Investors Appear Satisfied With Bubs Australia Limited's (ASX:BUB) Prospects As Shares Rocket 36%

The Bubs Australia Limited (ASX:BUB) share price has done very well over the last month, posting an excellent gain of 36%. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 28% over that time.

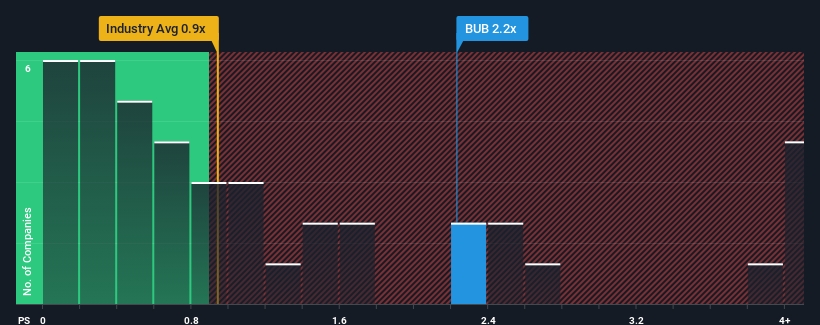

Since its price has surged higher, you could be forgiven for thinking Bubs Australia is a stock not worth researching with a price-to-sales ratios (or "P/S") of 2.2x, considering almost half the companies in Australia's Food industry have P/S ratios below 0.9x. However, the P/S might be high for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for Bubs Australia

How Has Bubs Australia Performed Recently?

Bubs Australia hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. One possibility is that the P/S ratio is high because investors think this poor revenue performance will turn the corner. If not, then existing shareholders may be extremely nervous about the viability of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Bubs Australia will help you uncover what's on the horizon.Do Revenue Forecasts Match The High P/S Ratio?

Bubs Australia's P/S ratio would be typical for a company that's expected to deliver solid growth, and importantly, perform better than the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 22%. However, a few very strong years before that means that it was still able to grow revenue by an impressive 48% in total over the last three years. Accordingly, while they would have preferred to keep the run going, shareholders would definitely welcome the medium-term rates of revenue growth.

Turning to the outlook, the next year should generate growth of 30% as estimated by the three analysts watching the company. Meanwhile, the rest of the industry is forecast to only expand by 8.9%, which is noticeably less attractive.

With this in mind, it's not hard to understand why Bubs Australia's P/S is high relative to its industry peers. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Bottom Line On Bubs Australia's P/S

Bubs Australia's P/S is on the rise since its shares have risen strongly. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

As we suspected, our examination of Bubs Australia's analyst forecasts revealed that its superior revenue outlook is contributing to its high P/S. At this stage investors feel the potential for a deterioration in revenues is quite remote, justifying the elevated P/S ratio. It's hard to see the share price falling strongly in the near future under these circumstances.

Don't forget that there may be other risks. For instance, we've identified 4 warning signs for Bubs Australia that you should be aware of.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Valuation is complex, but we're here to simplify it.

Discover if Bubs Australia might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:BUB

Bubs Australia

Engages in the manufacture and sale of various infant nutrition and wellbeing products in Australia, China, the United States, and internationally.

Good value with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives