- Australia

- /

- Oil and Gas

- /

- ASX:STO

Santos (ASX:STO) Appoints New CFO Sherry Duhe, Reports Strong Dividend and Project Advancements

Reviewed by Simply Wall St

Click here to discover the nuances of Santos with our detailed analytical report.

Strengths: Core Advantages Driving Sustained Success For Santos

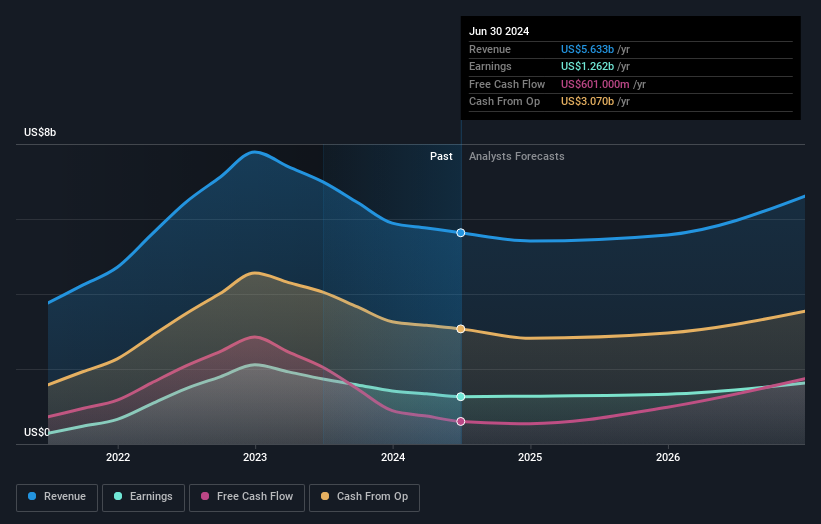

Santos has demonstrated robust financial performance, with Managing Director and Chief Executive Officer Kevin Gallagher highlighting their disciplined operating model. For the first half of 2024, the company reported production of 44 million barrels of oil equivalent, generating sales revenue of $2.7 billion, free cash flow from operations of $1.1 billion, and an underlying profit of $654 million. Additionally, Santos continues to generate strong cash flow from operations, which supports its shareholder returns, including an interim dividend of $422 million or USD 0.13 per share. The company is trading at 62.3% below its estimated fair value of A$18.8. Moreover, the Moomba CCS project is in advanced commissioning stages, and the Barossa project is nearing 80% completion with first gas expected in the third quarter of 2025, showcasing significant project advancements.

Weaknesses: Critical Issues Affecting Santos's Performance and Areas For Growth

Despite its strong financial performance, Santos faces several challenges. The company is considered expensive based on its Price-To-Earnings Ratio of 12.4x compared to the Australian Oil and Gas industry average of 9.6x and the peer average of 8.7x. Production costs have increased due to extreme weather events, leading to higher maintenance costs, as noted by Chief Financial Officer Anthea McKinnell. Additionally, Santos's current net profit margins of 22.4% are lower than last year's 24.8%, and its earnings growth has been negative over the past year, with a decline of 27.3%. The market has also focused on these higher operating costs, which have impacted the company's overall performance.

Opportunities: Potential Strategies for Leveraging Growth and Competitive Advantage

Santos has several opportunities for growth and competitive advantage. The Phase 1 of the Pikka project is almost 60% complete, with first oil expected in the first half of 2026, and the company becomes more cash flow accretive as these projects come online. Strategic initiatives across the business aim to drive down costs, enhancing profitability. Additionally, the demand for gas is expected to remain strong and potentially grow until 2050 and beyond, providing a stable market for Santos's products. The company's revenue is forecast to grow at 7.9% per year, faster than the Australian market's 5.4% per year, positioning Santos well for future growth.

Threats: Key Risks and Challenges That Could Impact Santos's Success

Santos faces several threats that could impact its success. There are risks of production decline, particularly with concerns about the sustainability of the Hides field's output towards the end of the decade. Market and regulatory challenges also pose significant risks, with the company not proceeding with final investment decisions until regulatory certainty is achieved. Additionally, competition and economic factors, such as inflation, present challenges that Santos must absorb to maintain profitability. Operational risks, including potential inflation in cost numbers, further threaten the company's financial stability. The dividend of 5.41% is not well covered by free cash flows, raising concerns about its sustainability.

Conclusion

Santos's disciplined operating model has resulted in strong financial performance, evident from its substantial production and revenue figures, as well as significant project advancements like the Moomba CCS and Barossa projects. However, the company faces challenges such as higher production costs and a Price-To-Earnings Ratio of 12.4x, which is higher than both the industry and peer averages, despite trading significantly below its estimated fair value of A$18.8. Opportunities for growth are promising, particularly with ongoing projects and a favorable market outlook for gas demand, but risks related to production sustainability, regulatory uncertainties, and economic factors must be managed to ensure continued profitability and shareholder returns.

Key Takeaways

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Simply Wall St and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

About ASX:STO

Santos

Explores, develops, produces, transports, and markets hydrocarbons in Australia and Papua New Guinea.

Very undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives