- Australia

- /

- Capital Markets

- /

- ASX:AEF

Undiscovered Gems In Australia To Watch This October 2025

Reviewed by Simply Wall St

As the Australian market experiences a slight downturn following a bullish streak, investors are closely watching how economic indicators and global events, such as the U.S. government shutdown and fluctuating commodity prices, impact small-cap stocks. In this dynamic environment, identifying promising stocks often involves looking for companies with strong fundamentals and growth potential that can weather market fluctuations and capitalize on emerging opportunities.

Top 10 Undiscovered Gems With Strong Fundamentals In Australia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Fiducian Group | NA | 10.00% | 9.57% | ★★★★★★ |

| Tribune Resources | NA | -8.81% | -36.95% | ★★★★★★ |

| Spheria Emerging Companies | NA | -1.31% | 0.28% | ★★★★★★ |

| Hearts and Minds Investments | NA | 56.27% | 59.19% | ★★★★★★ |

| Focus Minerals | NA | 75.35% | 51.34% | ★★★★★★ |

| Djerriwarrh Investments | 2.39% | 8.18% | 7.91% | ★★★★★★ |

| Carlton Investments | 0.02% | 9.10% | 8.68% | ★★★★★☆ |

| Zimplats Holdings | 5.44% | -9.79% | -42.03% | ★★★★★☆ |

| Peet | 53.46% | 12.70% | 31.21% | ★★★★☆☆ |

| Australian United Investment | 1.90% | 5.23% | 4.56% | ★★★★☆☆ |

We're going to check out a few of the best picks from our screener tool.

Australian Ethical Investment (ASX:AEF)

Simply Wall St Value Rating: ★★★★★★

Overview: Australian Ethical Investment Ltd is a publicly owned investment manager with a market cap of A$848.38 million, focusing on ethical and sustainable investment solutions.

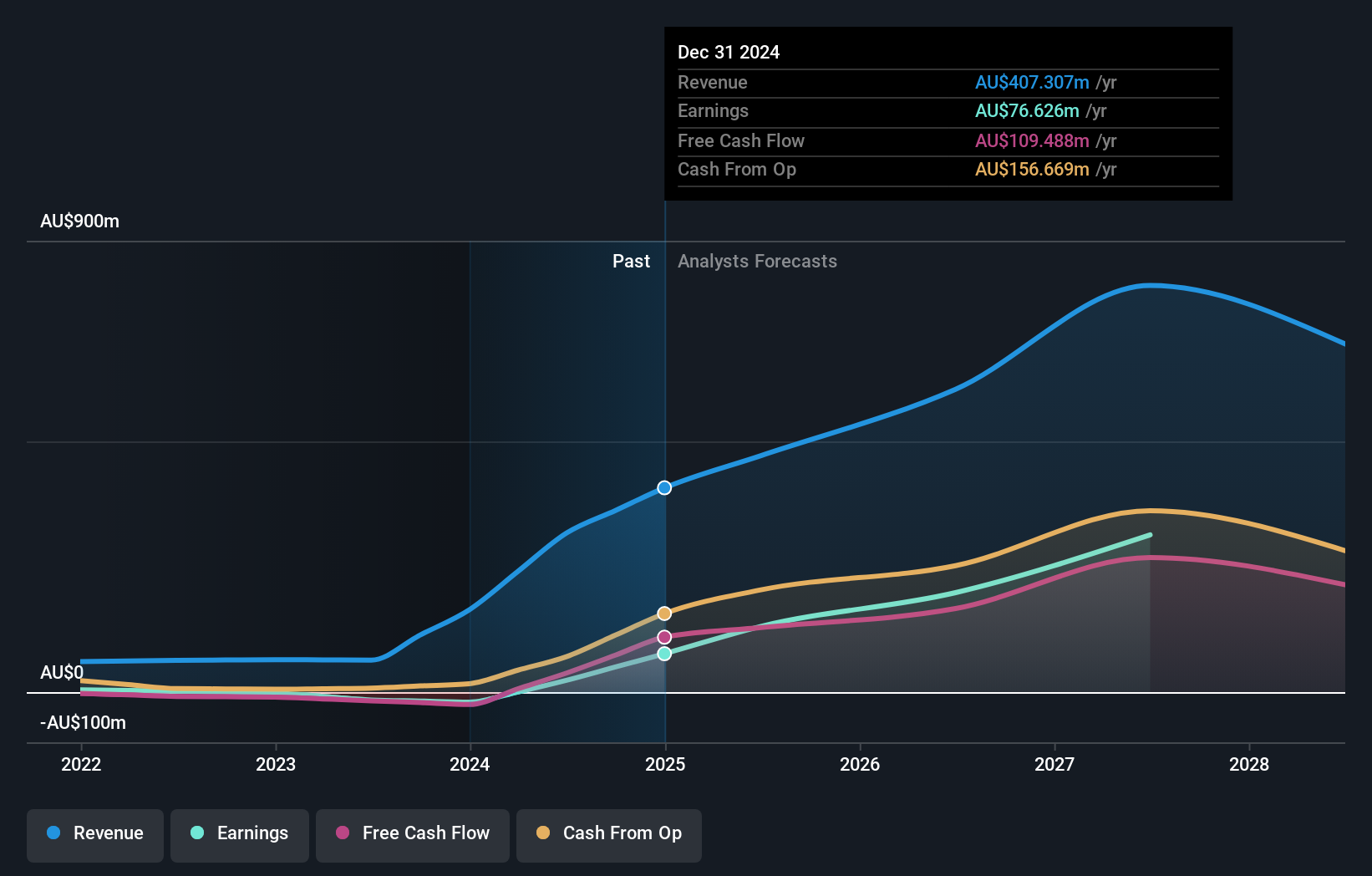

Operations: The company generates revenue primarily through its funds management segment, which reported A$119.38 million.

