- Australia

- /

- Oil and Gas

- /

- ASX:VEA

Viva Energy Group (ASX:VEA) Is Paying Out Less In Dividends Than Last Year

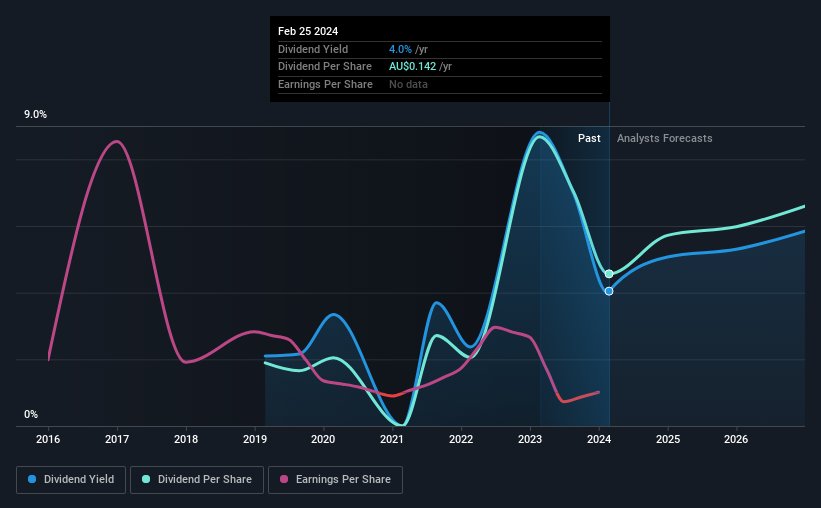

Viva Energy Group Limited (ASX:VEA) has announced that on 22nd of March, it will be paying a dividend ofA$0.071, which a reduction from last year's comparable dividend. This payment takes the dividend yield to 4.0%, which only provides a modest boost to overall returns.

Check out our latest analysis for Viva Energy Group

Viva Energy Group Is Paying Out More Than It Is Earning

If it is predictable over a long period, even low dividend yields can be attractive. Before making this announcement, the company's dividend was much higher than its earnings. Without profits and cash flows increasing, it would be difficult for the company to continue paying the dividend at this level.

Over the next year, EPS is forecast to grow rapidly. If the dividend continues along recent trends, we estimate the payout ratio could reach 104%, which is unsustainable.

Viva Energy Group's Dividend Has Lacked Consistency

Looking back, Viva Energy Group's dividend hasn't been particularly consistent. This makes us cautious about the consistency of the dividend over a full economic cycle. The annual payment during the last 5 years was A$0.0589 in 2019, and the most recent fiscal year payment was A$0.142. This means that it has been growing its distributions at 19% per annum over that time. Dividends have grown rapidly over this time, but with cuts in the past we are not certain that this stock will be a reliable source of income in the future.

Dividend Growth Potential Is Shaky

With a relatively unstable dividend, it's even more important to see if earnings per share is growing. Earnings per share has been sinking by 63% over the last five years. This steep decline can indicate that the business is going through a tough time, which could constrain its ability to pay a larger dividend each year in the future. Over the next year, however, earnings are actually predicted to rise, but we would still be cautious until a track record of earnings growth can be built.

Viva Energy Group's Dividend Doesn't Look Great

In summary, it's not great to see that the dividend is being cut, but it is probably understandable given that the current payment level was quite high. The company isn't making enough to be paying as much as it is, and the other factors don't look particularly promising either. Overall, this doesn't get us very excited from an income standpoint.

Companies possessing a stable dividend policy will likely enjoy greater investor interest than those suffering from a more inconsistent approach. However, there are other things to consider for investors when analysing stock performance. For example, we've identified 2 warning signs for Viva Energy Group (1 is a bit concerning!) that you should be aware of before investing. Is Viva Energy Group not quite the opportunity you were looking for? Why not check out our selection of top dividend stocks.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:VEA

Viva Energy Group

Operates as an energy company in Australia, Singapore, and Papua New Guinea.

Undervalued with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Staggered by dilution; positions for growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026