- Australia

- /

- Healthtech

- /

- ASX:ALC

Little Excitement Around Alcidion Group Limited's (ASX:ALC) Revenues As Shares Take 29% Pounding

Alcidion Group Limited (ASX:ALC) shareholders that were waiting for something to happen have been dealt a blow with a 29% share price drop in the last month. For any long-term shareholders, the last month ends a year to forget by locking in a 63% share price decline.

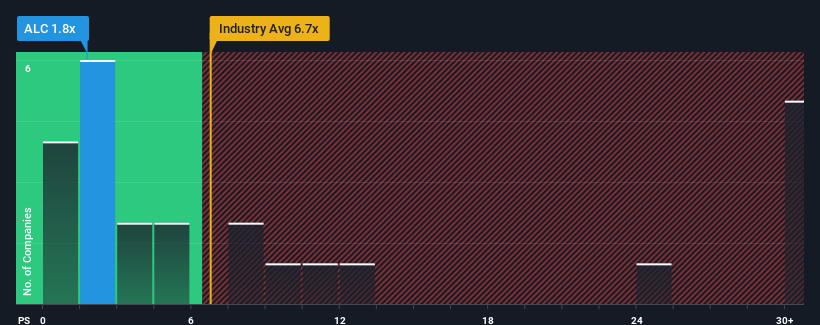

After such a large drop in price, Alcidion Group may look like a strong buying opportunity at present with its price-to-sales (or "P/S") ratio of 1.8x, considering almost half of all companies in the Healthcare Services industry in Australia have P/S ratios greater than 6.7x and even P/S higher than 27x aren't out of the ordinary. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so limited.

See our latest analysis for Alcidion Group

How Alcidion Group Has Been Performing

Alcidion Group could be doing better as it's been growing revenue less than most other companies lately. It seems that many are expecting the uninspiring revenue performance to persist, which has repressed the growth of the P/S ratio. If you still like the company, you'd be hoping revenue doesn't get any worse and that you could pick up some stock while it's out of favour.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Alcidion Group.Is There Any Revenue Growth Forecasted For Alcidion Group?

Alcidion Group's P/S ratio would be typical for a company that's expected to deliver very poor growth or even falling revenue, and importantly, perform much worse than the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 18%. Pleasingly, revenue has also lifted 117% in aggregate from three years ago, thanks to the last 12 months of growth. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Looking ahead now, revenue is anticipated to climb by 11% per annum during the coming three years according to the three analysts following the company. That's shaping up to be materially lower than the 51% each year growth forecast for the broader industry.

With this in consideration, its clear as to why Alcidion Group's P/S is falling short industry peers. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

What We Can Learn From Alcidion Group's P/S?

Alcidion Group's P/S looks about as weak as its stock price lately. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

As expected, our analysis of Alcidion Group's analyst forecasts confirms that the company's underwhelming revenue outlook is a major contributor to its low P/S. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

Having said that, be aware Alcidion Group is showing 2 warning signs in our investment analysis, you should know about.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:ALC

Alcidion Group

Engages in the development and licensing of healthcare software products in Australia, New Zealand, and the United Kingdom.

Flawless balance sheet with reasonable growth potential.

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.