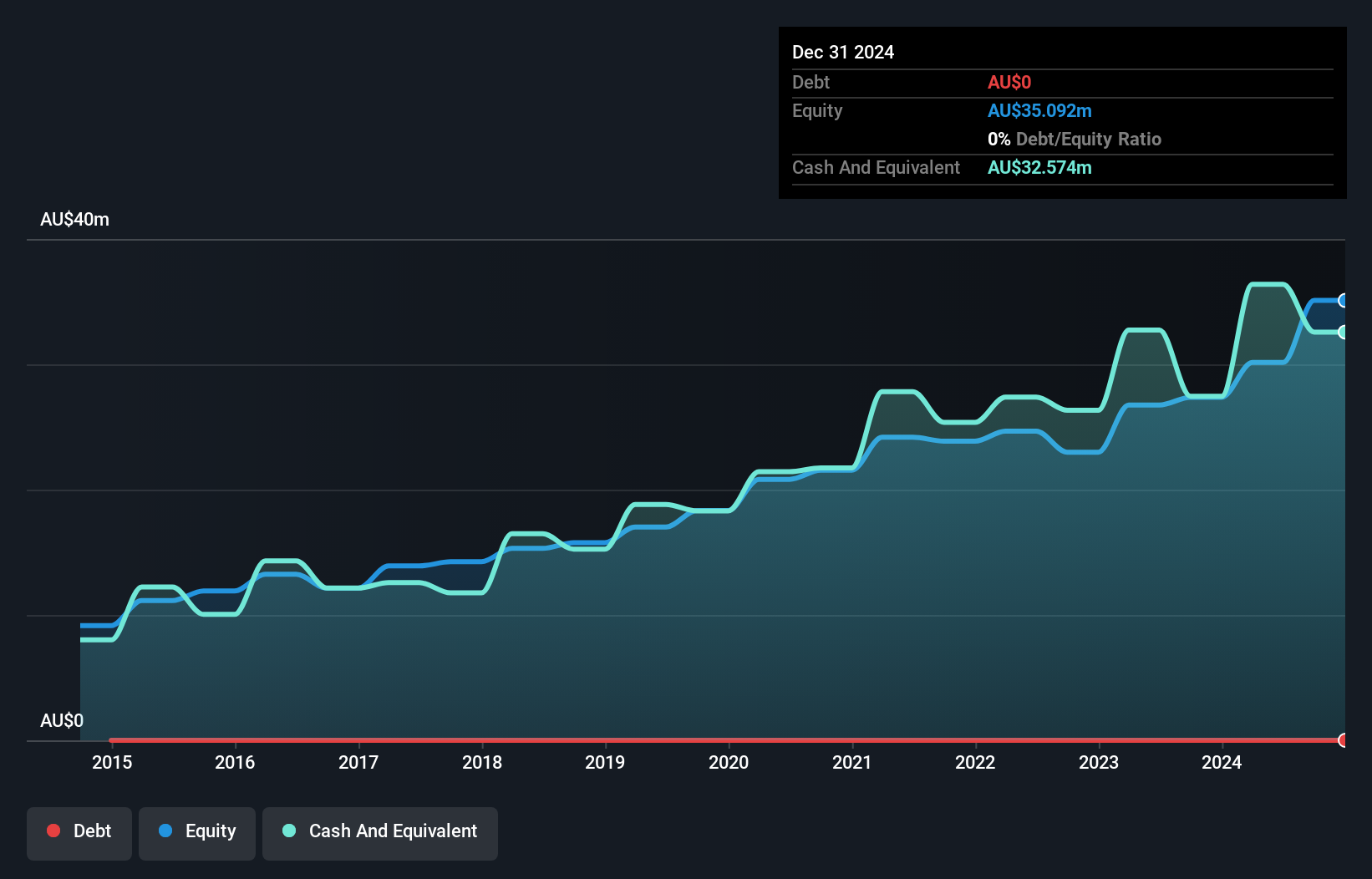

Australian Ethical Investment, a nimble player in the ethical investing space, reported a robust earnings growth of 75.1% over the past year, significantly outpacing the Capital Markets industry's 12.7%. With no debt burden over the last five years, its financial health is sound and free cash flow remains positive. The company’s revenue reached A$119.38 million for the year ending June 2025, up from A$100.49 million previously, while net income rose to A$20.2 million from A$11.53 million. Despite competitive pressures and fee reduction strategies potentially impacting margins, forecasts suggest annual revenue growth of 11.2% with improving profit margins on the horizon.

Catalyst Metals (ASX:CYL)

Simply Wall St Value Rating: ★★★★★☆

Overview: Catalyst Metals Limited is involved in mineral exploration and evaluation activities in Australia, with a market capitalization of approximately A$2.05 billion.

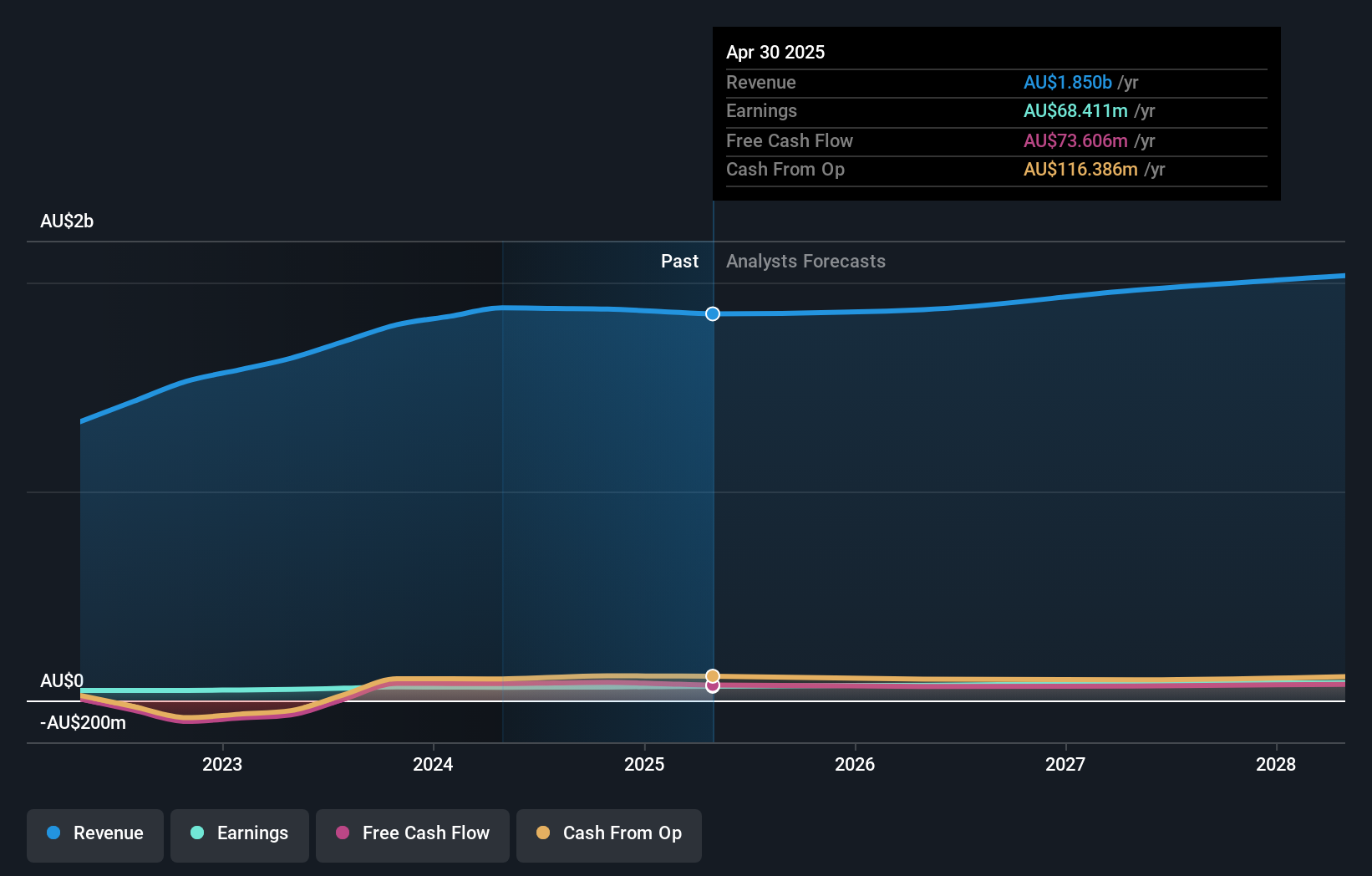

Operations: Catalyst Metals generates revenue primarily from its operations in Western Australia, amounting to A$361.41 million.

Catalyst Metals, a nimble player in the mining sector, has shown impressive growth with earnings surging 394.9% over the past year, outpacing the industry average of 10.6%. The company boasts a debt-to-equity ratio that has modestly risen to 0.2% over five years and enjoys robust interest coverage at 81 times EBIT. Recent additions to major indices like S&P/ASX 200 highlight its growing prominence. Despite significant insider selling recently, Catalyst remains profitable with free cash flow turning positive this year at A$36.5 million by June's end, suggesting solid financial health and potential for future expansion.

- Click to explore a detailed breakdown of our findings in Catalyst Metals' health report.

Review our historical performance report to gain insights into Catalyst Metals''s past performance.

Ricegrowers (ASX:SGLLV)

Simply Wall St Value Rating: ★★★★★☆

Overview: Ricegrowers Limited is a rice food company with operations spanning Australia, New Zealand, the Pacific Islands, Europe, the Middle East, Africa, Asia, and North America and has a market cap of A$1.22 billion.

Operations: Ricegrowers generates revenue primarily from its International Rice segment, contributing A$860.96 million, and the Rice Pool segment with A$481.87 million. The Cop Rice and Riviana segments add A$250.64 million and A$231.14 million, respectively, while the Rice Food segment contributes A$132.53 million to the total revenue stream.

Strategically expanding into the Middle East and U.S., Ricegrowers is tapping into rising rice demand, driven by population growth and affluence. With over 40 new product launches in ready-to-eat and health-focused categories, the company aims to bolster its portfolio of higher-margin branded products. Investments in agritech are expected to enhance cost savings, while strong ESG initiatives align with global sustainability goals. Despite these efforts, challenges from competition and supply chain uncertainties loom large. The company's recent inclusion in the S&P/ASX Small Ordinaries Index highlights its growing recognition within investment circles.

Key Takeaways

- Click through to start exploring the rest of the 49 ASX Undiscovered Gems With Strong Fundamentals now.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:AEF

Australian Ethical Investment

Australian Ethical Investment Ltd is a publicly owned investment manager.

Outstanding track record with flawless balance sheet.

Market Insights

Community Narratives