Treasury Wine Estates (ASX:TWE) Is Down 6.9% After Buy-Back Pause and Guidance Withdrawal – Has The Bull Case Changed?

Reviewed by Sasha Jovanovic

- Treasury Wine Estates recently paused its A$200 million share buy-back plan and withdrew its FY26 earnings guidance, citing lower-than-expected performance in China and distribution challenges in California. The company also held its 2025 Annual General Meeting, where shareholders approved an increase in board size and discussed issues including executive compensation and governance stability.

- This combination of operational headwinds and significant shifts in capital allocation signals a reassessment of near-term growth expectations and investor priorities for the business.

- We'll examine how pausing the share buy-back and withdrawing guidance in response to China and US market challenges impacts the investment narrative.

Find companies with promising cash flow potential yet trading below their fair value.

Treasury Wine Estates Investment Narrative Recap

For anyone holding Treasury Wine Estates, the key belief is that premiumisation and a strong Chinese luxury wine market can underpin growth and margin resilience. However, the suspension of the A$200 million buy-back and the withdrawn FY26 guidance clearly put near-term earnings momentum at risk, reflecting how sensitive the company is to shifting demand and distribution bottlenecks in China and the US. This marks a significant impact on both the short-term catalyst, Penfolds’ return in China, and the most immediate risk, namely margin pressure from weaker-than-expected demand.

One of the most relevant recent announcements is the shareholder-approved board expansion, with the company now permitted up to ten directors. While more strategic input could help address ongoing challenges, the immediate headwinds from China and the US may weigh more heavily on investor sentiment than changes in governance structure.

However, investors should also be aware that despite robust revenue, risks related to luxury wine demand in China haven't disappeared and...

Read the full narrative on Treasury Wine Estates (it's free!)

Treasury Wine Estates' narrative projects A$3.3 billion revenue and A$605.8 million earnings by 2028. This requires 3.6% yearly revenue growth and a A$168.9 million earnings increase from A$436.9 million today.

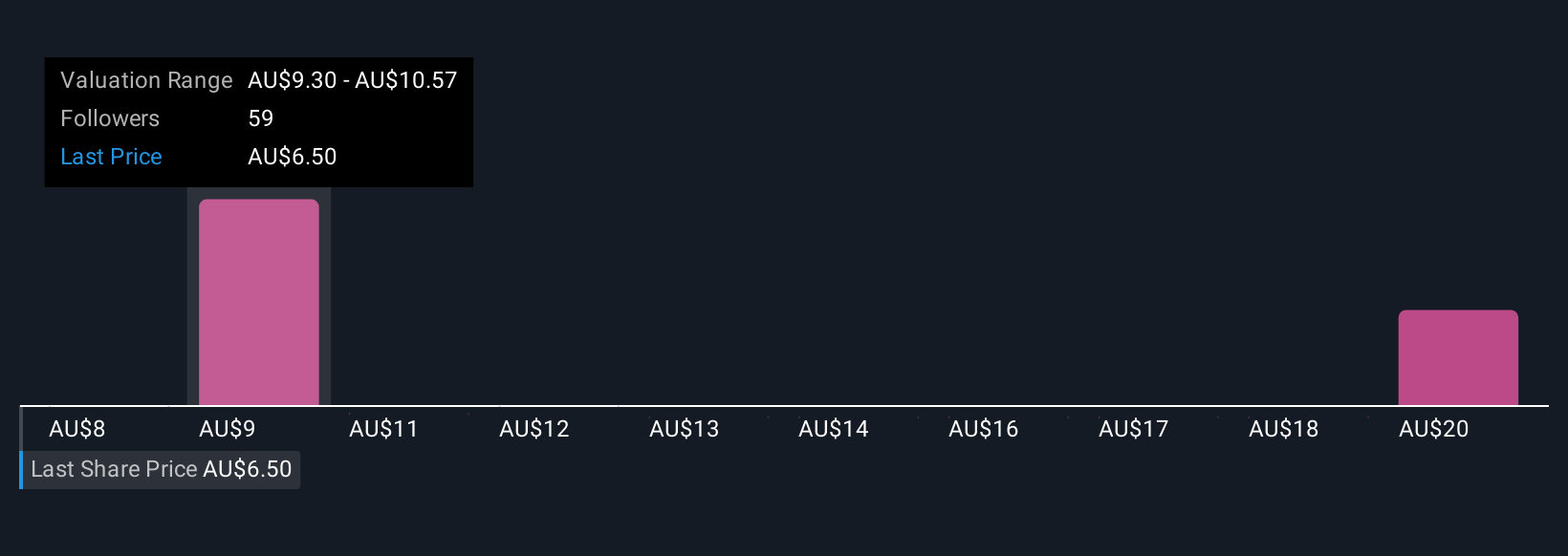

Uncover how Treasury Wine Estates' forecasts yield a A$9.60 fair value, a 48% upside to its current price.

Exploring Other Perspectives

Nine members of the Simply Wall St Community estimate fair values for TWE ranging from A$8.02 to A$20.78. With current uncertainty over luxury wine sales in China, shifting consumer demand remains front of mind for many.

Explore 9 other fair value estimates on Treasury Wine Estates - why the stock might be worth just A$8.02!

Build Your Own Treasury Wine Estates Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Treasury Wine Estates research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Treasury Wine Estates research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Treasury Wine Estates' overall financial health at a glance.

Contemplating Other Strategies?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Treasury Wine Estates might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:TWE

Treasury Wine Estates

Operates as a wine company in Australia, the United States, the United Kingdom, and internationally.

Undervalued with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives