The Australian share market has experienced a mixed trading session, with gains in the materials sector offset by declines in financials, highlighting the volatility and sector-specific dynamics influencing current market conditions. In this environment, dividend stocks can offer stability and income potential for investors seeking to navigate these fluctuations, as they typically provide regular payouts regardless of broader market movements.

Top 10 Dividend Stocks In Australia

| Name | Dividend Yield | Dividend Rating |

| Treasury Wine Estates (ASX:TWE) | 6.97% | ★★★★★☆ |

| Super Retail Group (ASX:SUL) | 5.89% | ★★★★★☆ |

| Sugar Terminals (NSX:SUG) | 7.90% | ★★★★★☆ |

| Steadfast Group (ASX:SDF) | 3.73% | ★★★★★☆ |

| Smartgroup (ASX:SIQ) | 5.98% | ★★★★★☆ |

| MFF Capital Investments (ASX:MFF) | 3.83% | ★★★★★☆ |

| Lindsay Australia (ASX:LAU) | 5.76% | ★★★★★☆ |

| Kina Securities (ASX:KSL) | 7.91% | ★★★★★☆ |

| Fiducian Group (ASX:FID) | 4.36% | ★★★★★☆ |

| Accent Group (ASX:AX1) | 7.33% | ★★★★★☆ |

Click here to see the full list of 31 stocks from our Top ASX Dividend Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Cash Converters International (ASX:CCV)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Cash Converters International Limited operates in unsecured lending and second-hand retail services across Australia, New Zealand, the United Kingdom, and internationally, with a market cap of A$205.08 million.

Operations: Cash Converters International Limited's revenue is derived from several segments, including New Zealand (A$22.19 million), Vehicle Finance (A$12.02 million), Personal Finance (A$78.53 million), Store Operations (A$157.12 million), and the United Kingdom (A$83.49 million).

Dividend Yield: 6.6%

Cash Converters International offers a dividend yield of 6.56%, placing it in the top quartile of Australian dividend payers. Its dividends are well covered by cash flows with a low payout ratio of 17.7%. However, its dividend history has been volatile over the past decade, reflecting instability despite recent earnings growth and favorable valuation metrics like an 8.4x P/E ratio compared to the market's 21x. Recent equity offerings may impact future dividends and share value dynamics.

- Delve into the full analysis dividend report here for a deeper understanding of Cash Converters International.

- Our expertly prepared valuation report Cash Converters International implies its share price may be lower than expected.

Jumbo Interactive (ASX:JIN)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Jumbo Interactive Limited operates as an online retailer of lottery tickets across Australia, the United Kingdom, Canada, Fiji, and other international markets with a market cap of A$651.38 million.

Operations: Jumbo Interactive Limited generates revenue through its segments of Lottery Retailing (A$108.05 million), Software-As-A-Service (SaaS) (A$44.25 million), and Managed Services (A$26.72 million).

Dividend Yield: 5.3%

Jumbo Interactive's dividend yield of 5.3% is below the top quartile in Australia, with dividends covered by earnings and cash flows at an 85% payout ratio. Despite a decade of increasing payments, its dividend history shows volatility over 20%. Recent debt facility expansion to A$120 million supports acquisitions but may affect future payouts. Trading at a significant discount to estimated fair value, Jumbo's valuation remains attractive despite inconsistent dividend reliability.

- Unlock comprehensive insights into our analysis of Jumbo Interactive stock in this dividend report.

- According our valuation report, there's an indication that Jumbo Interactive's share price might be on the cheaper side.

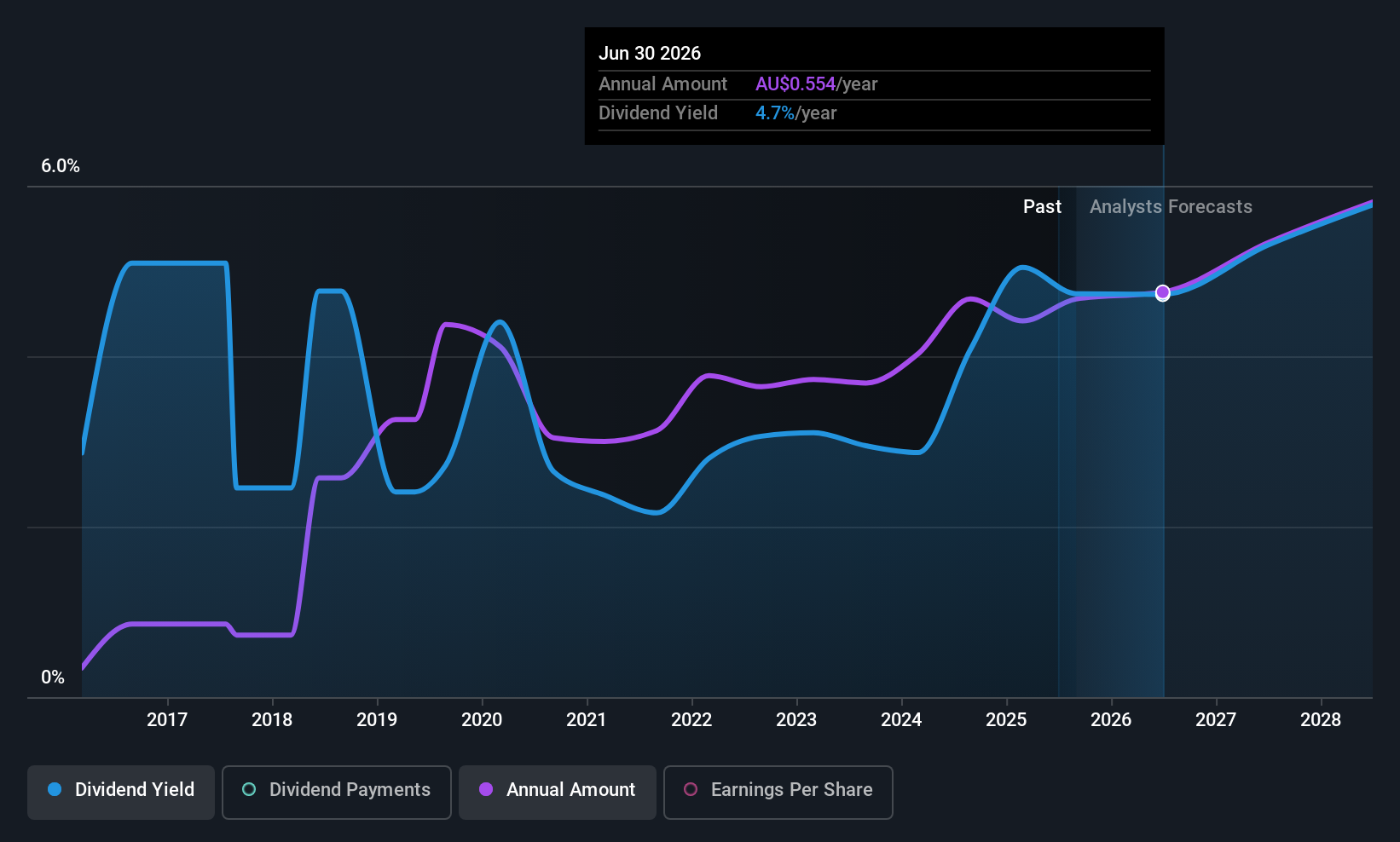

Ricegrowers (ASX:SGLLV)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Ricegrowers Limited is a rice food company operating across Australia, New Zealand, the Pacific Islands, Europe, the Middle East, Africa, Asia, and North America with a market cap of A$1.13 billion.

Operations: Ricegrowers Limited generates revenue from several segments, including Riviana (A$231.14 million), Cop Rice (A$250.64 million), Rice Food (A$132.53 million), Rice Pool (A$481.87 million), Corporate Segment (A$26.93 million), and International Rice (A$860.96 million).

Dividend Yield: 3.9%

Ricegrowers, trading at a 40.3% discount to its estimated fair value, has seen earnings grow 23.4% annually over five years and forecasts a 7.9% growth rate. Despite this, its dividend history is marked by volatility and unreliability over the past decade, with payments sometimes dropping significantly. However, dividends are covered by both earnings (63.2%) and cash flows (60.1%). Its recent inclusion in the S&P/ASX indices may enhance investor interest despite a modest dividend yield of 3.9%.

- Get an in-depth perspective on Ricegrowers' performance by reading our dividend report here.

- In light of our recent valuation report, it seems possible that Ricegrowers is trading behind its estimated value.

Turning Ideas Into Actions

- Delve into our full catalog of 31 Top ASX Dividend Stocks here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:SGLLV

Ricegrowers

Operates as a rice food company in Australia, New Zealand, the Pacific Islands, Europe, the Middle East, Africa, Asia, and North America.

Excellent balance sheet, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success