Here's Why Australian Agricultural Projects (ASX:AAP) Is Weighed Down By Its Debt Load

Warren Buffett famously said, 'Volatility is far from synonymous with risk.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. We note that Australian Agricultural Projects Ltd (ASX:AAP) does have debt on its balance sheet. But is this debt a concern to shareholders?

What Risk Does Debt Bring?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. When we think about a company's use of debt, we first look at cash and debt together.

See our latest analysis for Australian Agricultural Projects

How Much Debt Does Australian Agricultural Projects Carry?

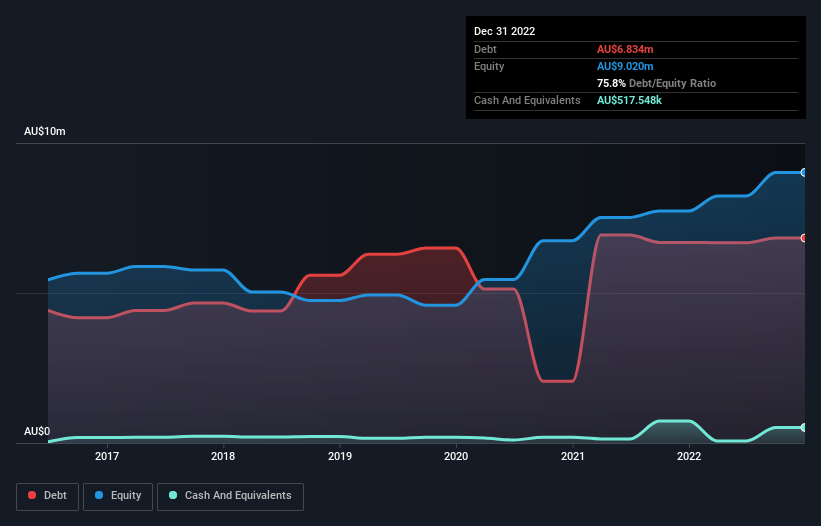

The chart below, which you can click on for greater detail, shows that Australian Agricultural Projects had AU$6.83m in debt in December 2022; about the same as the year before. On the flip side, it has AU$517.5k in cash leading to net debt of about AU$6.32m.

How Healthy Is Australian Agricultural Projects' Balance Sheet?

According to the last reported balance sheet, Australian Agricultural Projects had liabilities of AU$3.62m due within 12 months, and liabilities of AU$6.36m due beyond 12 months. Offsetting this, it had AU$517.5k in cash and AU$2.24m in receivables that were due within 12 months. So its liabilities outweigh the sum of its cash and (near-term) receivables by AU$7.23m.

The deficiency here weighs heavily on the AU$4.27m company itself, as if a child were struggling under the weight of an enormous back-pack full of books, his sports gear, and a trumpet. So we'd watch its balance sheet closely, without a doubt. After all, Australian Agricultural Projects would likely require a major re-capitalisation if it had to pay its creditors today.

We use two main ratios to inform us about debt levels relative to earnings. The first is net debt divided by earnings before interest, tax, depreciation, and amortization (EBITDA), while the second is how many times its earnings before interest and tax (EBIT) covers its interest expense (or its interest cover, for short). This way, we consider both the absolute quantum of the debt, as well as the interest rates paid on it.

Weak interest cover of 0.14 times and a disturbingly high net debt to EBITDA ratio of 9.4 hit our confidence in Australian Agricultural Projects like a one-two punch to the gut. The debt burden here is substantial. Even worse, Australian Agricultural Projects saw its EBIT tank 88% over the last 12 months. If earnings continue to follow that trajectory, paying off that debt load will be harder than convincing us to run a marathon in the rain. When analysing debt levels, the balance sheet is the obvious place to start. But you can't view debt in total isolation; since Australian Agricultural Projects will need earnings to service that debt. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

Finally, a business needs free cash flow to pay off debt; accounting profits just don't cut it. So we always check how much of that EBIT is translated into free cash flow. During the last two years, Australian Agricultural Projects burned a lot of cash. While that may be a result of expenditure for growth, it does make the debt far more risky.

Our View

On the face of it, Australian Agricultural Projects's EBIT growth rate left us tentative about the stock, and its level of total liabilities was no more enticing than the one empty restaurant on the busiest night of the year. And even its interest cover fails to inspire much confidence. Considering everything we've mentioned above, it's fair to say that Australian Agricultural Projects is carrying heavy debt load. If you play with fire you risk getting burnt, so we'd probably give this stock a wide berth. There's no doubt that we learn most about debt from the balance sheet. But ultimately, every company can contain risks that exist outside of the balance sheet. To that end, you should learn about the 6 warning signs we've spotted with Australian Agricultural Projects (including 3 which shouldn't be ignored) .

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:AAP

Australian Agricultural Projects

Operates and manages olive groves in Australia.

Excellent balance sheet and good value.

Market Insights

Community Narratives