- Australia

- /

- Personal Products

- /

- ASX:BIO

3 ASX Penny Stocks With Market Caps Under A$200M To Watch

Reviewed by Simply Wall St

The Australian market recently saw the ASX 200 close down by 0.57%, with notable movements across various sectors, including a record high in total wages and salaries. Despite these fluctuations, investors often look for potential opportunities among smaller or newer companies that can offer unique growth prospects at lower price points. While the term "penny stock" might seem outdated, it still represents an intriguing investment area where strong financials and solid fundamentals can lead to significant returns.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Financial Health Rating |

| LaserBond (ASX:LBL) | A$0.585 | A$70.33M | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.80 | A$148.62M | ★★★★☆☆ |

| Helloworld Travel (ASX:HLO) | A$1.955 | A$332.15M | ★★★★★★ |

| Austin Engineering (ASX:ANG) | A$0.50 | A$328.68M | ★★★★★☆ |

| MaxiPARTS (ASX:MXI) | A$1.87 | A$103.44M | ★★★★★★ |

| SHAPE Australia (ASX:SHA) | A$2.89 | A$232.15M | ★★★★★★ |

| Navigator Global Investments (ASX:NGI) | A$1.685 | A$813.53M | ★★★★★☆ |

| West African Resources (ASX:WAF) | A$1.495 | A$1.66B | ★★★★★★ |

| Atlas Pearls (ASX:ATP) | A$0.16 | A$67.53M | ★★★★★★ |

| Servcorp (ASX:SRV) | A$4.90 | A$487.41M | ★★★★☆☆ |

Click here to see the full list of 1,044 stocks from our ASX Penny Stocks screener.

Let's review some notable picks from our screened stocks.

Biome Australia (ASX:BIO)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Biome Australia Limited develops, commercializes, and markets live biotherapeutics and complementary medicines both in Australia and internationally, with a market cap of A$140.24 million.

Operations: The company's revenue comes from its Innovative Evidence-Based Products Linking the Gut and Human Health, generating A$13.01 million.

Market Cap: A$140.24M

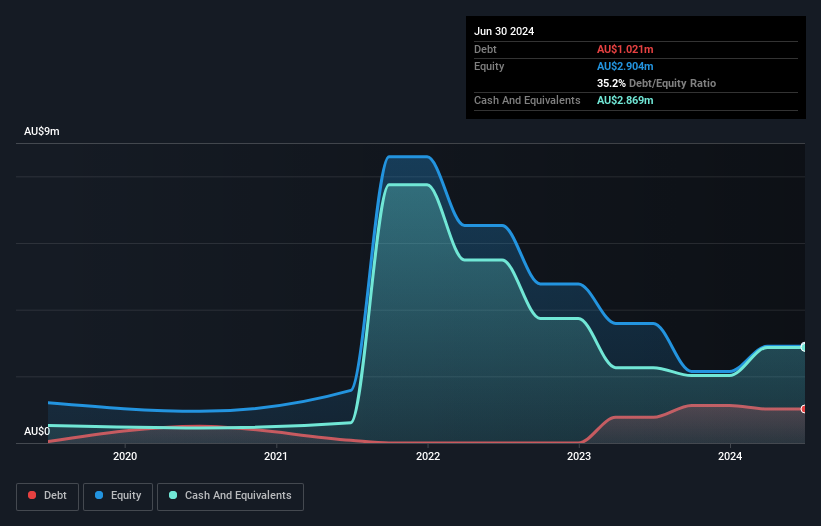

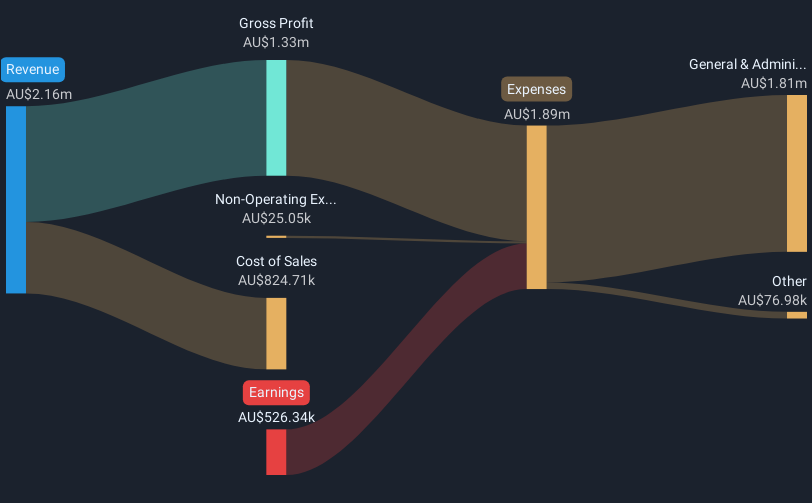

Biome Australia has shown promising revenue growth, with sales reaching A$13.01 million in the last fiscal year, up from A$7.24 million previously. Despite being unprofitable, the company reduced its net loss to A$1.67 million from A$3.08 million and maintains a substantial cash runway exceeding three years. Recent quarterly sales of A$4.25 million surpassed expectations and set a new record, highlighting potential for continued growth in its biotherapeutics market segment. However, shareholder dilution increased by 8.3% over the past year and the debt-to-equity ratio rose significantly over five years, warranting caution for investors considering this penny stock opportunity.

