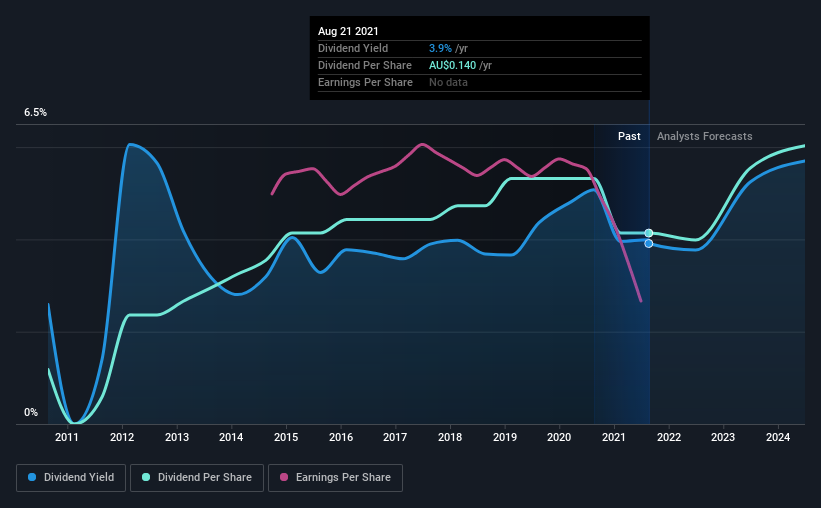

Tassal Group Limited (ASX:TGR) has announced it will be reducing its dividend payable on the 29th of September to AU$0.07. However, the dividend yield of 3.9% is still a decent boost to shareholder returns.

View our latest analysis for Tassal Group

Tassal Group's Payment Has Solid Earnings Coverage

While it is great to have a strong dividend yield, we should also consider whether the payment is sustainable. Based on the last payment, earnings were actually smaller than the dividend, and the company was actually spending more cash than it was making. This high of a dividend payment could start to put pressure on the balance sheet in the future.

The next year is set to see EPS grow by 52.4%. Assuming the dividend continues along the course it has been charting recently, our estimates show the payout ratio being 59% which brings it into quite a comfortable range.

Dividend Volatility

Although the company has a long dividend history, it has been cut at least once in the last 10 years. The first annual payment during the last 10 years was AU$0.04 in 2011, and the most recent fiscal year payment was AU$0.14. This means that it has been growing its distributions at 13% per annum over that time. Despite the rapid growth in the dividend over the past number of years, we have seen the payments go down the past as well, so that makes us cautious.

Dividend Growth Potential Is Shaky

Growing earnings per share could be a mitigating factor when considering the past fluctuations in the dividend. Tassal Group's EPS has fallen by approximately 13% per year during the past five years. Dividend payments are likely to come under some pressure unless EPS can pull out of the nosedive it is in. It's not all bad news though, as the earnings are predicted to rise over the next 12 months - we would just be a bit cautious until this becomes a long term trend.

Tassal Group's Dividend Doesn't Look Great

Overall, the dividend looks like it may have been a bit high, which explains why it has now been cut. The company isn't making enough to be paying as much as it is, and the other factors don't look particularly promising either. Overall, this doesn't get us very excited from an income standpoint.

Market movements attest to how highly valued a consistent dividend policy is compared to one which is more unpredictable. Still, investors need to consider a host of other factors, apart from dividend payments, when analysing a company. Just as an example, we've come across 4 warning signs for Tassal Group you should be aware of, and 3 of them are potentially serious. We have also put together a list of global stocks with a solid dividend.

If you’re looking to trade Tassal Group, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Tassal Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About ASX:TGR

Tassal Group

Tassal Group Limited, together with its subsidiaries, engages in the hatching, farming, processing, marketing, and sale of Atlantic salmon and tiger prawns in Australia.

Adequate balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives