Such Is Life: How Costa Group Holdings (ASX:CGC) Shareholders Saw Their Shares Drop 57%

The nature of investing is that you win some, and you lose some. And unfortunately for Costa Group Holdings Limited (ASX:CGC) shareholders, the stock is a lot lower today than it was a year ago. To wit the share price is down 57% in that time. At least the damage isn't so bad if you look at the last three years, since the stock is down 3.6% in that time. Shareholders have had an even rougher run lately, with the share price down 28% in the last 90 days.

View our latest analysis for Costa Group Holdings

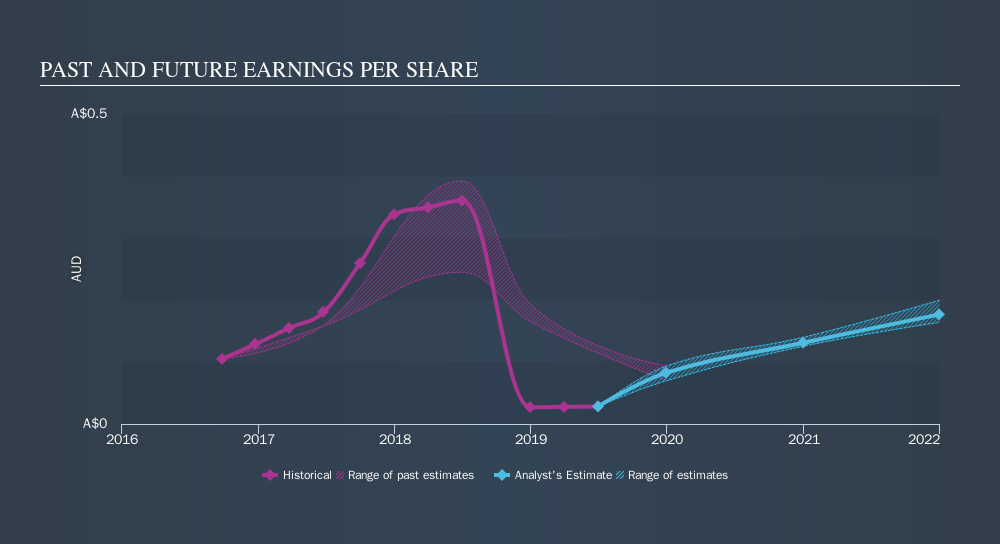

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

Unhappily, Costa Group Holdings had to report a 92% decline in EPS over the last year. This fall in the EPS is significantly worse than the 57% the share price fall. So despite the weak per-share profits, some investors are probably relieved the situation wasn't more difficult. With a P/E ratio of 95.45, it's fair to say the market sees an EPS rebound on the cards.

The graphic below depicts how EPS has changed over time.

It's good to see that there was some significant insider buying in the last three months. That's a positive. That said, we think earnings and revenue growth trends are even more important factors to consider. Dive deeper into the earnings by checking this interactive graph of Costa Group Holdings's earnings, revenue and cash flow.

What About Dividends?

When looking at investment returns, it is important to consider the difference between total shareholder return (TSR) and share price return. Whereas the share price return only reflects the change in the share price, the TSR includes the value of dividends (assuming they were reinvested) and the benefit of any discounted capital raising or spin-off. Arguably, the TSR gives a more comprehensive picture of the return generated by a stock. In the case of Costa Group Holdings, it has a TSR of -54% for the last year. That exceeds its share price return that we previously mentioned. This is largely a result of its dividend payments!

A Different Perspective

Over the last year, Costa Group Holdings shareholders took a loss of 54% , including dividends . In contrast the market gained about 19%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Fortunately the longer term story is brighter, with total returns averaging about 2.2% per year over three years. The recent sell-off could be an opportunity if the business remains sound, so it may be worth checking the fundamental data for signs of a long-term growth trend. It is all well and good that insiders have been buying shares, but we suggest you check here to see what price insiders were buying at.

There are plenty of other companies that have insiders buying up shares. You probably do not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on AU exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About ASX:CGC

Costa Group Holdings

Costa Group Holdings Limited produces, packs, and markets fruits and vegetables to food retailers.

Reasonable growth potential with imperfect balance sheet.

Market Insights

Community Narratives