- Australia

- /

- Oil and Gas

- /

- ASX:WDS

Woodside Energy Group (ASX:WDS) Maintains Production Guidance, Declares Strong Interim Dividend

Reviewed by Simply Wall St

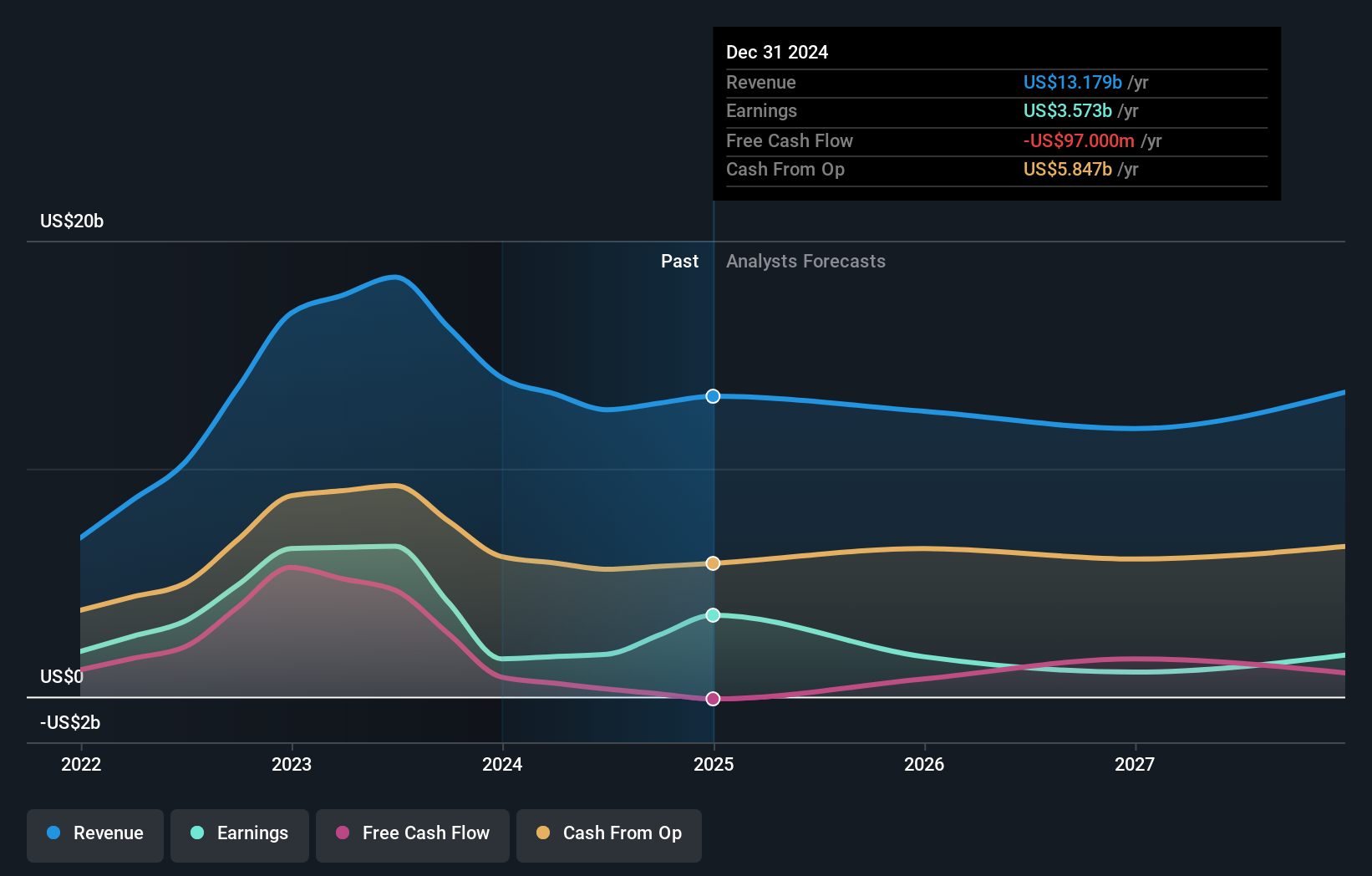

Woodside Energy Group (ASX:WDS) is navigating a complex environment characterized by both significant achievements and pressing challenges. Recent developments include a robust net profit after tax of $1.9 billion and a 6% reduction in unit production costs, contrasted with a 71.9% decline in earnings over the past year and high tax payments. In the discussion that follows, we will explore Woodside's core advantages, critical issues, strategic opportunities, and key risks to provide a comprehensive overview of the company's current business situation.

