In a session where the broader Asian markets showed strength, the ASX lagged slightly, with investors awaiting key economic data and geopolitical developments. For those looking beyond well-known names, penny stocks—typically smaller or newer companies—remain an intriguing investment area despite being an older market term. By focusing on financially robust penny stocks, investors can potentially uncover valuable opportunities in lesser-known corners of the market.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Rewards & Risks |

| Alfabs Australia (ASX:AAL) | A$0.475 | A$136.13M | ✅ 4 ⚠️ 3 View Analysis > |

| Dusk Group (ASX:DSK) | A$0.915 | A$56.98M | ✅ 4 ⚠️ 2 View Analysis > |

| IVE Group (ASX:IGL) | A$2.83 | A$434.94M | ✅ 4 ⚠️ 3 View Analysis > |

| MotorCycle Holdings (ASX:MTO) | A$3.75 | A$276.77M | ✅ 4 ⚠️ 2 View Analysis > |

| Pureprofile (ASX:PPL) | A$0.047 | A$54.98M | ✅ 3 ⚠️ 1 View Analysis > |

| Veris (ASX:VRS) | A$0.077 | A$40.56M | ✅ 3 ⚠️ 2 View Analysis > |

| West African Resources (ASX:WAF) | A$3.04 | A$3.47B | ✅ 4 ⚠️ 2 View Analysis > |

| Fleetwood (ASX:FWD) | A$2.96 | A$273.31M | ✅ 3 ⚠️ 2 View Analysis > |

| GWA Group (ASX:GWA) | A$2.47 | A$649.44M | ✅ 5 ⚠️ 1 View Analysis > |

| Clover (ASX:CLV) | A$0.63 | A$105.21M | ✅ 3 ⚠️ 2 View Analysis > |

Click here to see the full list of 420 stocks from our ASX Penny Stocks screener.

We'll examine a selection from our screener results.

Appen (ASX:APX)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Appen Limited is an AI lifecycle company offering data sourcing, data annotation, and model evaluation solutions across Australia, the United States, and globally, with a market cap of A$223.11 million.

Operations: Appen generates revenue through its Corporate segment ($1.24 billion), New Markets ($126.84 million), and Global Services ($96.93 million).

Market Cap: A$223.11M

Appen Limited, with a market cap of A$223.11 million, is navigating challenges as it remains unprofitable and reported a net loss of US$19.26 million for the first half of 2025. Despite this, the company has no debt and holds sufficient cash to cover its liabilities, providing a runway for more than three years based on current free cash flow. Trading at good value relative to peers and industry estimates, Appen's stock price is significantly below its perceived fair value. The company's earnings are forecasted to grow substantially per year, though past losses have increased annually by 33.5%.

- Dive into the specifics of Appen here with our thorough balance sheet health report.

- Gain insights into Appen's future direction by reviewing our growth report.

Maggie Beer Holdings (ASX:MBH)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Maggie Beer Holdings Limited is a company that manufactures and sells food, beverage, and gifting products both in Australia and internationally, with a market cap of A$34.36 million.

Operations: The company's revenue is derived from its Maggie Beer Products segment, generating A$33.52 million, and the Hampers & Gifts Australia segment, contributing A$44.74 million.

Market Cap: A$34.36M

Maggie Beer Holdings Limited, with a market cap of A$34.36 million, recently completed a follow-on equity offering raising A$2.98 million, enhancing its financial position. Despite being debt-free and having short-term assets exceeding liabilities, the company remains unprofitable with a net loss of A$24.3 million for the year ended June 30, 2025. While revenue increased to A$76.32 million from the previous year, earnings have declined significantly over five years by an average of 44.9% annually. The management team is relatively new with an average tenure of 0.7 years and faces challenges in stabilizing profitability amidst industry volatility.

- Unlock comprehensive insights into our analysis of Maggie Beer Holdings stock in this financial health report.

- Learn about Maggie Beer Holdings' historical performance here.

Rubicon Water (ASX:RWL)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Rubicon Water Limited specializes in designing, manufacturing, installing, and maintaining irrigation automation software and hardware across Australia, New Zealand, Asia, and other international markets with a market cap of A$57.77 million.

Operations: The company generates revenue of A$69.07 million from its Industrial Automation & Controls segment.

Market Cap: A$57.77M

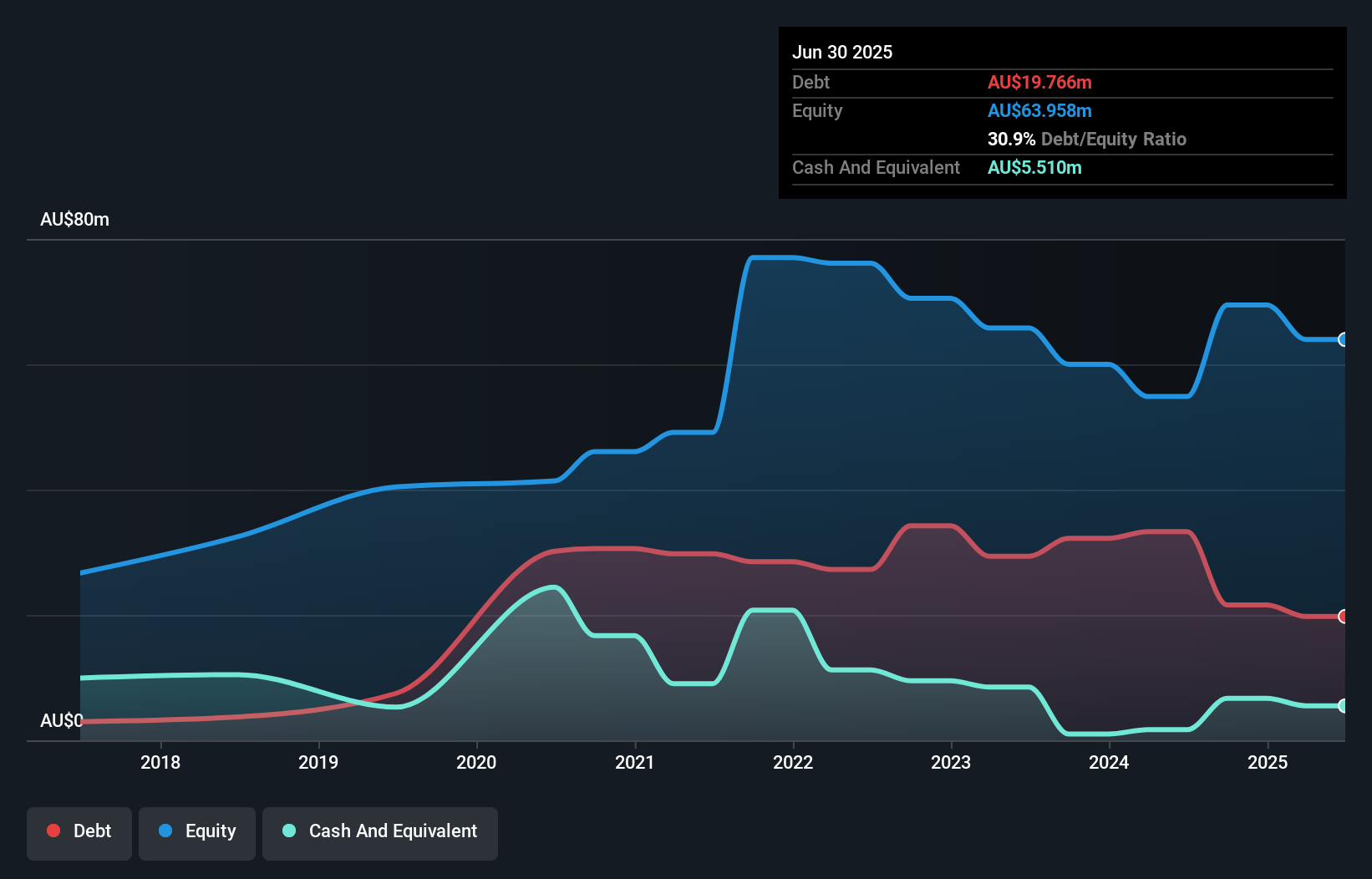

Rubicon Water Limited, with a market cap of A$57.77 million, reported revenue growth to A$69.07 million for the year ending June 30, 2025, while narrowing its net loss to A$6.79 million from A$10.71 million the previous year. Despite being unprofitable and having a negative return on equity of -10.93%, Rubicon's financial health is supported by a satisfactory net debt to equity ratio of 22.3% and sufficient cash runway exceeding three years due to positive free cash flow growth. The company's experienced management team and board further bolster its stability amidst share price volatility in recent months.

- Click here and access our complete financial health analysis report to understand the dynamics of Rubicon Water.

- Gain insights into Rubicon Water's past trends and performance with our report on the company's historical track record.

Taking Advantage

- Take a closer look at our ASX Penny Stocks list of 420 companies by clicking here.

- Ready To Venture Into Other Investment Styles? We've found 19 US stocks that are forecast to pay a dividend yeild of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:APX

Appen

Operates as an AI lifecycle company that provides data sourcing, data annotation, and model evaluation solutions in Australia, the United States, and internationally.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives