Imagine Owning Wingara (ASX:WNR) And Wondering If The 32% Share Price Slide Is Justified

Investors can approximate the average market return by buying an index fund. While individual stocks can be big winners, plenty more fail to generate satisfactory returns. Unfortunately the Wingara AG Limited (ASX:WNR) share price slid 32% over twelve months. That falls noticeably short of the market return of around 8.9%. On the other hand, the stock is actually up 18% over three years. Even worse, it's down 16% in about a month, which isn't fun at all.

See our latest analysis for Wingara

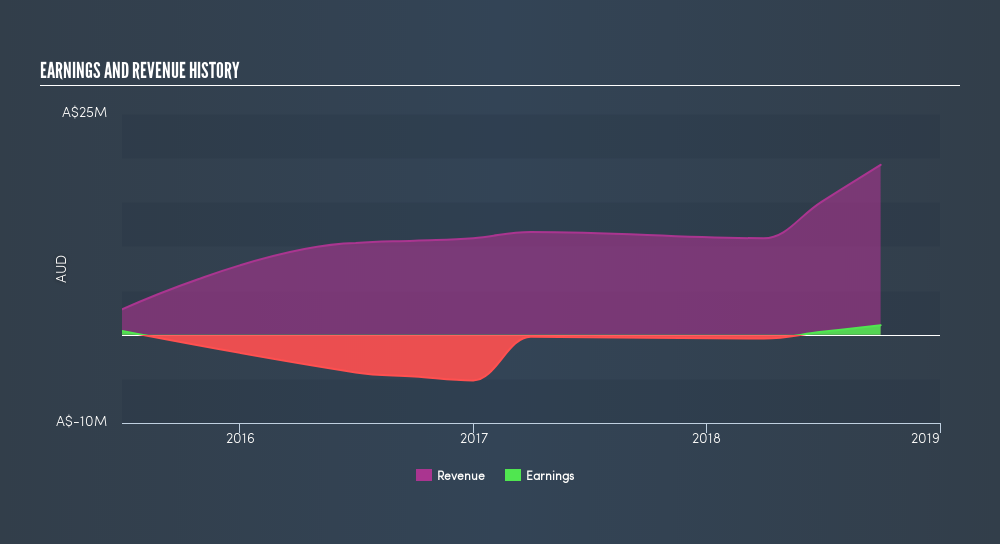

Given that Wingara only made minimal earnings in the last twelve months, we'll focus on revenue to gauge its business development. Many high growth companies focus on growing revenue before profits, but if revenue is the focus, it really needs to grow. As you can imagine, it's easy to imagine a fast growing company becoming (potentially very) profitable, but when revenue growth slows, then the potential upside often seems less impressive.

In the last year Wingara saw its revenue grow by 71%. That's well above most other pre-profit companies. Given the revenue growth, the share price drop of 32% seems quite harsh. Our sympathies to shareholders who are now underwater. Prima facie, revenue growth like that should be a good thing, so it's worth checking whether losses have stabilized. Our monkey brains haven't evolved to think exponentially, so humans do tend to underestimate companies that have exponential growth.

The chart below shows how revenue and earnings have changed with time, (if you click on the chart you can see the actual values).

Balance sheet strength is crucual. It might be well worthwhile taking a look at our freereport on how its financial position has changed over time.

A Different Perspective

The last twelve months weren't great for Wingara shares, which cost holders 32%, while the market was up about 8.9%. Of course the long term matters more than the short term, and even great stocks will sometimes have a poor year. Fortunately the longer term story is brighter, with total returns averaging about 5.5% per year over three years. Sometimes when a good quality long term winner has a weak period, it's turns out to be an opportunity, but you really need to be sure that the quality is there. Before spending more time on Wingara it might be wise to click here to see if insiders have been buying or selling shares.

But note: Wingara may not be the best stock to buy. So take a peek at this freelist of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on AU exchanges.We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About ASX:WNR

Wingara

Engages in processing, storage, and marketing agricultural products in Australia.

Moderate and slightly overvalued.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)