Strengths: Core Advantages Driving Sustained Success For Woodside Energy Group

Woodside Energy Group has demonstrated robust financial performance, with CEO Meg O'Neill reporting a net profit after tax of $1.9 billion, translating into strong earnings per share and a healthy interim dividend. The company's disciplined cost management approach has also resulted in a 6% reduction in unit production costs despite an inflationary environment. High operational reliability is another key strength, with LNG reliability at 98% and production exceeding 89 million barrels of oil equivalent, keeping the company on track to meet its full-year production guidance. Additionally, Woodside's commitment to safety remains a top priority, ensuring the well-being of its workforce. The company has also achieved positive free cash flow of $740 million, even in a year with heavy capital investment and significant tax payments, as highlighted by CFO Graham Tiver in the latest earnings call.

The company's current share price is significantly below the estimated fair value of A$60.33, suggesting it may be undervalued. However, it is considered expensive compared to industry and peer Price-To-Earnings ratios (16.8x vs. industry average of 9.8x and peer average of 8.3x).

Weaknesses: Critical Issues Affecting Woodside Energy Group's Performance and Areas For Growth

Despite its strengths, Woodside faces several critical issues. The company's overall safety performance is not yet meeting expectations, as acknowledged by CEO Meg O'Neill. Additionally, market challenges persist, particularly in the Asia Pacific region, which accounts for over 80% of global coal use. High tax payments, amounting to AUD 2.7 billion in the first half, also pose a financial strain. The company's earnings have shown negative growth over the past year, with a 71.9% decline, making it difficult to compare to the Oil and Gas industry average of -40.9%. Furthermore, Woodside's current net profit margins have decreased to 14.8% from 35.8% last year, indicating a potential area for improvement.

Opportunities: Potential Strategies for Leveraging Growth and Competitive Advantage

Woodside Energy Group has several strategic opportunities to enhance its market position. The proposed acquisition of Tellurian and its Driftwood LNG development positions Woodside as a leading independent LNG player, as highlighted by CEO Meg O'Neill. The acquisition of OCI's Clean Ammonia Project is another significant step towards achieving the company's Scope 3 investments and abatement targets. Additionally, the growing demand for reliable, affordable, and increasingly lower carbon energy presents a substantial opportunity for Woodside. The company also sees a clear and sustained opportunity for coal to gas switching in key markets as they navigate the energy transition.

Threats: Key Risks and Challenges That Could Impact Woodside Energy Group's Success

Woodside faces several external threats that could impact its growth and market share. Regulatory risks are a significant concern, particularly with potential renegotiation of contracts with the Senegalese government. Market competition remains intense, with new supply coming online, as noted by CEO Meg O'Neill. Economic factors also pose a threat, with CFO Graham Tiver indicating that the company's gearing may exceed the top of its range for a period of time, suggesting potential financial strain during economic fluctuations. Additionally, the company's earnings are forecast to decline by an average of 1.8% per year over the next three years, which could further impact its competitive positioning.

Conclusion

Woodside Energy Group's strong financial performance, disciplined cost management, and high operational reliability underscore its potential for sustained success. However, challenges such as unmet safety expectations, high tax payments, and declining net profit margins highlight areas requiring attention. Strategic opportunities like the acquisition of Tellurian and OCI's Clean Ammonia Project could position Woodside favorably in the evolving energy market. Despite its share price being significantly below the estimated fair value of A$60.33, the company's higher Price-To-Earnings ratio compared to industry peers suggests a cautious approach for investors. Balancing these strengths and weaknesses will be crucial for Woodside's future performance and competitive positioning.

Next Steps

- Are you invested in Woodside Energy Group already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St , where we make it simple for investors like you to stay informed and proactive.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management .

- Find companies with promising cash flow potential yet trading below their fair value .

Valuation is complex, but we're here to simplify it.

Discover if Woodside Energy Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Simply Wall St and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

About ASX:WDS

Woodside Energy Group

Engages in the exploration, evaluation, development, production, marketing, and sale of hydrocarbons in the Asia Pacific, Africa, the Americas, and the Europe.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives