Do Australian Agricultural Projects' (ASX:AAP) Earnings Warrant Your Attention?

It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' Loss-making companies are always racing against time to reach financial sustainability, so investors in these companies may be taking on more risk than they should.

If this kind of company isn't your style, you like companies that generate revenue, and even earn profits, then you may well be interested in Australian Agricultural Projects (ASX:AAP). While this doesn't necessarily speak to whether it's undervalued, the profitability of the business is enough to warrant some appreciation - especially if its growing.

Check out our latest analysis for Australian Agricultural Projects

Australian Agricultural Projects' Improving Profits

Even with very modest growth rates, a company will usually do well if it improves earnings per share (EPS) year after year. So it's no surprise that some investors are more inclined to invest in profitable businesses. Commendations have to be given in seeing that Australian Agricultural Projects grew its EPS from AU$0.000079 to AU$0.0004, in one short year. While it's difficult to sustain growth at that level, it bodes well for the company's outlook for the future.

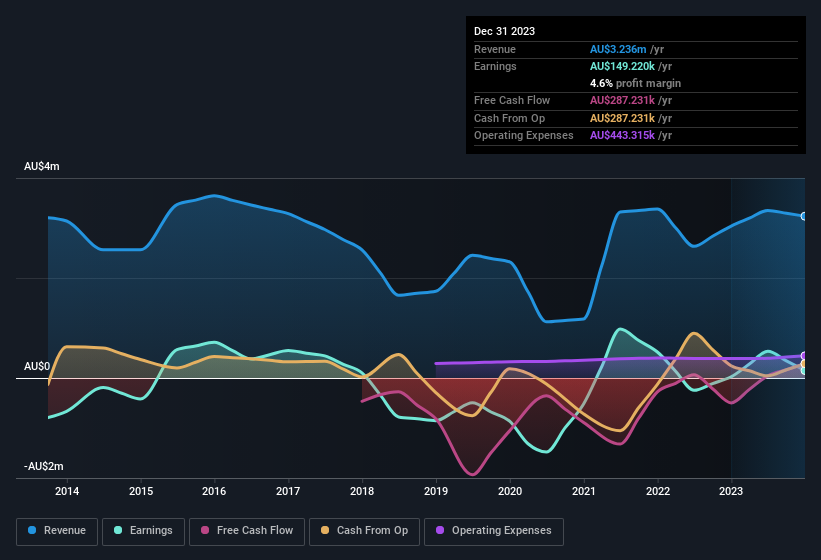

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. EBIT margins for Australian Agricultural Projects remained fairly unchanged over the last year, however the company should be pleased to report its revenue growth for the period of 6.5% to AU$3.2m. That's progress.

In the chart below, you can see how the company has grown earnings and revenue, over time. Click on the chart to see the exact numbers.

Since Australian Agricultural Projects is no giant, with a market capitalisation of AU$13m, you should definitely check its cash and debt before getting too excited about its prospects.

Are Australian Agricultural Projects Insiders Aligned With All Shareholders?

Investors are always searching for a vote of confidence in the companies they hold and insider buying is one of the key indicators for optimism on the market. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

Not only did Australian Agricultural Projects insiders refrain from selling stock during the year, but they also spent AU$77k buying it. That paints the company in a nice light, as it signals that its leaders are feeling confident in where the company is heading. Zooming in, we can see that the biggest insider purchase was by Non Executive Director Daniel Stefanetti for AU$49k worth of shares, at about AU$0.015 per share.

On top of the insider buying, we can also see that Australian Agricultural Projects insiders own a large chunk of the company. To be exact, company insiders hold 52% of the company, so their decisions have a significant impact on their investments. Intuition will tell you this is a good sign because it suggests they will be incentivised to build value for shareholders over the long term. Valued at only AU$13m Australian Agricultural Projects is really small for a listed company. So despite a large proportional holding, insiders only have AU$6.5m worth of stock. That's not a huge stake in absolute terms, but it should help keep insiders aligned with other shareholders.

While insiders are apparently happy to hold and accumulate shares, that is just part of the big picture. That's because Australian Agricultural Projects' CEO, Paul Challis, is paid at a relatively modest level when compared to other CEOs for companies of this size. For companies with market capitalisations under AU$301m, like Australian Agricultural Projects, the median CEO pay is around AU$446k.

The Australian Agricultural Projects CEO received total compensation of just AU$158k in the year to June 2023. First impressions seem to indicate a compensation policy that is favourable to shareholders. While the level of CEO compensation shouldn't be the biggest factor in how the company is viewed, modest remuneration is a positive, because it suggests that the board keeps shareholder interests in mind. It can also be a sign of good governance, more generally.

Should You Add Australian Agricultural Projects To Your Watchlist?

Australian Agricultural Projects' earnings per share growth have been climbing higher at an appreciable rate. Just as heartening; insiders both own and are buying more stock. These factors seem to indicate the company's potential and that it has reached an inflection point. We'd suggest Australian Agricultural Projects belongs near the top of your watchlist. We should say that we've discovered 5 warning signs for Australian Agricultural Projects (2 are a bit unpleasant!) that you should be aware of before investing here.

Keen growth investors love to see insider activity. Thankfully, Australian Agricultural Projects isn't the only one. You can see a a curated list of Australian companies which have exhibited consistent growth accompanied by high insider ownership.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:AAP

Australian Agricultural Projects

Operates and manages olive groves in Boort, Victoria.

Good value with proven track record.

Market Insights

Community Narratives