There's no doubt that investing in the stock market is a truly brilliant way to build wealth. But not every stock you buy will perform as well as the overall market. Unfortunately for shareholders, while the Wingara AG Limited (ASX:WNR) share price is up 13% in the last year, that falls short of the market return. In contrast, the longer term returns are negative, since the share price is 6.9% lower than it was three years ago.

See our latest analysis for Wingara

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

Over the last twelve months, Wingara actually shrank its EPS by 19%.

Given the share price gain, we doubt the market is measuring progress with EPS. Indeed, when EPS is declining but the share price is up, it often means the market is considering other factors.

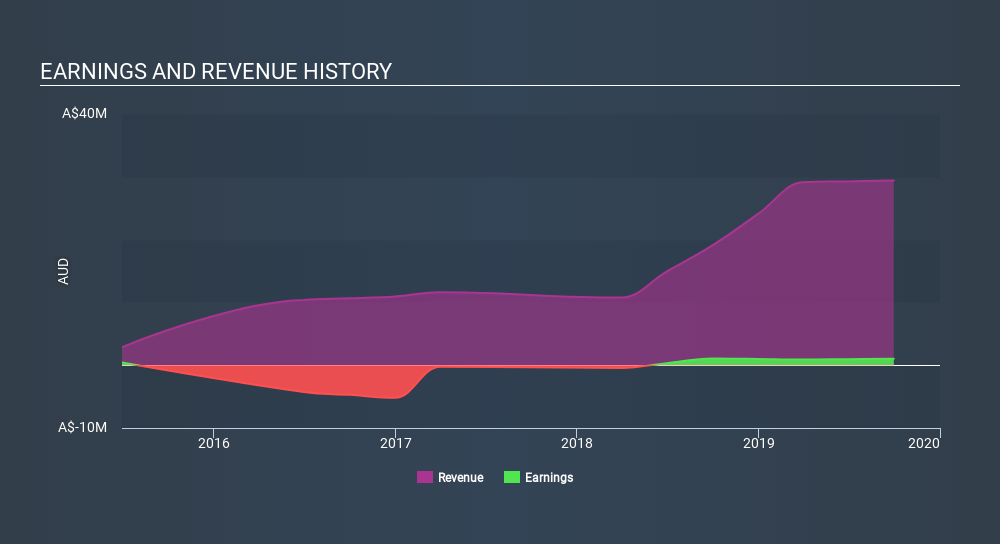

However the year on year revenue growth of 54% would help. We do see some companies suppress earnings in order to accelerate revenue growth.

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

This free interactive report on Wingara's balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

Wingara shareholders are up 13% for the year. It's always nice to make money but this return falls short of the market return which was about 20% for the year. The silver lining is that the recent rise is far preferable to the annual loss of 2.4% that shareholders have suffered over the last three years. It could well be that the business is stabilizing. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Take risks, for example - Wingara has 5 warning signs (and 2 which are concerning) we think you should know about.

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on AU exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About ASX:WNR

Wingara

Engages in processing, storage, and marketing agricultural products in Australia.

Moderate with mediocre balance sheet.

Market Insights

Community Narratives