The Australian market has experienced a mixed performance recently, with the ASX200 retreating and sectors like IT showing resilience while others lag. Amid these fluctuations, investors are paying close attention to potential interest rate cuts in the US and their impact on global markets. Despite the vintage feel of the term "penny stocks," these smaller or newer companies can still offer surprising value, especially when they combine financial strength with growth potential. In this article, we explore three such penny stocks that could present compelling opportunities for investors seeking hidden value in quality companies.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Rewards & Risks |

| Alfabs Australia (ASX:AAL) | A$0.52 | A$149.03M | ✅ 4 ⚠️ 3 View Analysis > |

| EZZ Life Science Holdings (ASX:EZZ) | A$2.17 | A$102.37M | ✅ 3 ⚠️ 3 View Analysis > |

| Dusk Group (ASX:DSK) | A$0.84 | A$52.31M | ✅ 4 ⚠️ 2 View Analysis > |

| IVE Group (ASX:IGL) | A$2.81 | A$434.5M | ✅ 4 ⚠️ 2 View Analysis > |

| MotorCycle Holdings (ASX:MTO) | A$3.39 | A$250.2M | ✅ 4 ⚠️ 2 View Analysis > |

| Veris (ASX:VRS) | A$0.075 | A$38.83M | ✅ 4 ⚠️ 2 View Analysis > |

| SHAPE Australia (ASX:SHA) | A$4.48 | A$368.9M | ✅ 3 ⚠️ 1 View Analysis > |

| West African Resources (ASX:WAF) | A$3.04 | A$3.47B | ✅ 4 ⚠️ 1 View Analysis > |

| Tasmea (ASX:TEA) | A$4.35 | A$1.06B | ✅ 3 ⚠️ 2 View Analysis > |

| Praemium (ASX:PPS) | A$0.78 | A$373M | ✅ 5 ⚠️ 2 View Analysis > |

Click here to see the full list of 442 stocks from our ASX Penny Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Austco Healthcare (ASX:AHC)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Austco Healthcare Limited, with a market cap of A$138.89 million, develops, manufactures, services, supplies, and distributes healthcare communications equipment and software across Australia, New Zealand, Asia, Europe, and North America.

Operations: The company's revenue is derived from its healthcare communication solutions, with A$10.84 million from Asia, A$4.99 million from Europe, A$41.33 million from North America, and A$39.42 million from Australia/New Zealand.

Market Cap: A$138.89M

Austco Healthcare, with a market cap of A$138.89 million, presents an intriguing case within the penny stocks landscape due to its debt-free status and strong asset position. Despite trading at 72.2% below estimated fair value, recent financials reveal challenges such as declining net profit margins from 12.2% to 7.3% and a significant one-off loss of A$2.2 million impacting results for the year ending June 30, 2025. While earnings grew substantially over five years by an average of 23.6%, recent negative growth and stable weekly volatility highlight potential risks amidst its global revenue streams totaling A$81.41 million annually.

- Unlock comprehensive insights into our analysis of Austco Healthcare stock in this financial health report.

- Assess Austco Healthcare's future earnings estimates with our detailed growth reports.

Austin Engineering (ASX:ANG)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Austin Engineering Limited, with a market cap of A$189.26 million, specializes in the manufacturing, repair, and supply of mining attachment products and related services for industrial and resource sectors across Australia, Chile, the United States, Canada, Indonesia, and other international markets.

Operations: The company's revenue is derived from three main regions: Asia-Pacific contributing A$173.30 million, North America with A$146.78 million, and South America generating A$56.65 million.

Market Cap: A$189.26M

Austin Engineering, with a market cap of A$189.26 million, shows both potential and challenges in the penny stock arena. Recent financials indicate stable revenue growth, with FY25 sales reaching A$376.73 million and net income rising to A$25.99 million from the previous year. However, an accounting error in FY24 led to restated figures impacting past financial statements but not materially affecting current projections or overall financial health. The company's debt management is satisfactory with interest payments well covered by EBIT at 13.4 times coverage, yet its dividend sustainability remains questionable due to inadequate free cash flow coverage despite increased payouts this year.

- Take a closer look at Austin Engineering's potential here in our financial health report.

- Explore Austin Engineering's analyst forecasts in our growth report.

Environmental Group (ASX:EGL)

Simply Wall St Financial Health Rating: ★★★★★☆

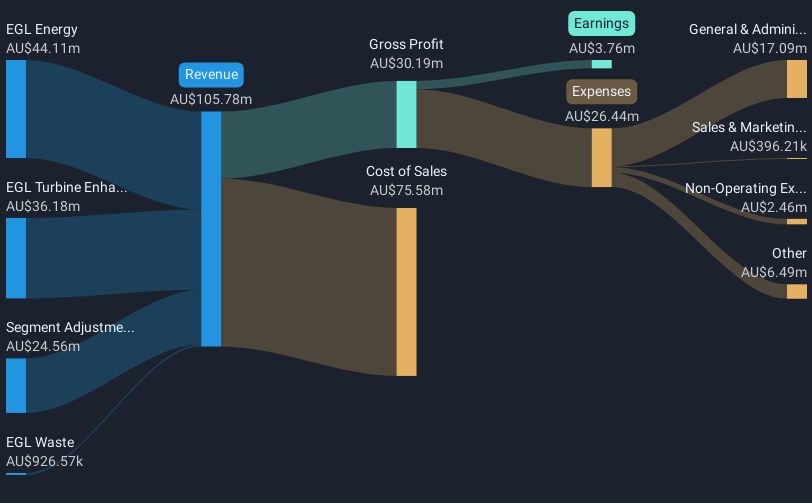

Overview: The Environmental Group Limited designs, applies, and services gas, vapor, and dust emission control systems as well as inlet and exhaust systems for gas turbines in Australia and internationally with a market cap of A$100.83 million.