- Navigate through the intricacies of Biome Australia with our comprehensive balance sheet health report here.

- Gain insights into Biome Australia's future direction by reviewing our growth report.

Resonance Health (ASX:RHT)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Resonance Health Limited is a healthcare technology and services company that designs, develops, manufactures, and commercializes software-as-medical devices across various regions including Australia, the Asia Pacific, North America, Europe, the Middle East, and Africa with a market cap of A$27.12 million.

Operations: The company's revenue is derived from three segments: CRO at A$3.84 million, Services contributing A$4.54 million, and Trialswest generating A$0.20 million.

Market Cap: A$27.12M

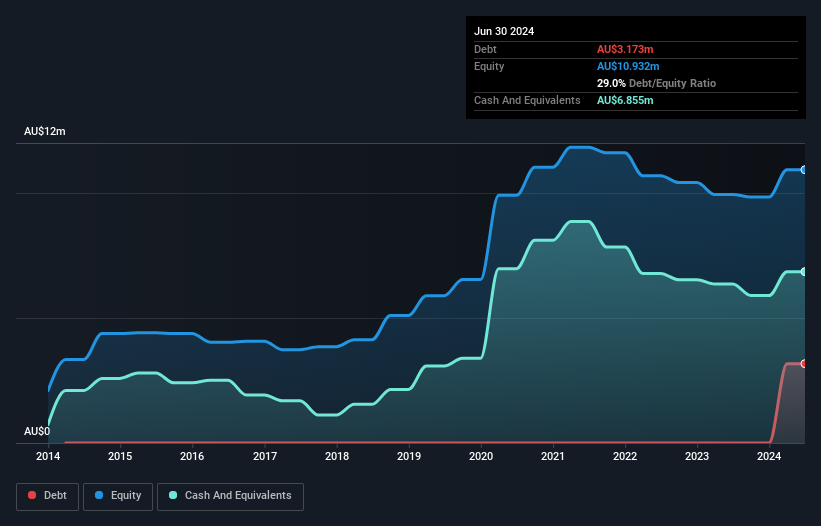

Resonance Health Limited, with a market cap of A$27.12 million, has seen its sales grow to A$8.59 million for the year ended June 30, 2024, up from A$4.4 million the previous year. The company turned profitable this year with net income of A$0.17 million compared to a loss last year and maintains high-quality earnings. Short-term assets exceed both short- and long-term liabilities, indicating strong liquidity management despite increased share price volatility and low return on equity at 1.5%. The board is experienced; however, the management team is relatively new with an average tenure of 1.2 years.

- Take a closer look at Resonance Health's potential here in our financial health report.

- Understand Resonance Health's track record by examining our performance history report.

Red Sky Energy (ASX:ROG)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Red Sky Energy Limited is an oil and gas exploration and development company focused on acquiring, drilling, and developing resources in the United States and Australia, with a market cap of A$48.80 million.

Operations: Red Sky Energy Limited does not have any reported revenue segments.

Market Cap: A$48.8M

Red Sky Energy Limited, with a market cap of A$48.80 million, has shown significant revenue growth, reporting A$1.85 million for the half year ended June 30, 2024—up from just A$0.058662 million a year ago. Despite being unprofitable historically, the company achieved net income of A$0.321219 million compared to a net loss previously and maintains no debt on its balance sheet. It boasts sufficient cash runway exceeding three years and stable short- and long-term asset coverage over liabilities. However, shareholder dilution occurred recently with increased shares outstanding by 2.3%, coupled with high share price volatility over the past months.

- Dive into the specifics of Red Sky Energy here with our thorough balance sheet health report.

- Evaluate Red Sky Energy's historical performance by accessing our past performance report.

Key Takeaways

- Explore the 1,044 names from our ASX Penny Stocks screener here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Biome Australia might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:BIO

Biome Australia

Engages in the development, commercialization, and marketing of various live biotherapeutics and complimentary medicines in Australia and internationally.

Exceptional growth potential with adequate balance sheet.