Bubs Australia Limited (ASX:BUB) Looks Just Right With A 33% Price Jump

Bubs Australia Limited (ASX:BUB) shareholders have had their patience rewarded with a 33% share price jump in the last month. Taking a wider view, although not as strong as the last month, the full year gain of 14% is also fairly reasonable.

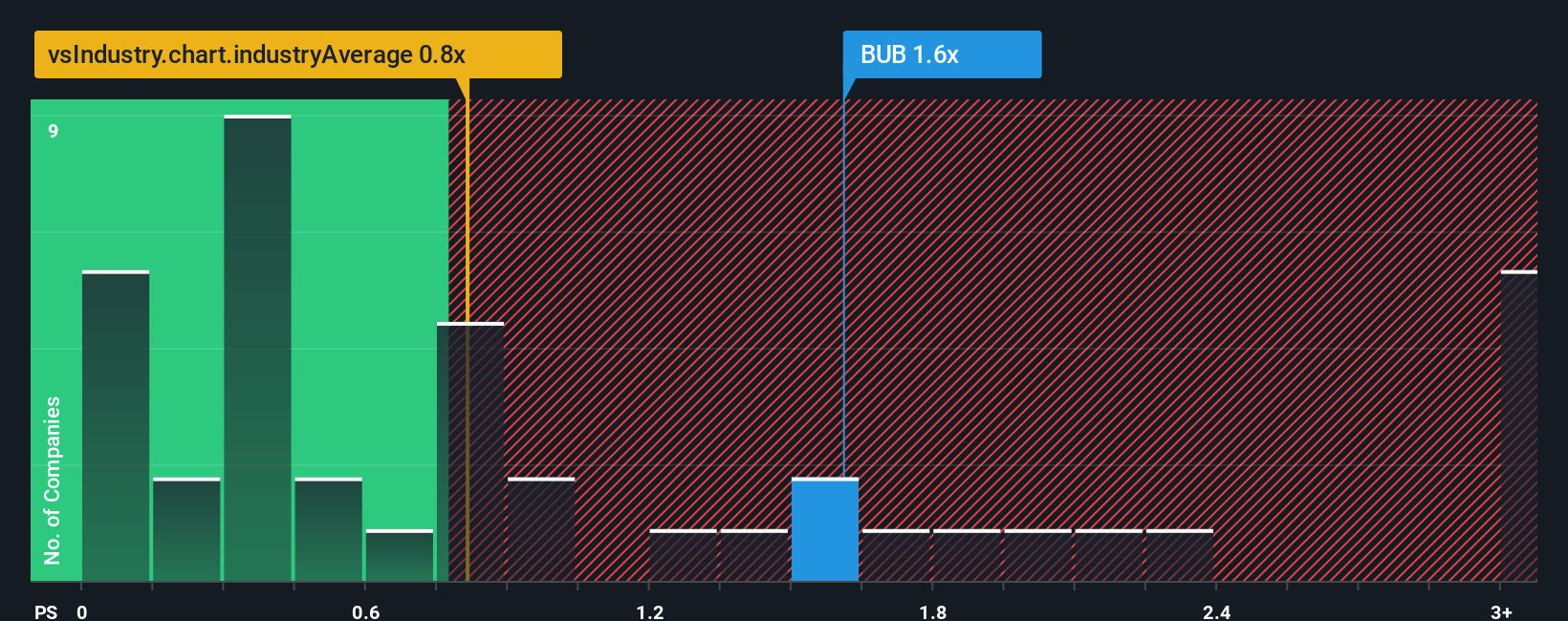

After such a large jump in price, you could be forgiven for thinking Bubs Australia is a stock not worth researching with a price-to-sales ratios (or "P/S") of 1.6x, considering almost half the companies in Australia's Food industry have P/S ratios below 0.8x. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/S.

Check out our latest analysis for Bubs Australia

What Does Bubs Australia's P/S Mean For Shareholders?

Recent times haven't been great for Bubs Australia as its revenue has been rising slower than most other companies. It might be that many expect the uninspiring revenue performance to recover significantly, which has kept the P/S ratio from collapsing. However, if this isn't the case, investors might get caught out paying too much for the stock.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Bubs Australia.Is There Enough Revenue Growth Forecasted For Bubs Australia?

Bubs Australia's P/S ratio would be typical for a company that's expected to deliver solid growth, and importantly, perform better than the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 31%. Pleasingly, revenue has also lifted 63% in aggregate from three years ago, thanks to the last 12 months of growth. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Looking ahead now, revenue is anticipated to climb by 27% during the coming year according to the dual analysts following the company. With the industry only predicted to deliver 13%, the company is positioned for a stronger revenue result.

With this information, we can see why Bubs Australia is trading at such a high P/S compared to the industry. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Final Word

The large bounce in Bubs Australia's shares has lifted the company's P/S handsomely. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Our look into Bubs Australia shows that its P/S ratio remains high on the merit of its strong future revenues. It appears that shareholders are confident in the company's future revenues, which is propping up the P/S. Unless the analysts have really missed the mark, these strong revenue forecasts should keep the share price buoyant.

There are also other vital risk factors to consider before investing and we've discovered 1 warning sign for Bubs Australia that you should be aware of.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're here to simplify it.

Discover if Bubs Australia might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:BUB

Bubs Australia

Manufactures and sell infant and adult chilled and powdered goat dairy products in Australia, China, the United States, and internationally.

Flawless balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives