Should You Be Adding Australian Vintage (ASX:AVG) To Your Watchlist Today?

Like a puppy chasing its tail, some new investors often chase 'the next big thing', even if that means buying 'story stocks' without revenue, let alone profit. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses.

So if you're like me, you might be more interested in profitable, growing companies, like Australian Vintage (ASX:AVG). Now, I'm not saying that the stock is necessarily undervalued today; but I can't shake an appreciation for the profitability of the business itself. Loss-making companies are always racing against time to reach financial sustainability, but time is often a friend of the profitable company, especially if it is growing.

Check out our latest analysis for Australian Vintage

Australian Vintage's Earnings Per Share Are Growing.

The market is a voting machine in the short term, but a weighing machine in the long term, so share price follows earnings per share (EPS) eventually. That means EPS growth is considered a real positive by most successful long-term investors. It certainly is nice to see that Australian Vintage has managed to grow EPS by 30% per year over three years. If the company can sustain that sort of growth, we'd expect shareholders to come away winners.

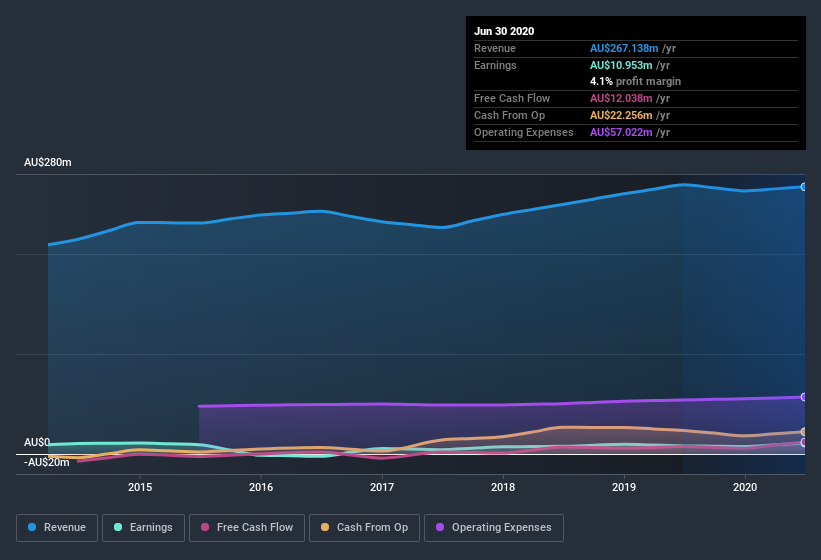

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. Australian Vintage reported flat revenue and EBIT margins over the last year. That's not a major concern but nor does it point to the long term growth we like to see.

The chart below shows how the company's bottom and top lines have progressed over time. To see the actual numbers, click on the chart.

In investing, as in life, the future matters more than the past. So why not check out this free interactive visualization of Australian Vintage's forecast profits?

Are Australian Vintage Insiders Aligned With All Shareholders?

Like standing at the lookout, surveying the horizon at sunrise, insider buying, for some investors, sparks joy. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

Over the last 12 months Australian Vintage insiders spent AU$216k more buying shares than they received from selling them. On balance, that's a good sign. It is also worth noting that it was Non-Independent Non-Executive Director Jiang Yuan who made the biggest single purchase, worth AU$307k, paying AU$0.61 per share.

The good news, alongside the insider buying, for Australian Vintage bulls is that insiders (collectively) have a meaningful investment in the stock. Indeed, they hold AU$27m worth of its stock. That's a lot of money, and no small incentive to work hard. That amounts to 17% of the company, demonstrating a degree of high-level alignment with shareholders.

Should You Add Australian Vintage To Your Watchlist?

You can't deny that Australian Vintage has grown its earnings per share at a very impressive rate. That's attractive. On top of that, insiders own a significant stake in the company and have been buying more shares. So I do think this is one stock worth watching. Even so, be aware that Australian Vintage is showing 2 warning signs in our investment analysis , you should know about...

The good news is that Australian Vintage is not the only growth stock with insider buying. Here's a list of them... with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

If you decide to trade Australian Vintage, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About ASX:AVG

Australian Vintage

Produces, packages, markets, and distributes wine in Australia, New Zealand, the United Kingdom, Europe, North America, Asia, and internationally.

Undervalued with moderate growth potential.

Similar Companies

Market Insights

Community Narratives