- Australia

- /

- Oil and Gas

- /

- ASX:PDN

Can Paladin Energy’s Recent Price Rebound Signal Sustainable Growth in 2025?

Reviewed by Bailey Pemberton

If you’ve been watching Paladin Energy’s stock, you’re probably wondering whether now is the time to jump in, hold steady, or wait things out. The uranium producer has had everyone’s attention, especially after a tremendous 600.7% gain over five years, which is enough to make even the most seasoned investors stop and take notice. However, over the past year, its share price fell by 26.5%, raising questions about shifting market sentiment and whether the growth story still holds up.

More recently, in the last month, Paladin Energy bounced back with a 10.9% rise, while the year-to-date return sits at 8.6%. Even in the last week, the stock inched higher by 1.2%. These moves come amid ongoing global interest in nuclear energy as countries seek lower-carbon options for power generation, pushing uranium demand and Paladin’s own outlook into the spotlight. Despite this momentum, investors seem to be re-evaluating the risks and rewards, reflected in the volatile stretch over the past year.

So, what about value? On a straightforward quantitative score, Paladin is actually undervalued in 0 out of 6 valuation checks, meaning it doesn’t pass any of the basic screens for a bargain at today’s prices. However, valuation is rarely so simple, and that is where things get interesting.

Next, we’ll break down the different valuation methods analysts use for stocks like Paladin Energy, including some that go far beyond the usual price ratios. And if you stick around to the end, I’ll share the one factor that might matter even more than any valuation checklist.

Paladin Energy scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Paladin Energy Dividend Discount Model (DDM) Analysis

The Dividend Discount Model (DDM) estimates a company's intrinsic value based on expected future dividend payments by discounting them back to today's dollars. This approach works best when a company pays consistent, predictable dividends, giving investors insight into how sustainable and rewarding its payout may be in the future.

For Paladin Energy, the DDM uses a projected dividend per share (DPS) of $0.0285 and assumes a modest long-term dividend growth rate of 3.11%, using the risk-free rate as its anchor for growth expectations. However, the company’s return on equity (ROE) currently stands at negative 7.8%, which can be a red flag for dividend sustainability because negative ROE suggests the business is not generating profits from shareholders’ equity. There is no payout ratio provided, which further underscores uncertainty about how dependable future dividends might be.

With these factors considered, the DDM calculates an intrinsic value for Paladin Energy at $1.28 per share. This estimate is significantly below the current share price, with the implied discount reaching negative 569.7%. This implies the stock is trading much higher than what its dividends would justify, even when projected growth is factored in.

Result: OVERVALUED

Our Dividend Discount Model (DDM) analysis suggests Paladin Energy may be overvalued by 569.7%. Find undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Paladin Energy Price vs Sales

For many profitable companies, the price-to-sales (PS) ratio is a widely used tool to gauge valuation when earnings are negative or volatile. This metric is particularly useful for resource companies like Paladin Energy, where revenue flows are significant but bottom-line profits can swing due to factors like commodity prices and development costs.

Generally, higher growth prospects and lower risk can justify a higher PS ratio; by contrast, a stable, low-growth or riskier business might deserve a lower multiple. This means that what counts as a "fair" PS ratio is not fixed, but moves with market and company conditions.

Paladin Energy is currently trading at a PS ratio of 14.0x. For context, the industry average PS ratio for Oil and Gas is 9.28x, and similar peers average just 3.71x. This positions Paladin well above both benchmarks and signals a hefty premium is being baked into the share price.

However, a simple comparison to peers or industry norms tells only part of the story. Simply Wall St’s "Fair Ratio" aims to provide a more nuanced view by factoring in Paladin's unique profile, including its revenue growth, margins, risk factors, market cap, and industry specifics. For Paladin, the Fair Ratio comes out at 1.52x, which is significantly beneath the company’s actual PS ratio.

This proprietary metric is more reliable than a basic peer or sector comparison because it accounts for the context and future potential of the business rather than relying on averages that may not suit Paladin's situation.

Given that Paladin's actual PS ratio sits much higher than its Fair Ratio, this suggests the stock is overvalued using this approach.

Result: OVERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Paladin Energy Narrative

Earlier we mentioned that there’s an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is a simple, powerful way to frame your investment by connecting your assumptions about a company’s story, such as growth drivers, risks, or industry trends, to a financial forecast and ultimately to a fair value.

This approach moves beyond static ratios, letting you express your own view on a company’s future by estimating things like revenue, earnings, and margins, and seeing how those assumptions translate to what you believe the shares are truly worth. Narratives are front and centre on Simply Wall St’s Community page, giving millions of investors an easy way to create, share, and update their perspectives in real time.

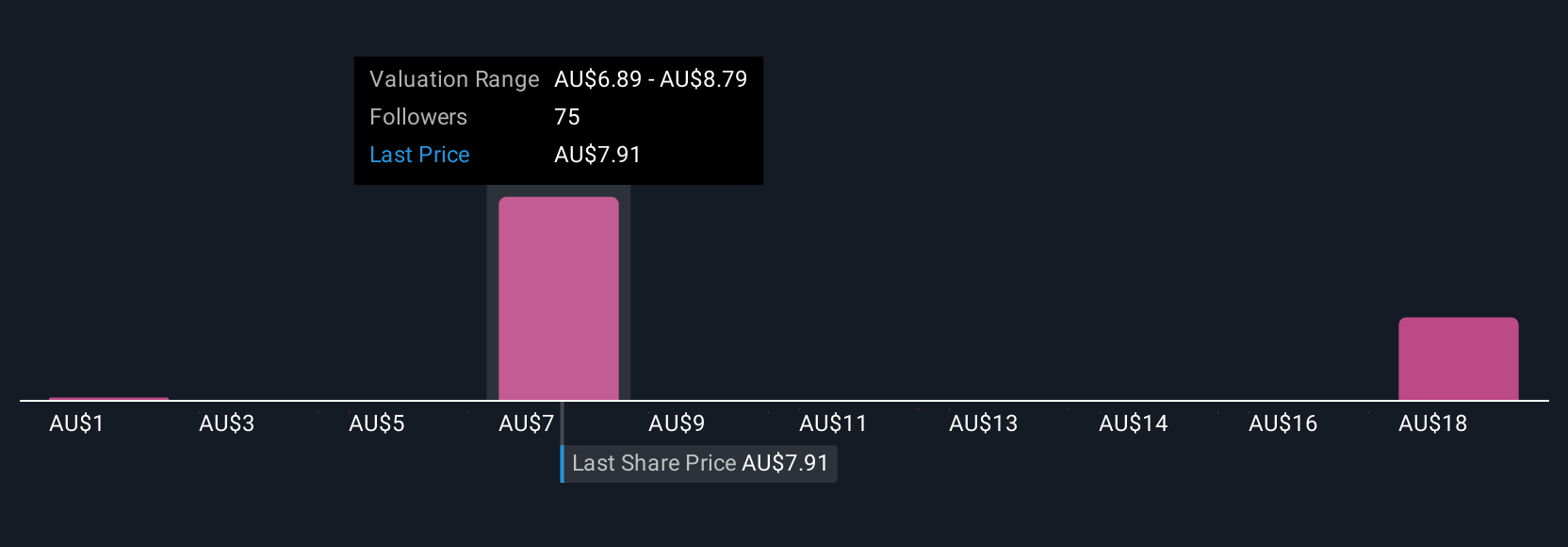

With Narratives, you can compare your estimated Fair Value to the current Price, helping you decide whether it’s the right time to buy, hold, or sell. These forecasts also update automatically as new information or market events happen. For example, right now, some investors project a fair value for Paladin Energy as high as A$13.06, banking on surging uranium demand and new projects coming online, while others see it as low as A$5.2 due to concerns around regulatory delays and cost overruns.

Do you think there's more to the story for Paladin Energy? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:PDN

Paladin Energy

Through its subsidiaries, engages in the development and exploration of mineral properties in Australia, Canada, and Namibia.

High growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success