Operations: The company's revenue is derived from segments including EGL Waste (A$3.65 million), EGL Baltec (A$35.67 million), EGL Energy (A$49.28 million), EGL Clean Air (A$19.63 million), and Advanced Boilers & Combustion (A$4.34 million).

Market Cap: A$100.83M

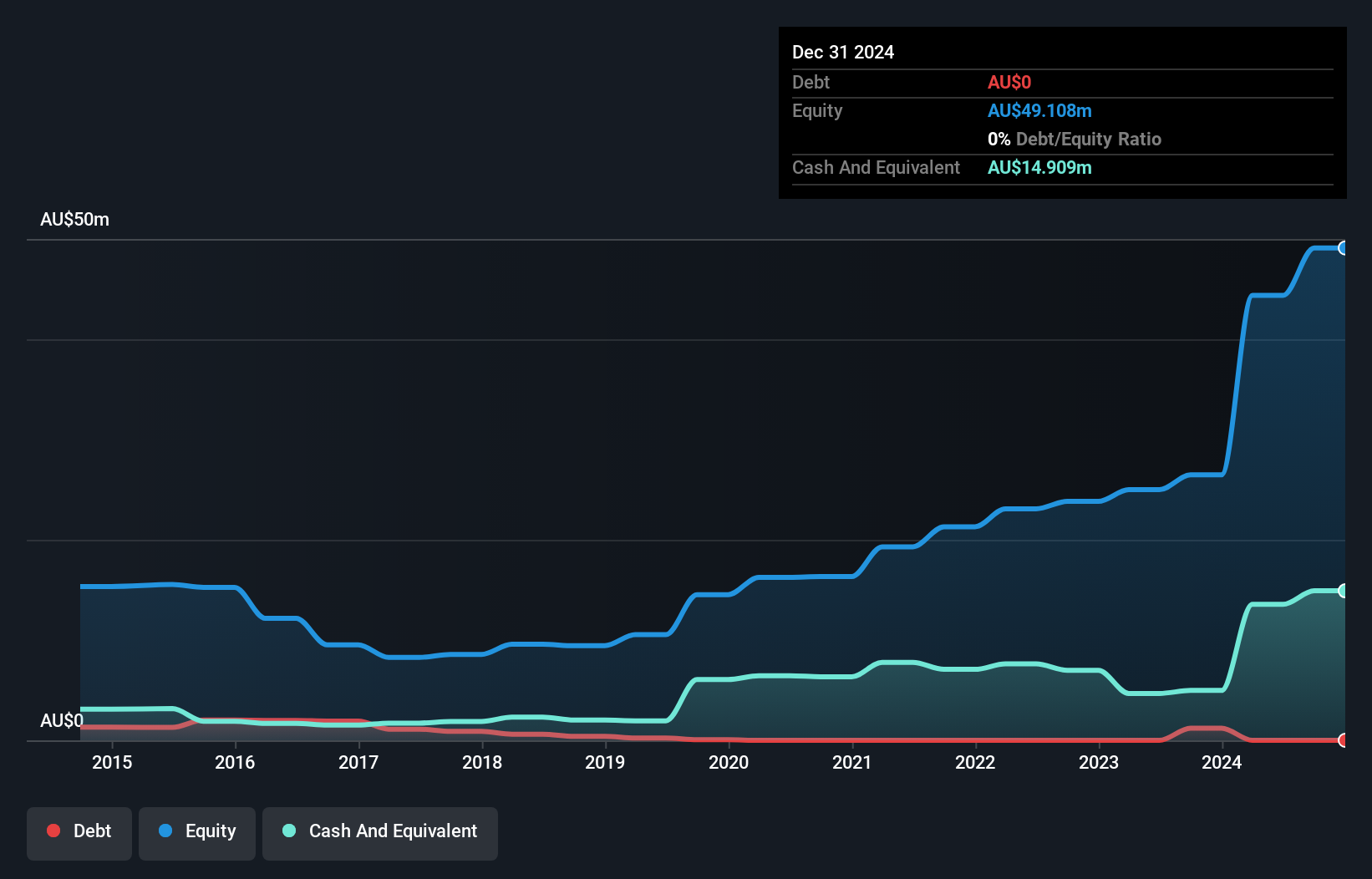

Environmental Group Limited, with a market cap of A$100.83 million, has demonstrated steady revenue growth, reporting A$111.92 million in sales for FY25 compared to A$98.25 million the previous year. Despite earnings growth over five years at 43.1% annually, recent performance shows a deceleration to 7.3%, underperforming the broader Machinery industry and reflecting lower profit margins than last year (4.2% vs 4.5%). The company maintains strong liquidity with short-term assets exceeding liabilities and reduced debt levels over five years; however, negative operating cash flow raises concerns about debt coverage sustainability amidst significant insider selling recently observed.

- Get an in-depth perspective on Environmental Group's performance by reading our balance sheet health report here.

- Review our growth performance report to gain insights into Environmental Group's future.

Key Takeaways

- Explore the 442 names from our ASX Penny Stocks screener here.

- Contemplating Other Strategies? Trump's oil boom is here — pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Environmental Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:EGL

Environmental Group

Engages in the design, application, and servicing of gas, vapor and dust emission control systems, and inlet and exhaust systems for gas turbines in Australia and internationally.

Undervalued with excellent balance sheet.

Market Insights

Community Narratives