Top Shelf International Holdings Ltd's (ASX:TSI) Share Price Matching Investor Opinion

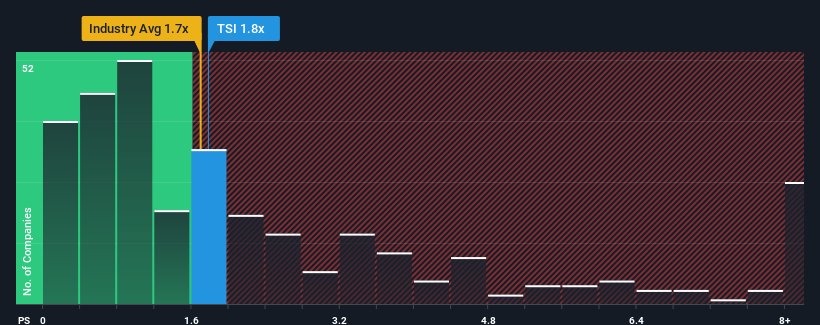

When close to half the companies in the Beverage industry in Australia have price-to-sales ratios (or "P/S") below 1.1x, you may consider Top Shelf International Holdings Ltd (ASX:TSI) as a stock to potentially avoid with its 1.8x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's as high as it is.

View our latest analysis for Top Shelf International Holdings

How Has Top Shelf International Holdings Performed Recently?

Revenue has risen firmly for Top Shelf International Holdings recently, which is pleasing to see. Perhaps the market is expecting this decent revenue performance to beat out the industry over the near term, which has kept the P/S propped up. However, if this isn't the case, investors might get caught out paying too much for the stock.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Top Shelf International Holdings will help you shine a light on its historical performance.How Is Top Shelf International Holdings' Revenue Growth Trending?

In order to justify its P/S ratio, Top Shelf International Holdings would need to produce impressive growth in excess of the industry.

Retrospectively, the last year delivered a decent 10% gain to the company's revenues. The latest three year period has also seen an excellent 142% overall rise in revenue, aided somewhat by its short-term performance. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Comparing that to the industry, which is only predicted to deliver 18% growth in the next 12 months, the company's momentum is stronger based on recent medium-term annualised revenue results.

In light of this, it's understandable that Top Shelf International Holdings' P/S sits above the majority of other companies. It seems most investors are expecting this strong growth to continue and are willing to pay more for the stock.

The Final Word

We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

It's no surprise that Top Shelf International Holdings can support its high P/S given the strong revenue growth its experienced over the last three-year is superior to the current industry outlook. At this stage investors feel the potential continued revenue growth in the future is great enough to warrant an inflated P/S. If recent medium-term revenue trends continue, it's hard to see the share price falling strongly in the near future under these circumstances.

Having said that, be aware Top Shelf International Holdings is showing 5 warning signs in our investment analysis, and 3 of those are potentially serious.

If these risks are making you reconsider your opinion on Top Shelf International Holdings, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if Top Shelf International Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:TSI

Top Shelf International Holdings

Engages in the production, marketing, and selling of NED Australian Whisky and Grainshaker Hand Made Vodka spirit products in Australia.

Moderate and slightly overvalued.

Market Insights

Community Narratives