaedics's TSR for the year was broadly in line with the market average, at 25%. We should note here that the five-year TSR is more impressive, at 37% per year. More recently, the share price growth has slowed. But it has to be said the overall picture is one of good long term and short term performance. Arguably that makes Allegra Orthopaedics a stock worth watching. You could get a better understanding of Allegra Orthopaedics's growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on AU exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About ASX:AMT

Allegra Medical Technologies

Allegra Medical Technologies Limited designs, sells, and distributes medical device products in Australia.

Medium with weak fundamentals.

Market Insights

Community Narratives