We Think Tassal Group (ASX:TGR) In Taking Some Risk With Its Debt

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

Warren Buffett famously said, 'Volatility is far from synonymous with risk.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. We note that Tassal Group Limited (ASX:TGR) does have debt on its balance sheet. But the real question is whether this debt is making the company risky.

Why Does Debt Bring Risk?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. The first step when considering a company's debt levels is to consider its cash and debt together.

Check out our latest analysis for Tassal Group

What Is Tassal Group's Debt?

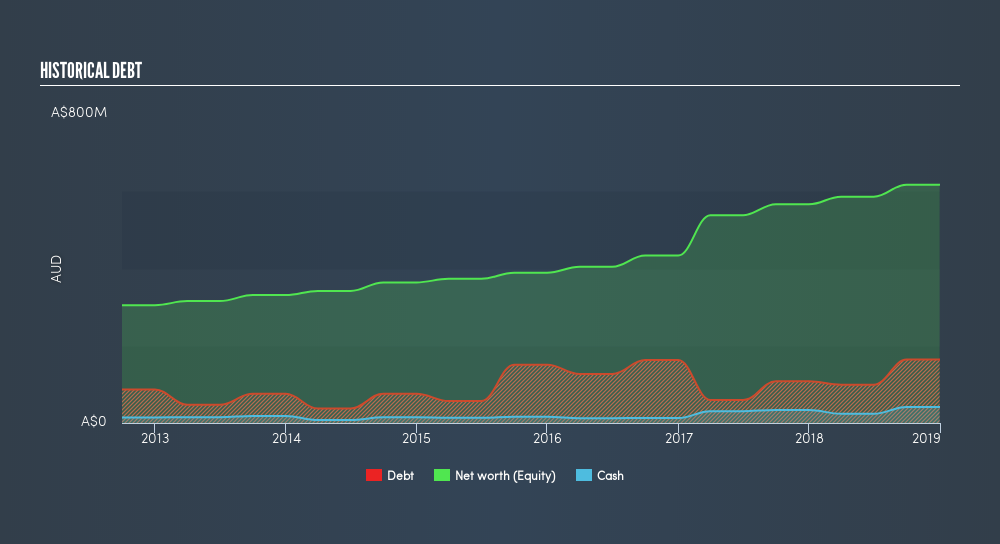

The image below, which you can click on for greater detail, shows that at December 2018 Tassal Group had debt of AU$164.3m, up from AU$107.8m in one year. However, because it has a cash reserve of AU$41.6m, its net debt is less, at about AU$122.6m.

A Look At Tassal Group's Liabilities

Zooming in on the latest balance sheet data, we can see that Tassal Group had liabilities of AU$144.6m due within 12 months and liabilities of AU$267.6m due beyond that. Offsetting these obligations, it had cash of AU$41.6m as well as receivables valued at AU$26.0m due within 12 months. So its liabilities total AU$344.6m more than the combination of its cash and short-term receivables.

While this might seem like a lot, it is not so bad since Tassal Group has a market capitalization of AU$851.2m, and so it could probably strengthen its balance sheet by raising capital if it needed to. However, it is still worthwhile taking a close look at its ability to pay off debt. Since Tassal Group does have net debt, we think it is worthwhile for shareholders to keep an eye on the balance sheet, over time.

In order to size up a company's debt relative to its earnings, we calculate its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and its earnings before interest and tax (EBIT) divided by its interest expense (its interest cover). The advantage of this approach is that we take into account both the absolute quantum of debt (with net debt to EBITDA) and the actual interest expenses associated with that debt (with its interest cover ratio).

Tassal Group has a low net debt to EBITDA ratio of only 0.99. And its EBIT covers its interest expense a whopping 11.5 times over. So we're pretty relaxed about its super-conservative use of debt. On the other hand, Tassal Group saw its EBIT drop by 4.4% in the last twelve months. If earnings continue to decline at that rate the company may have increasing difficulty managing its debt load. There's no doubt that we learn most about debt from the balance sheet. But it is future earnings, more than anything, that will determine Tassal Group's ability to maintain a healthy balance sheet going forward. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

Finally, a company can only pay off debt with cold hard cash, not accounting profits. So it's worth checking how much of that EBIT is backed by free cash flow. In the last three years, Tassal Group created free cash flow amounting to 6.4% of its EBIT, an uninspiring performance. For us, cash conversion that low sparks some a little paranoia about is ability to extinguish debt.

Our View

Tassal Group's conversion of EBIT to free cash flow and EBIT growth rate definitely weigh on it, in our esteem. But the good news is it seems to be able to cover its interest expense with its EBIT with ease. We think that Tassal Group's debt does make it a bit risky, after considering the aforementioned data points together. That's not necessarily a bad thing, since leverage can boost returns on equity, but it is something to be aware of. Given our hesitation about the stock, it would be good to know if Tassal Group insiders have sold any shares recently. You click here to find out if insiders have sold recently.

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About ASX:TGR

Tassal Group

Tassal Group Limited, together with its subsidiaries, engages in the hatching, farming, processing, marketing, and sale of Atlantic salmon and tiger prawns in Australia.

Adequate balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives