Australian Vintage Ltd's (ASX:AVG) 54% Dip In Price Shows Sentiment Is Matching Revenues

The Australian Vintage Ltd (ASX:AVG) share price has fared very poorly over the last month, falling by a substantial 54%. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 60% loss during that time.

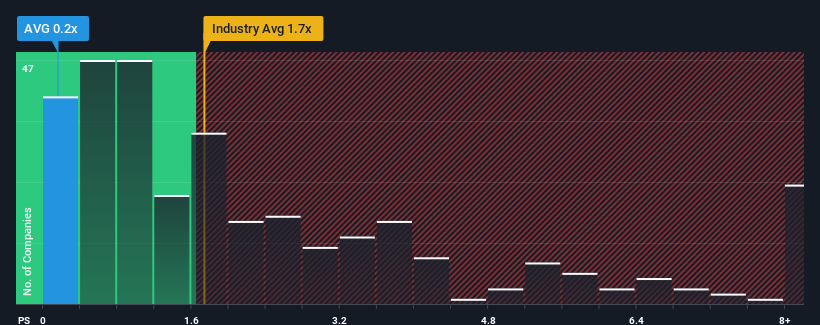

Since its price has dipped substantially, Australian Vintage's price-to-sales (or "P/S") ratio of 0.2x might make it look like a buy right now compared to the Beverage industry in Australia, where around half of the companies have P/S ratios above 0.9x and even P/S above 4x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

View our latest analysis for Australian Vintage

How Has Australian Vintage Performed Recently?

Australian Vintage's negative revenue growth of late has neither been better nor worse than most other companies. One possibility is that the P/S ratio is low because investors think the company's revenue may begin to slide even faster. You'd much rather the company continue improving its revenue if you still believe in the business. At the very least, you'd be hoping that revenue doesn't fall off a cliff if your plan is to pick up some stock while it's out of favour.

Want the full picture on analyst estimates for the company? Then our free report on Australian Vintage will help you uncover what's on the horizon.What Are Revenue Growth Metrics Telling Us About The Low P/S?

In order to justify its P/S ratio, Australian Vintage would need to produce sluggish growth that's trailing the industry.

Retrospectively, the last year delivered virtually the same number to the company's top line as the year before. This isn't what shareholders were looking for as it means they've been left with a 7.3% decline in revenue over the last three years in total. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Turning to the outlook, the next year should generate growth of 1.1% as estimated by the dual analysts watching the company. With the industry predicted to deliver 17% growth, the company is positioned for a weaker revenue result.

In light of this, it's understandable that Australian Vintage's P/S sits below the majority of other companies. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

What Does Australian Vintage's P/S Mean For Investors?

The southerly movements of Australian Vintage's shares means its P/S is now sitting at a pretty low level. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

As we suspected, our examination of Australian Vintage's analyst forecasts revealed that its inferior revenue outlook is contributing to its low P/S. Shareholders' pessimism on the revenue prospects for the company seems to be the main contributor to the depressed P/S. It's hard to see the share price rising strongly in the near future under these circumstances.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 2 warning signs with Australian Vintage, and understanding these should be part of your investment process.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:AVG

Australian Vintage

Produces, packages, markets, and distributes wine in Australia, New Zealand, the United Kingdom, Europe, North America, Asia, and internationally.

Undervalued with moderate growth potential.

Similar Companies

Market Insights

Community Narratives