- Australia

- /

- Entertainment

- /

- ASX:BBL

Brisbane Broncos And 2 Other Promising Penny Stocks On The ASX

Reviewed by Simply Wall St

As the ASX200 edges up by 0.5% to 8,582 points, attention remains focused on the Reserve Bank of Australia's upcoming rate decision. Amidst these market dynamics, identifying promising investment opportunities becomes crucial. While 'penny stocks' might seem like a term from trading days gone by, they continue to represent potential in smaller or newer companies with solid financials and growth prospects.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Financial Health Rating |

| Embark Early Education (ASX:EVO) | A$0.79 | A$144.95M | ★★★★☆☆ |

| LaserBond (ASX:LBL) | A$0.57 | A$66.88M | ★★★★★★ |

| EZZ Life Science Holdings (ASX:EZZ) | A$1.86 | A$87.74M | ★★★★★★ |

| Austin Engineering (ASX:ANG) | A$0.475 | A$294.57M | ★★★★★☆ |

| IVE Group (ASX:IGL) | A$2.15 | A$333.01M | ★★★★☆☆ |

| SHAPE Australia (ASX:SHA) | A$3.01 | A$249.56M | ★★★★★★ |

| Bisalloy Steel Group (ASX:BIS) | A$3.40 | A$162.87M | ★★★★★★ |

| Dusk Group (ASX:DSK) | A$1.065 | A$66.32M | ★★★★★★ |

| GTN (ASX:GTN) | A$0.535 | A$105.06M | ★★★★★★ |

| MaxiPARTS (ASX:MXI) | A$1.875 | A$103.72M | ★★★★★★ |

Click here to see the full list of 1,032 stocks from our ASX Penny Stocks screener.

Let's uncover some gems from our specialized screener.

Brisbane Broncos (ASX:BBL)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Brisbane Broncos Limited manages and operates the Brisbane Broncos Rugby League Football Team in Australia, with a market cap of A$92.65 million.

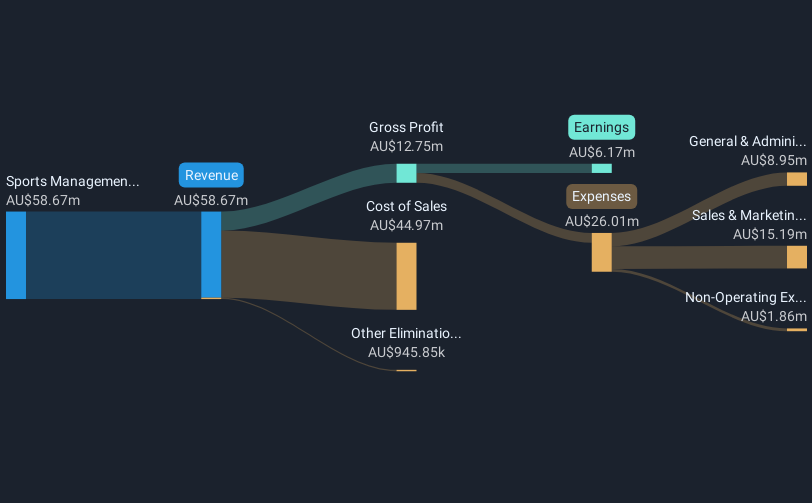

Operations: The company generates its revenue primarily from Sports Management and Entertainment, amounting to A$58.67 million.

Market Cap: A$92.65M

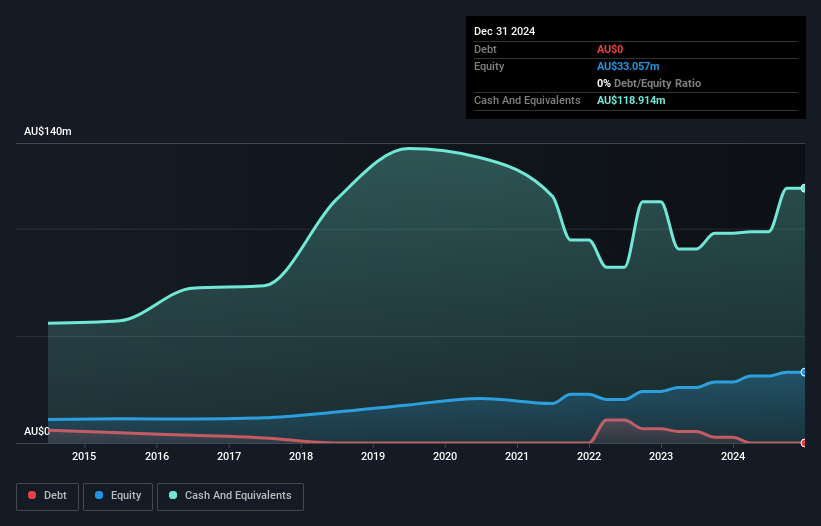

Brisbane Broncos Limited, with a market cap of A$92.65 million, has demonstrated financial stability and growth potential in the penny stock segment. The company boasts significant earnings growth of 39.3% over the past year, surpassing its five-year average and industry benchmarks. Its net profit margins have improved to 10.7%, and it remains debt-free with sufficient short-term assets (A$31.1 million) covering both short- (A$13.1 million) and long-term liabilities (A$2.7 million). Although its Return on Equity is low at 13.3%, the stock trades significantly below estimated fair value, suggesting potential for future appreciation.

- Unlock comprehensive insights into our analysis of Brisbane Broncos stock in this financial health report.

- Explore historical data to track Brisbane Broncos' performance over time in our past results report.

SHAPE Australia (ASX:SHA)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: SHAPE Australia Corporation Limited operates in the construction, fitout, and refurbishment of commercial properties across Australia with a market cap of A$249.56 million.

Operations: The company generates its revenue primarily from the heavy construction segment, amounting to A$839.00 million.

Market Cap: A$249.56M

SHAPE Australia Corporation Limited, with a market cap of A$249.56 million, shows strong financial health and growth potential within the penny stock segment. The company has experienced impressive earnings growth of 52.6% over the past year, outpacing both its historical average and industry peers. SHAPE's short-term assets (A$206.9 million) comfortably cover both short- (A$186.9 million) and long-term liabilities (A$33 million). The company operates debt-free, enhancing its financial flexibility, while maintaining high-quality earnings and an outstanding Return on Equity of 51.2%. Recent strategic moves include seeking acquisitions to diversify business operations further.

- Click here to discover the nuances of SHAPE Australia with our detailed analytical financial health report.

- Evaluate SHAPE Australia's prospects by accessing our earnings growth report.

Wellard (ASX:WLD)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Wellard Limited operates in the supply of livestock and livestock vessels across Australia, Singapore, Brazil, and internationally with a market capitalization of A$79.69 million.

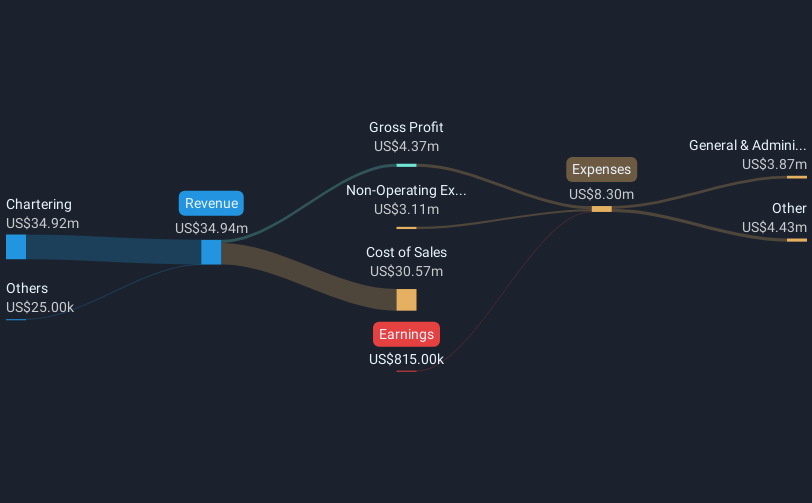

Operations: The company generates revenue primarily through its Chartering segment, which accounts for $34.92 million.

Market Cap: A$79.69M

Wellard Limited, with a market cap of A$79.69 million, operates debt-free and has reduced its losses by 39.4% annually over the past five years despite being unprofitable. Its Chartering segment generates A$34.92 million in revenue, providing some financial stability amidst high share price volatility and negative return on equity (-2.2%). The company maintains a strong cash position with short-term assets of $23.1 million exceeding liabilities and boasts a seasoned management team with an average tenure of 5.9 years. Wellard recently declared a special cash dividend, showcasing its commitment to shareholder returns even while unprofitable.

- Navigate through the intricacies of Wellard with our comprehensive balance sheet health report here.

- Learn about Wellard's historical performance here.

Turning Ideas Into Actions

- Navigate through the entire inventory of 1,032 ASX Penny Stocks here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Brisbane Broncos might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:BBL

Brisbane Broncos

Manages and operates the Brisbane Broncos Rugby League Football Team in Australia.

Flawless balance sheet with solid track record.

Market Insights

Community Narratives